Difference between Basic EPS and Diluted EPS

With the increasing complexity in the businesses, accounting bodies are trying their best to improve transparency, reliability and comparability of financial statements. This is the reason why frequent changes have been observed in the financial reporting standards in past two decades. In 1997, Financial Accounting Standards Board (FASB) issued a new rule according to which, companies were required to calculate and report their EPS by the end of every quarter in two ways, “basic” and “diluted”. If you see a financial statement of any company, you will always find two types of earnings per shares (EPS), basic earnings per share and diluted earnings per share. Both of these terms serve a different purpose for the company’s stakeholders, especially investors.

Therefore, every stakeholder should know what basic and diluted EPS are and how are they different from each other. By looking at the per share profit, they can calculate the amount of profit earned by the company on their investment. For example, if you have to evaluate the financial performance of a company, you look at the net profit earned by a business as well as the per share profit earned by a company. This will provide a true picture to shareholders when they plan to invest in the company.

The Basic EPS

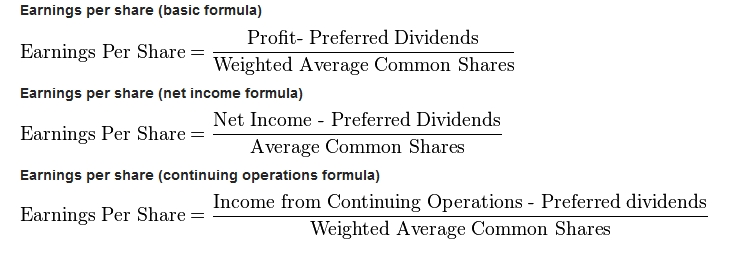

The basic earnings per share is a total amount of earnings per share that is calculated on the basis of a number of shares issued at that time. The basic EPS is calculated according to the following formula:

Basic EPS = (Net Income – Preference Dividend) ÷ number of issued shares

It is also used in the calculation of price-earnings ratio. Basic EPS represents the measure of profitability of a business, and represents the true price of a share. However, an individual must know that if two companies generate same EPS, it doesn’t mean they are representing the same financial performance. It is possible that one company may have efficiently used its equity, while the other company may have issued more shares in order to arrive at the same amount of basic EPS.

The Diluted EPS

On the other hand, the diluted EPS shows earning per share a business could earn, if all the warrants, stock options, convertibles, and other exercisable dilutive securities were taken into account along with the additional number of shares issued at that time.

As you can see that diluted EPS is calculated by accounting for the warrants, convertibles (stocks and bonds), stock options and all other financial instruments that can be converted into shares. It shows the amount of EPS after dilutive financial instruments are exercised. If you look at it from the investors’ perspective, diluted EPS is not considered favorable, because it shows the EPS after conversion of all the dilutive securities into shares while no change in the net income occurs.

Differences

Dilution of shares – The primary difference between basic earnings per share and diluted earnings per share is that basic EPS does not consider the prospective dilution that arise from warrants, convertibles and other securities.

Difference in Value – The value of basic EPS will always be higher than the diluted EPS, because in case of diluted earnings per share, the net income remains the same as it is in basic EPS and only the number of issued shares increase.

Impact on Investment Decision – It is very important to calculate diluted earnings per share and include it in the financial statement, as it shows the earnings after dilution. Moreover, investors will be reluctant to buy shares of those companies where there is a huge difference between the basic and diluted EPS due to the adverse impact of dilution on a share price.

- Difference Between Ocular Rosacea and Blepharitis - September 22, 2023

- Difference Between Toxic and Nontoxic Goiter - August 18, 2023

- Difference Between Anterolisthesis and Retrolisthesis - July 31, 2023

Search DifferenceBetween.net :

Leave a Response

References :

[0]http://en.wikipedia.org/wiki/Earnings_per_share