Difference Between Gross NPA and Net NPA

Gross NPA stands for Gross Non-Performing Assets, and Net NPA stands for Net Non-Performing Assets.

What is Gross Non-Performing Assets?

Gross non-performing assets is a term used by financial institutions to refer to the sum of all the unpaid loans which are classified as non-performing loans.

Credit institutions offer loans to their customers who fail to be honoured and within ninety days, financial institutions are obligated to classify them as non-performing assets because they are not receiving either principle or net payments.

What is Net Non-Performing Assets?

Net non-performing assets is a term used by credit institutions to refer to the sum of the non-performing loans less provision for bad and doubtful debts. Credit institutions tend to provide a precautionary amount to cover the unpaid debts.

Therefore, if one deducts provision for unpaid debts from the unpaid debts, the resulting amount refers to the net non-performing assets.

Difference between Gross NPA and Net NPA

-

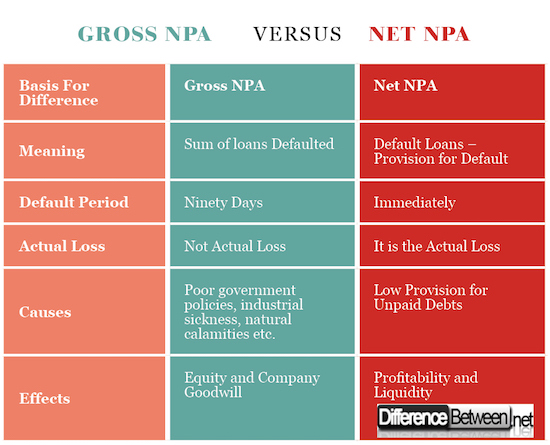

Meaning

One of the main difference between gross non-performing assets and net non-performing assets arises from the meaning. Gross non-performing assets refer to the total amount of the debts that an organization has failed to collect or the people owing the organization has failed to honor their contractual obligations of paying both the principal and interest amount.

On the other hand, net-non performing loans is the amount that results after deducting provision for doubtful and unpaid debts from the sum of the loans defaulted. It is the actual loss that the organization incurs after loan defaults.

-

Default Period

Credit institutions offer a grace period after which an individual is required to start paying the loan and its associated interests. If the payment duration expires, the institution is obligated to write-off those debts which are not paid.

Non-performing loans are listed as default after ninety days which is internationally recognised. Any amount that is due after the ninety-day grace period is classified as a default. However, net-non performing asset does not have a grace period and is immediately calculated and classified as a net non-performing asset.

-

Method of Calculation

Gross non-performing loans are the sum of all the loans that have been defaulted by the individuals who have acquired loans from the financial institution. This means that all loans defaulted are added together to form gross non-performing assets.

Gross NPA = (A1 + A2 + A3 ……………………. + An)/Gross Advances

Where A1 stands for loans given to person number one.

On the other hand, net non-performing assets are the amount that is realized after provision amount has been deducted from the gross non-performing assets.

Net NPA = (Total Gross NPA) – (Provision for Unpaid Debts)/Gross Advances

-

Actual Loss

The other difference between gross non-performing assets and net non-performing assets is what the organization refers to as the actual loss facing the company. Gross non-performing assets do not constitute the actual loss facing the organization.

Net non-performing assets constitute the actual loss experienced by the organization after debts have defaulted. Since the credit institution has already provided for unpaid loans, the provided amount is deducted from default amount which results in the actual loss experienced by the organization.

-

Causes of Gross NPA and net NPA

There are some significant factors that have been highlighted to be the extreme causes of gross non-performing assets include poor government policies, industrial sickness, natural calamities, willful defaults, and ineffective recovery tribunal among others.

Although net non-performing assets are principal products of gross non-performing assets, there is a significant difference in that the amount provided by the credit institution to cover for unpaid debts plays a vital role in determining the amount of net non-performing assets.

-

Effects of Gross NPA and Net NPA

Some of the significant causes of gross non-performing assets include the bad effect on the goodwill of the company and bad effect on the equity value of the organization.

A company with bad equity value experiences difficulties in attracting investors due to low return on investment and low share value of the company.

On the hand, net non-performing assets have significant impacts on profitability and liquidity of the company. Low liquidity means that the company does not have enough cash to meet its obligations when they fall due which means the company cannot afford to run the daily activities.

Difference between Gross NPA and Net NPA

Summary of Gross NPA and Net NPA

- Gross non-performing assets refer to the sum of all the loans that have been defaulted by the borrowers within the provided period of ninety days while net non-performing assets are the amount that results after deducting provision for unpaid debts from gross NPA.

- The gross non-performing asset does not amount to the actual loss of the organization because the provision for unpaid debts has not been deducted, but net non-performing assets amount to the actual loss of the organization because the provision for unpaid loans has already been deducted.

- Gross non-performing assets lead to a bad effect on company goodwill and bad effects on the equity value of the organisation while net non-performing assets lead to low profitability and liquidity in the company cash reserves.

- Other differences between gross and net non-performing loans include the method of calculation, causes, and default period among others.

- Difference Between Gross NPA and Net NPA - April 20, 2018

- Difference Between Job Description and Job Specification - April 13, 2018

- Difference Between Yoga and Power Yoga - April 10, 2018

Search DifferenceBetween.net :

Leave a Response

References :

[0]Balasubramaniam, C. S. "Non-performing assets and profitability of commercial banks in India: assessment and emerging issues." National Monthly Refereed Journal Of Research In Commerce & Management, June, volume 1 (2012): 41-52.

[1]Ng’etich Joseph Collins, Kenneth Wanjau. "The effects of the interest rate spread on the level of non-performing assets: A case of commercial banks in Kenya." International Journal of Business and Public Management (ISSN: 2223-6244) Vol 1.1 (2011): 58-65.

[2]Reddy, Prashanth K. "A comparative study of Non-Performing Assets in India in the Global context-similarities and dissimilarities, remedial measures." (2002).

[3]Image credit: https://pxhere.com/en/photo/519433

[4]Image credit: https://pixabay.com/en/connections-market-bond-borrow-1207323/