Difference Between Accounting and Bookkeeping

Businesses need accounting and bookkeeping to manage their finances. Well, you can say accounting is your business compass; it helps you keep tabs on your money. You want to know where the money is coming from and where it’s going, right? Accounting helps you monitor your incomes and expenses.

The term accounting is often used interchangeably with bookkeeping. This is why you need to have a firm understanding of accounting and bookkeeping.

What is accounting?

Accounting involves recording, summarizing, analyzing, and reporting the financial transactions of a business to help them keep track of their income, expenses, assets, and liabilities.

Accounting provides insights into how a company is performing, financially.

Typical tasks of an accountant include but not limited to:

- Managing cash receipts and payments

- Tracking assets

- Preparing financial statements and budgets

- Filing tax returns

You need to have a four-year university degree in accounting with some specialization and credit-hours to practice accounting.

What is bookkeeping?

The methodical documentation of financial transactions in a business is known as bookkeeping. A transaction is what bookkeeping is all about. As a bookkeeper, it is your responsibility to make sure that all transactions, no matter how small, are documented. You use a journal to keep track of these transactions.

This journal may be a bank feed that you get straight from your bank, an entry in your accounting program, or a spreadsheet. You make a journal entry each time you document a transaction. You have to select whose account each entry belongs to as you record it.

Following recording, the transactions are added to ledgers, which are basically classified accounts.

Bookkeeping software is used by accountants to automate and streamline the process. Accuracy is ensured and transaction recording and report generation are made simpler using these tools.

Difference between Accounting and Bookkeeping

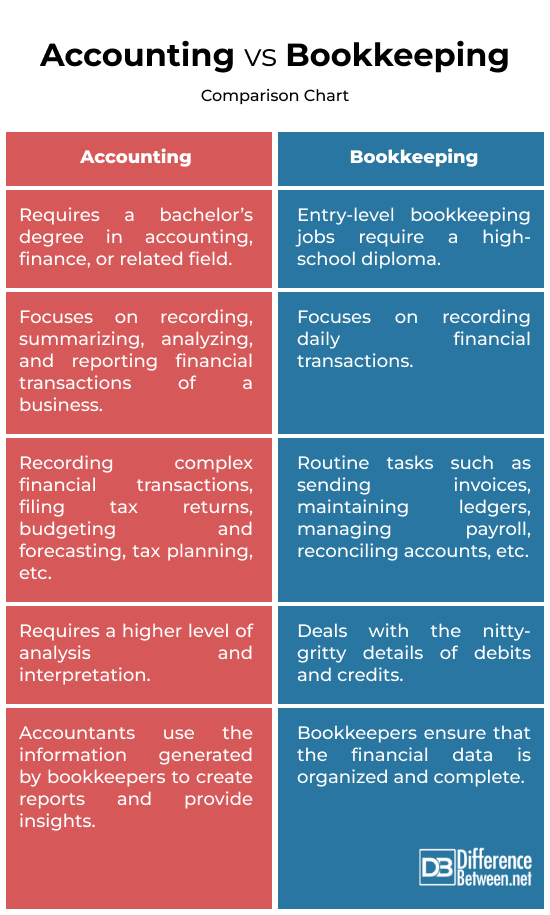

Educational Requirements

While a high school diploma may be sufficient for entry-level bookkeeping roles, some employers prefer candidates with an associate degree in accounting or a related field.

If you’re interested in accounting, you’ll need a higher level of education. Many accountants hold a bachelor’s degree in accounting, finance, or a related field. You could pursue advanced degrees such as a master’s in accounting or become certified through professional accounting organizations.

Function

Bookkeeping primarily focuses on recording daily financial transactions. Bookkeepers ensure every small or large transaction that takes place gets recorded. They record these transactions in a journal. Bookkeeping is more transactional and deals with day-to-day financial data.

Accounting has a much broader scope; it involves recording, summarizing, analyzing, and reporting the financial transactions of a business.

Tasks Involved

Bookkeeping involves routine tasks such as data entry, sending invoices, maintaining ledgers, managing payroll, reconciling accounts, etc.

Accounting involves monitoring and recording complex financial transactions, filing tax returns, budgeting and forecasting, tax planning, and providing financial advice.

Level of Detail

Bookkeeping deals with the detailed and systematic recording of financial transactions. It is concerned with the nitty-gritty details of debits and credits, ensuring that each transaction is accurately recorded.

Accounting involves a higher level of analysis and interpretation. Most transactions are simple exchanges of cash or credit for goods or services, but there could be situations where accountants have to dig a bit deeper to handle a specific transaction.

Tools

Traditionally, bookkeeping was done manually using ledgers and journals. However, modern bookkeepers often use accounting software to streamline and automate the recording process.

Accountants use advanced accounting software and tools for data analysis, financial modeling, and invoicing. Common accounting tools include:

- Accounting software

- Invoicing software

- Business credit cards

- Financial calendar

Accounting vs. Bookkeeping: Comparison Chart

Summary

Bookkeeping is primarily concerned with recording financial transactions accurately. Bookkeepers ensure that the financial data is organized and complete. They lay the groundwork for further analysis. Accountants then use the information generated by bookkeepers to create detailed reports to provide insights and help make informed business decisions.

FAQs

Is it better to be an accountant or a bookkeeper?

Accounting offers higher income potential but requires a high level of education. Bookkeeping is a great starting point if you’re looking to work in the accounts payable or accounts receivable department.

Is accounting and bookkeeping hard?

It’s not hard to learn accounting and bookkeeping. But they require greater attention to detail, organization, and a good knowledge of finance.

What does a bookkeeper do?

Bookkeepers ensure every small or large transaction that takes place gets recorded. They record these transactions in a journal.

What comes first, accounting or bookkeeping?

Generally, bookkeeping comes first. Bookkeepers record day-to-day financial transactions, and accountants use this organized data to analyze, interpret, and create financial reports.

What is the best qualification for a bookkeeper?

You’d typically require a high-school diploma to apply for an entry-level position. However, some employers may prefer candidates with an associate degree in accounting or a related field.

Is bookkeeping stressful?

Bookkeeping can be demanding due to the need for accuracy and attention to detail. The level of stress can vary depending on factors such as workload, deadlines, and the complexity of financial transactions

What are the two kinds of bookkeeping?

The two primary methods of bookkeeping are single-entry bookkeeping and double-entry bookkeeping.

What can an accountant do that a bookkeeper cannot?

Accountants can create complex financial reports, provide financial advice, and aid in planning and forecasting. These are complex tasks that a bookkeeper cannot do.

What can bookkeepers not do?

Bookkeepers may not perform in-depth financial analysis or provide strategic financial advice. They typically perform day-to-day transactions.

Do accountants make more than bookkeepers?

Yes, accountants get paid more than bookkeepers.

- Difference Between Caucus and Primary - June 18, 2024

- Difference Between PPO and POS - May 30, 2024

- Difference Between RFID and NFC - May 28, 2024

Search DifferenceBetween.net :

3 Comments

Leave a Response

References :

[0]Image credit: https://www.canva.com/photos/MAED4Foejog-accounting/

[1]Image credit: https://www.canva.com/photos/MADA4UmBb_M-bookkeeping-concept-image-with-business-icons-and-copyspace-/

[2]Loughran, Maire and Sharon Farris. Nonprofit Bookkeeping & Accounting For Dummies. John Wiley & Sons, 2023.

[3]Curtis, Veechi. Bookkeeping For Dummies. John Wiley & Sons, 2020.

[4]Tracy, John A. Accounting For Dummies. John Wiley & Sons, 2011.

[5]Depersio, Greg. “Bookkeeping vs. Accounting: What's the Difference?” Investopedia, 8 Oct. 2022, www.investopedia.com/articles/professionals/091715/career-advice-accounting-vs-bookkeeping.asp.

I like working an account expecially in term of three-column cash book.

thanks for the info. 🙂

it hepled me a lot… thanku for d info…