Difference Between Book value and Market value

When you invest in the stock market you come across three values of share. Investors use these values to study the health of a company. The first one is Face Value, the second is Book Value, and the third one is Market Value. Many people get confused about what is the meaning of which value and what exactly is the concept behind each value. When you invest in shares of a company, you do not have to bother much about their face value because it does not change with time. In this article, we are going talk about book value and market value, their concepts, and how they differ. Read on to know more.

What is Book Value?

Book value is the net value of a company’s assets found on its balance sheet. So, basically book value is the accounting value of the firm’s assets that is carried on in their balance sheet. It’s the equity value of the company as reported in their financial statements. Investors study and analyze financial statements of a firm before investing in their stocks to get a better picture of the value of the company and its shares. Book value is the accounting value of shareholder’s equity according to the balance sheet. It represents the value of the company if it was liquidated. Let’s say a company had total assets worth $40 million, of which $10 million were intangible assets and the company had liabilities of $5 million. The book value of the company would be $25 million.

Book Value = Total Assets – Tangible Assets – Liabilities

What is Market Value?

Market value, also known as market capitalization, is the current trading price of stock in the marketplace. It represents the worth of an asset or a company on the financial market, according to market participants. The value of anything according the demand-supply or based on its future prospects is called the market value. It represents the maximum price at which an asset or security can be bought or sold in the market. Market value is basically the market perception about the future of the company. The future of the company depends on many factors such as the value of their intangible assets, brand value, and if the company has copyrights, patents and trademarks, and more.

Market Value = Current market price per share x Total shares outstanding

Difference between Book Value and Market Value

-

Definition

– Book value is the net worth of the assets of a firm that is carried on in their balance sheet. It’s the equity value of the company as reported in their financial statements. Book value is the value that remains if the firm has to sell all assets. Market value, on the other hand, is the current trading price of stock in the marketplace that represents the maximum price at which an asset or security can be bought or sold in the market.

-

Calculation

– Book value is the accounting value of shareholder’s equity according to the balance sheet. It represents the value of the company if it was liquidated. It is the difference between assets and liabilities in the balance sheet. Market value, on the other hand, is the market perception about the future of the company. Market value is volatile and it changes throughout the day because the share price of a company fluctuates constantly. Market value is the current market price per share of the company multiplied by the number of outstanding shares.

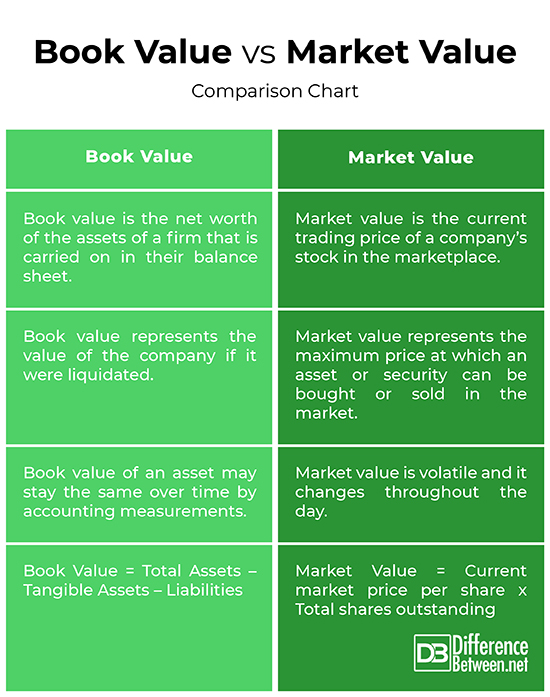

Book Value vs. Market Value: Comparison Chart

Summary

In a nutshell, book value of a company is the net value of its assets found on its balance sheet, meaning it is the amount of money the shareholders of the company should receive if the company’s assets had to be liquidated and all the liabilities had been paid off. Book value represents the shareholder’s equity according to accounting statements. Market value, on the other hand, represents the value of the company according to the stock market. It represents the market capitalization in the context of companies. It is the aggregate market value of a company if the company’s outstanding shares were sold at the current share price.

Why is book value different from market value?

Market value represents the market value of a company if the company’s outstanding shares were sold at the current share price. Book value is the amount of money the shareholders of the company should receive if the company’s assets had to be liquidated and all the liabilities had been paid off.

Is market value higher than book value?

Market value tends to be higher than the book value of a company since market value takes into consideration the company’s profitability, intangible assets, and future prospects. A higher book value means the stock price of the company is undervalued.

What is the difference between book value and fair market value?

Book value is the value of a company’s asset based on its balance sheet and it’s a key metric used frequently by value investors. Fair market value represents the current price of an asset both the buyer and the seller agrees upon.

How do you calculate book value from the market value?

The price-to-book ratio (P/B ratio) is a fanatical ratio that compares a firm’s market value to its book value. It is calculated by dividing market price per share by book value of assets per share.

- Difference Between Caucus and Primary - June 18, 2024

- Difference Between PPO and POS - May 30, 2024

- Difference Between RFID and NFC - May 28, 2024

Search DifferenceBetween.net :

3 Comments

Trackbacks

Leave a Response

References :

[0]Heins, John and Whitney Tilson. The Art of Value Investing: How the World's Best Investors Beat the Market. New Jersey, United States: John Wiley & Sons, 2013. Print

[1]Greenwald, Bruce C., et al. Value Investing: From Graham to Buffett and Beyond. New Jersey, United States: John Wiley & Sons, 2004. Print

[2]Hussain, Ali. “Book value vs. market value: Knowing the difference between these two measures can help investors pick stocks.” Business Insider, 29 Jan. 2021, https://www.businessinsider.com/personal-finance/book-value-vs-market-value?IR=T.

This was a brief but concise explanation of the difference between Book and Market Stock values.

I had read a few other site which covered the same subject but all of them (4 sites) where more confusing that anything else.

Thank you very much and will revisit you for additional lookups / research.

Doug!

You have to keep in mind basis is generally the amount of your capital investment in property for tax purposes. Use your basis to figure depreciation, amortization, depletion, casualty losses, and any gain or loss on the sale, exchange, or other disposition of the property. In most situations, the basis of an asset is its cost to yo