Difference Between Bank and Credit Union

Bank vs Credit Union

Banks as well as credit unions are financial institutions which provide a variety of services to their depositors like home loans, saving accounts, etc.

The key philosophy behind credit unions and banks is different. The banks operate for the aim of generating profits while credit unions are community-based institutions which run as non-profit. The concepts of banks are very old whereas the credit union history dates back to the 19th century. Initially, credit unions were established as worker’s cooperatives to help them to solve their financial problems.

In a credit union, if you want to be a depositor, then you need to have a membership first. In applying for a membership, you need to have a simple account with minimum deposits. Each member becomes a part owner in the credit union and is entitled to receive shares based upon his contributions. Thus, people having large amounts of funds get a higher number of shares and can receive a larger share of the profits.

The Board of Directors of a credit union are comprised of volunteers or elected members who participate in major financial decisions and elections; whereas a bank is owned by a private company. The bank’s Board of Directors is appointed by the company or shareholders. Depositors receive some amount of interest on certain types of accounts.

Credit unions encourage people to save, promote thrift, and also encourage them to use money wisely. Banks, on the other hand, are least interested in all the above-mentioned issues.

Credit unions are more personalized and friendly in service, and their strength lies in connecting with the community. Banks are standardized to a high degree, and their focus is on professional services with consistency not essentially customizing the services according to their clients.

Credit unions usually finance small projects related to community development and try to keep money within the community. Banks, on the other hand, tend to finance large and mighty projects. The interest rate charged by banks is a bit higher than what credit unions charge.

A credit union’s area of work is not as large as a bank’s. Banks are usually based locally and have multiple branches across a large region.

Difference between Bank and Credit Union

Financial institutions like banks, capital markets, credit union, and investment funds have a significant role in transforming a planned economy into a market economy. Banks have played a major role in the world’s economy and they still are. The primary function of a bank is to maintain the role of an intermediary between depositors and borrowers, and providing loans to individuals. When you’re looking for a loan or a line of credit, banks are your primary savior. But they are not the only ones who facilitate loans. An often overlooked option is the credit union, which offers similar types of financial products and services that a bank does. But what is a credit union and how is it any different than a bank?

Bank

Banking systems have been around for thousands of years, probably long before than that. Modern-day banking practices are what make the world economy stable and sustain diversity. Banks are a key component of the financial system and play a major role as instruments of the government’s monetary policy. So, banks are a type of financial institution licensed to receive deposits and make loans. Simply put, banks borrow and lend money every day from people like you. Banks are open to any individual interested in a product or account. There are many different kinds of banks including retail banks corporate or commercial banks, and investment banks. The primary role of a bank is to safeguard assets and supply credit to individuals and businesses looking for a loan.

Credit Union

A credit union is also a type of financial institution, but not an ordinary one. Neither is it a loan company, seeking to make profits. Like banks, credit unions provide a wide range of financial services, including taking deposits and providing loans. Credit unions, however, are a not-for-profit financial cooperative owned and controlled by their members, the same people who deposit money into the cooperative. They are like co-op financial institutions run by their members instead of the shareholders. It’s the ownership that sets the two financial institutions apart. The world of credit unions has experienced enormous transformation since the birth of these cooperatives in England and Europe, probably in the mid-1800s. As non-profits, credit unions are generally exempt from federal taxes.

Difference between Bank and Credit Union

-

Ownership

– Both banks and credit unions are types of financial institutions that supply credit to individuals and businesses looking for a loan, offering the same financial products and services. The main difference between the two is ownership. Credit unions are a not-for-profit financial cooperative owned and controlled by their members. The customers can be referred to as members and not merely clients. Banks, however, are a profit-making sector owned by investors and shareholders, who are not necessarily account holders or members.

-

Taxation

– Credit unions, because of their nature as a non-profit financial institution, are generally exempt from federal taxes. They do not pay the same taxes that the banks do. In addition, some credit unions often receive subsidies from organizations that they are affiliated with. Banks, on the other hand, are commercial entities that work to earn a profit and provide returns to their investors or stockholders. This profit is taxed by the federal government and most state governments. Banks are either privately owned or publicly traded.

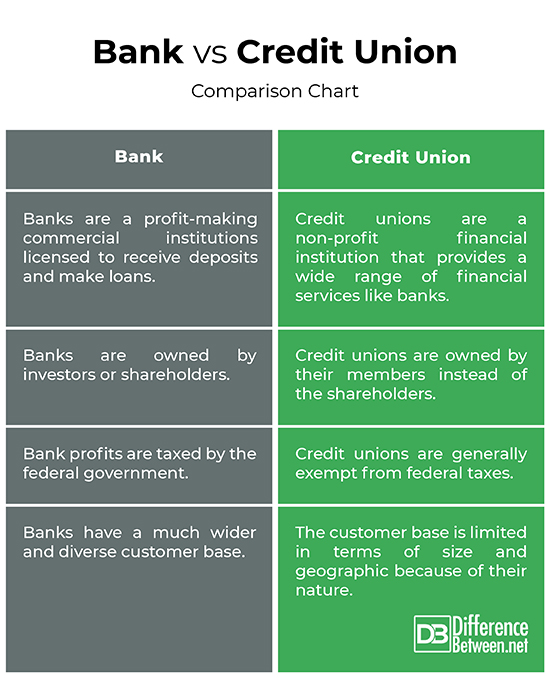

Bank vs. Credit Union: Comparison Chart

Difference Between Bank and Credit Union Comparison Chart

Summary

When you look at them from afar, banks and credit unions may appear identical because of their primary function – that is to accept deposits and offer loans to individuals and businesses. Looking closely, you will know that credit unions are non-profit financial institutions owned by their members instead of the shareholders. Credit unions offer basically the same products and financial services that you get from banks, like you can open a standard saving or checking account or invest in a money market account, or get a mortgage loan. The main difference between the two is the ownership. This is where the two part ways.

Which is better, credit union or bank?

Banks are a profit-making sector that is in business to make a profit, but it is also true that they are a financial institution that supply credit to individuals and businesses alike. Banks are open to everyone looking to open an account or seek a loan whereas credit unions are limited to members.

What are the disadvantages of credit unions?

Unlike banks, credit unions are open to their members only. Also, credit unions are not as competitive as banks in terms of size and geography. Banks are an easy choice among individuals who are not directly affiliated with any community served by a credit union.

What are two differences between a bank and a credit union?

The two main differences between a bank and credit union are ownership and taxation. Banks are owned by investors or shareholders whereas credit unions are owned by members. In addition, credit unions are generally exempt from federal taxes because of their non-profit nature, while banks are not.

What are 3 differences between a bank and a credit union?

Banks are profit-making institutions whereas credit unions are non-profit institutions; banks are owned by investors whereas credit unions are a member-owned cooperative; and banks are taxed by federal and state governments whereas credit unions are generally exempt from federal taxes.

- Difference Between Caucus and Primary - June 18, 2024

- Difference Between PPO and POS - May 30, 2024

- Difference Between RFID and NFC - May 28, 2024

Search DifferenceBetween.net :

3 Comments

Trackbacks

- Difference Between Finance and Leasing | Difference Between | Finance vs Leasing

- Difference Between FDIC and NCUA | Difference Between | FDIC vs NCUA

Leave a Response

References :

[0]Fountain, Wendell V. The New Emerging Credit Union World: Theory, Process, Practice--Cases & Application. Indiana, United States: AuthorHouse, 2012. Print

[1]Conti, Vittorio and Rony Hamaui. Financial Markets Liberalisation and the Role of Banks. Cambridge, United Kingdom: Cambridge University Press, 1993. Print

[2]Evanoff, Douglas Darrell. The Role of Central Banks in Financial Stability: How Has it Changed? Singapore: World Scientific, 2014. Print

I honestly prefer a credit union over big banks. For me, a credit union is a lot easier to deal with compared to banks and the folks at Oak Trust in Plainfield, Illinois just make the experience even better. Check out their website at http://www.oaktrust.com