Difference Between Income Tax and Capital Gains Tax

What is Income Tax?

Income tax is a direct tax imposed by the government upon its citizens on the income or profits earned by them within their jurisdiction. The tax law states every taxpayer must file an income tax return for each financial year to determine their tax obligations. Income tax is one of the biggest sources of revenue for the respective governments. The income tax depends on a specific tax bracket as regulated by the government, and is totally based on the income you make throughout the financial year. Income tax is basically the government’s right and is levied on the income of every earning individual or salaried individual or business. Earnings that are taxable come from multiple sources such as salaries, wages, interest, royalties, rents, product sales, etc.

What is Capital Gains Tax?

A capital gain, in simple terms, is the increase in value of a capital asset and is considered to be realized only when the asset is sold, that is, when the gain is realized as cash income. Capital gain is the profit you earn from selling an asset that has gone up in value – assets like stocks, bonds or real estate. If you buy something for $300 and sell it for $400, you earn a capital gain of $100. So, capital gains tax is the tax on the profit made from selling those investments. The gain or profit made by selling capital assets comes under the category of ‘income’, so is taxable. Capital gains on assets held till death or donated to charity are free from taxation altogether. But the tax law states you do not have income until you make the sale. So, you don’t report capital gain or loss until you have a sale or exchange.

Difference between Income Tax and Capital Gains Tax

Basics

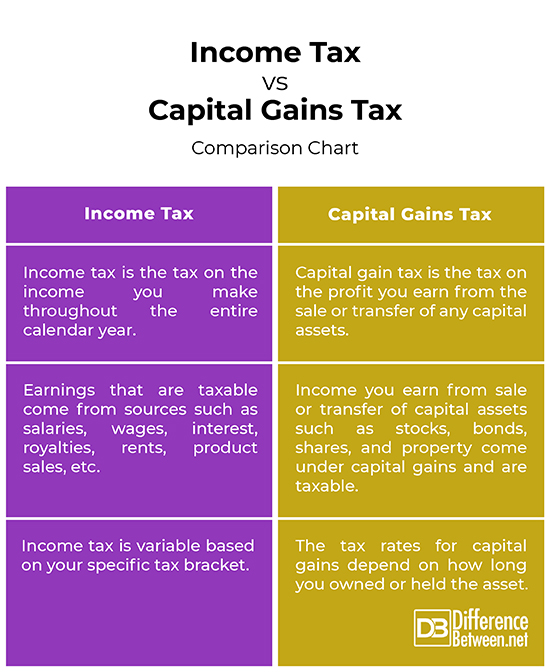

– Income tax is a direct tax imposed by the government upon its citizens on the income or profits earned by them. Earnings that are taxable come from multiple sources such as salaries, wages, interest, royalties, rents, product sales, etc. Capital gains tax, on the other hand, is the tax on the profit you earn from the sale or transfer of any capital assets, such as stocks, bonds, shares, property, etc. Simply put, capital gains tax is a subset of income tax.

Calculation

– Income tax is variable based on your specific tax bracket and is totally based on the income you make throughout the financial year. Lower income individuals are taxed at lower rates than high-income taxpayers who are capable enough to pay more. The tax rates for capital gains depend on how long you owned or held the asset. Long term capital gains are taxed at a lower rate than short term capital gains. The long term capital gain tax rates vary from 0% to 20% depending on your income.

Income Tax vs. Capital Gains Tax: Comparison Chart

Summary

If you are employed and earn a fixed monthly salary, then your annual income is taxable and comes under one of the many tax slab rates. The tax law states every taxpayer must file an income tax return for each financial year to determine their tax obligations. Capital gains, on the other hand, is the profit you have made from sale or transfer of any capital assets such as stocks, bonds, shares, mutual funds, and property, and hence is taxable like ordinary income. Capital gains are classified as either short term or long term and are taxed accordingly.

Do you pay capital gains tax and income tax?

You do not report capital gain or loss until you have a sale or exchange because the tax law states you do not have income until you make the sale. You can hold the stock for as long as you want while its value increases many times over without having to pay a single dime of income tax. Not all exchanges are taxable, though.

Is capital gains added to your total income and puts you in higher tax bracket?

A capital gain or loss affects your tax if it is recognized. The size of your capital gains and losses affects how much income tax you have to pay. Ordinary income includes all kinds of income other than capital gain. So, if you do not have capital gains and losses, your taxable income is simply your ordinary income reduced by your ordinary deductions.

Is capital gains tax higher than ordinary income?

Long term capital gains are taxed separately from your ordinary income, and the tax rate for long term capital gain is lower than the rate for ordinary income. Long term capital gains are taxed at a lower rate than short term capital gains. Capital gains do not push ordinary income into a higher income bracket.

How do I calculate capital gains tax?

The maximum tax rate for different assets depends on the type of asset, how long it is held, and when it was bought. Capital gains are classified as either short term or long term and are taxed accordingly. Short term capital gains are taxed at the same rate as ordinary income. The tax rate for long term capital gain is lower than the rate for ordinary income.

Capital gain = selling price – purchase price

How can I avoid paying capital gains tax?

One of the best ways to save on or avoid tax on capital gains is to reinvest the proceeds into another similar property. Capital gains on appreciated property donated to charity are generally not taxable. You can avoid capital gains tax by investing in tax-saving retirement plans.

Do seniors have to pay capital gains tax?

There’s no exception for senior citizens – they have to pay tax on their profits just like everyone else. However, the tax on capital gains might be reduced if your retirement income is low enough.

- Difference Between Caucus and Primary - June 18, 2024

- Difference Between PPO and POS - May 30, 2024

- Difference Between RFID and NFC - May 28, 2024

Search DifferenceBetween.net :

Leave a Response

References :

[0]Littlewood, Michael and Craig Elliffe. Capital Gains Taxation: A Comparative Analysis of Key Issues. Cheltenham, United Kingdom: Edward Elgar Publishing, 2017. Print

[1]Burman, Leonard E. The Labyrinth of Capital Gains Tax Policy: A Guide for the Perplexed. Massachusetts, United States: Brookings Institution Press, 2010. Print

[2]Thomas, Kaye A. Capital Gains, Minimal Taxes: The Essential Guide for Investors and Traders. Illinois, United States: Fairmark Press Inc., 2004. Print

[3]Image credit: https://upload.wikimedia.org/wikipedia/commons/f/f3/Income-tax-491626_1920_%281%29.jpg

[4]Image credit: https://pix4free.org/assets/library/2021-04-28/originals/capital_gains_tax.jpg