Difference Between NPV and Payback

NPV vs. Payback

In every business, it is crucial to evaluate the value of a proposed project before actually investing in it. There are a number of solutions to evaluate this on a financial perspective; among them are Net Present Value (NPV) and payback methods. These two can measure the sustainability and value of long-term projects. However, they differ in their computation, factors, and thus vary in terms of limitations and benefits.

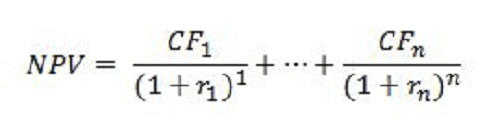

NPV, also known as Net Present Worth (NPW), is a standard method for using the time value of money to appraise long-term projects. It calculates a time series of cash flow, both incoming and outgoing, in terms of currency. NPV equates to the sum of the present values of the individual cash flows. The most important thing to remember about NPV is ‘present value.’ Put simply, NPV = PV (Present value) ‘“ I (Investment). For instance, given $1,000 for I, $10,000 for PV: $10,000 – $1,000 = $9, 000 = NPV. When choosing between alternative investments, NPV can help determine the one with the highest present value, specifically with these conditions: if NPV > 0, accept the investment, if NPV < 0, reject the investment, and if NPV= 0, the investment is marginal.

Conversely, the payback method is used to evaluate a purchase or expansion project. It determines the period, commonly in years, in which there’ll be a ‘payback’ on investments made. It is equal to the initial investment divided by annual savings or revenue, or in math terms: payback period = I/CF (cash flow per year). For example, given $10,000 for I, and $1,000 for CF, 10,000 / 1, 000 = 10 (years) = payback period. The shorter the payback period, the better the investment. A long payback means that the investment will be locked up for a long time; which usually renders a project relatively unsustainable.

Net Present Value analysis removes the time element in weighing alternative investments, while the payback method focuses on the time required for the return on an investment to repay the total initial investment. Given this, the payback method doesn’t properly assess the time value of money, inflation, financial risks, etc. as opposed to NPV, which accurately measures an investment’s profitability. In addition, although the payback method indicates the maximum acceptable period of the investment, it doesn’t take into consideration any probabilities that may occur after the payback period, nor does it measure total incomes. It doesn’t indicate whether purchases will yield positive profits over time.

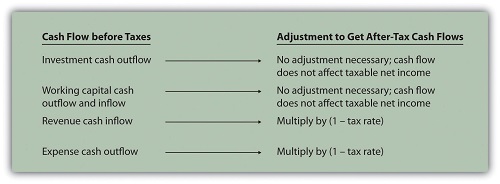

Thus, NPV provides better decisions than the payback method when making capital investments; relying solely on the payback method might result in poor financial decisions. Most businesses usually pair the payback method with NPV analysis. As far as advantages are concerned, the payback period method is simpler and easier to calculate for small, repetitive investment and factors in tax and depreciation rates. NPV, on the other hand, is more accurate and efficient as it uses cash flow, not earnings, and results in investment decisions that add value. On the downside, it assumes a constant discount rate over life of investment and is limited in predicting cash flows. Moreover, the cons of Payback include the fact that it doesn’t take into account cash flows and profits after the payback period and money value along with financial risks prior to or during investment.

Summary

1) NPV and payback methods measure the profitability of long-term investments.

2) NPV calculates an investment’s present value, but eliminates the time element and assumes a constant discount rate over time.

3) Payback determines the period over which a ‘payback’ on a specific investment will be made. However, it disregards the time value of money and the project’s profitability after the payback period.

4) Most businesses use a combination of the two assessment methods to come up with an optimal financial decision.

- Differences Between Fraternity And Sorority - January 8, 2014

- Differences Between Lucite and Plastic - January 7, 2014

- Differences Between Oil and Butter - January 6, 2014

Search DifferenceBetween.net :

1 Comment

Leave a Response

References :

[0]https://treasurycafe.blogspot.in/2011/09/poor-poor-npv.html

[1]https://2012books.lardbucket.org/books/accounting-for-managers/s12-how-is-capital-budgeting-used-.html

WHAT IS BETTER , TAKE 6OOO,OOO.00 NOW OR 1000000, NOW, AND

2000000.00 FIRST,SECOND AND THREE YEARS.?