Difference Between Trustee and Beneficiary

A trust is a legal entity specially created to hold assets on behalf of a third party. A trust is created by the owner of the property or assets who put those assets under the control of a “trustee” for the benefit of a “beneficiary” (or beneficiaries).

The concept of trust was believed to have originated in the Middle Ages. The Noblemen who fought wars or went off on long expeditions, fearing they might not return home, would ask someone who they trust to look after their property.

They would instruct their trustees on how to manage their property and what to do with them if they had died. The nature of the trusts hasn’t changed much over the years. The trust agreement is more than just a piece of legal document; it binds a trustee and a beneficiary in a fiduciary relationship. So, what it means to you if you are a trustee or a beneficiary?

Who is a Trustee?

A trustee is an individual or a legal entity responsible for holding and administering property and assets held within a trust for the benefits of another individual.

A trustee acts as a custodian for the assets who holds the legal control and authority over handling and administration of all the assets held within a trust. It is the job of a trustee to hold and manage the trust property consistent with the terms of the trust deed as stipulated by the owner of the trust.

A trustee, as the name suggests, is someone who the trust owner can trust to make decisions on his/her behalf towards the best interests of a third party called the beneficiary. A trustee is legally entitled to act solely in the interest of the beneficiary and strictly in accordance with the terms of the trust. This could include real estate and financial accounts.

Who is a Beneficiary?

A beneficiary is an individual or another legal entity that is entitled to receive assets, property or other benefits from a trust.

A beneficiary is someone who has an equitable interest in the property or assets owned by a trust, rather than being the legal owner of the trust. So, a beneficiary gains rights to use the assets without being its legal owner. If you have established a trust, the beneficiary or beneficiaries you name receives the assets of the trust.

In terms of life insurance policy, a beneficiary is the person who gets paid off on your behalf by the insurance company, after your death. Although, a beneficiary receives the trust assets, he/she does not have the power to control the assets.

The owner or the grantor usually prescribes the rules of the trust agreement like what the beneficiary will get and when, in a legally binding document that states the terms and conditions of the agreement.

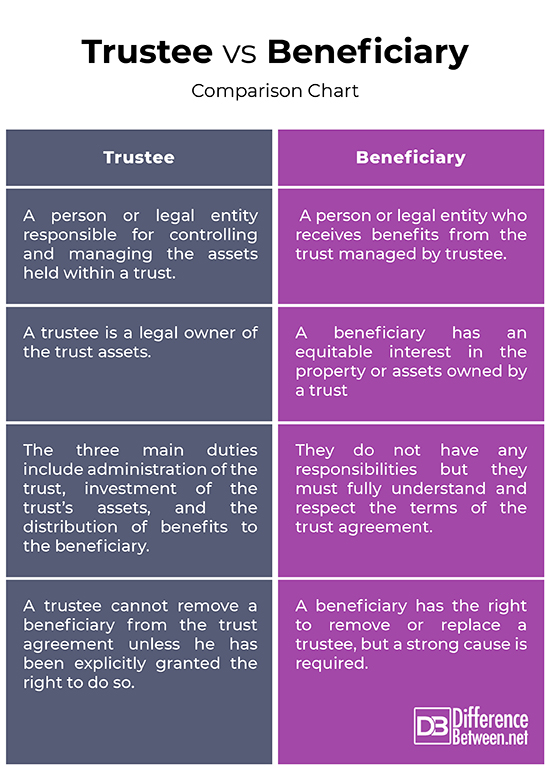

Difference between Trustee and Beneficiary

Definition of Trustee and Beneficiary

– A trustee is defined as an individual or a legal entity responsible for holding and administering property and assets held within a trust for the benefits of another individual named as the new owner called a beneficiary. A beneficiary, on the other hand, is defined as an individual or another legal entity that is entitled to receive assets, property or other benefits from a trust as prescribed in the trust agreement.

Role of a Trustee and Beneficiary

– The trustee is a legal owner of the trust assets but the beneficial interest lies with the beneficiary. A trustee simply acts as the custodian of the property or assets responsible for handling and administration of all the assets held within a trust. The beneficiary is someone who has an equitable interest in the property or assets owned by a trust, rather than being the legal owner of the trust.

Duties involved with Trustee and Beneficiary

– A trustee is legally entitled to act solely in the interest of the beneficiary and strictly in accordance with the terms of the trust. The three main duties of a trustee include administration of the trust, investment of the trust’s assets, and the distribution of benefits to the beneficiary. The trustee must understand the beneficiary’s true needs and act accordingly. Beneficiaries typically do not have any responsibilities but they must fully understand and respect the terms of the trust agreement, and coordinate well with the trustee to receive the benefits.

Rights of Trustee and Beneficiary

– So, who has more rights, a beneficiary or a trustee? When it comes to the rights of a trustee, it comes down to the trust instrument and compliance. A trustee is essential to the validity of a trust who acts as a legal owner of the trust whereas a beneficiary has equitable ownership of the trust. The trustee has the right to be reimbursed for his services and all the expenses incurred by him towards the interest of the trust; he is the legal owner of the trust so he has the right to invest the assets while making sure the assets are held in a well-diversified portfolio, which balances returns against expected risks.

Beneficiaries also have rights; they have the right to be notified of any trust agreement and they are obligated to obey the terms of the trust as described in the agreement. They are entitled to look at the trust accounts including a detailed accounting of the trust assets and liabilities. Moreover, a beneficiary has the right to petition the court for assistance, if he/she believes the trustee is not performing his duties or have breached the terms of the agreement in the context of the beneficiary rights of the trust.

Trustee vs. Beneficiary: Comparison Chart

Summary

The true nature of a trust is to benefit some beneficiary and the trustee is the person or an organization responsible for managing and handling the trust assets. It is the job of a trustee to understand the needs of the beneficiary and act accordingly. A trustee is essential to the validity of a trust who acts as a legal owner of the trust whereas a beneficiary has equitable ownership of the trust. A trustee may also act as a beneficiary of the trust, but he must still comply with the duties and responsibilities of a trustee and avoid breaching the terms of the trust agreement.

- Difference Between Caucus and Primary - June 18, 2024

- Difference Between PPO and POS - May 30, 2024

- Difference Between RFID and NFC - May 28, 2024

Search DifferenceBetween.net :

Leave a Response

References :

[0]Image credit: https://www.thebluediamondgallery.com/handwriting/images/trustee.jpg

[1]Image credit: https://www.thebluediamondgallery.com/handwriting/images/beneficiary.jpg

[2]Thibodeaux, Wanda. “Difference Between a Beneficiary and a Trustee.” PocketSense, Leaf Group Media, pocketsense.com/revocable-trust-become-irrevocable-8077238.html. Accessed 12 May 2021.

[3]Criddle, Evan J., et al. The Oxford Handbook of Fiduciary Law. Oxford, United Kingdom: Oxford University Press, 2019. Print

[4]Goldstone, Hartley, et al. Family Trusts: A Guide for Beneficiaries, Trustees, Trust Protectors, and Trust Creators. New Jersey, United States: John Wiley & Sons, 2015. Print

[5]Murray, Jean. “What is a Trustee?.” The Balance, Dotdash Publishing, thebalance.com/what-is-a-trustee-3505115. Accessed 12 May 2021.