Difference between Accounting and Auditing

Accounting and Auditing are two very important processes related to the financial activities and records of an organization.

What is Accounting?

Definition of Accounting:

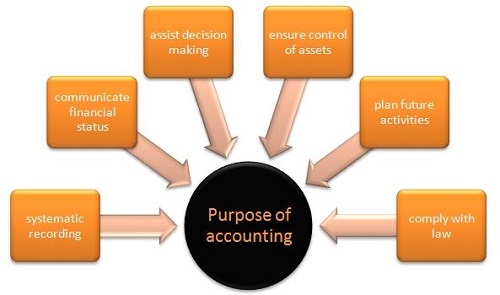

Accounting refers to the process of capturing, classifying, summarizing, analyzing and presenting the financial transactions, records, statements, profitability and financial position of an organization or entity. Accounting is the specialized language of business.

Accounting work for an organization is done usually by its own employees. Accounting is carried out almost continuously. Accounting is categorized in various branches like cost accounting, management accounting, financial accounting, etc.

What is Auditing?

Definition of Auditing:

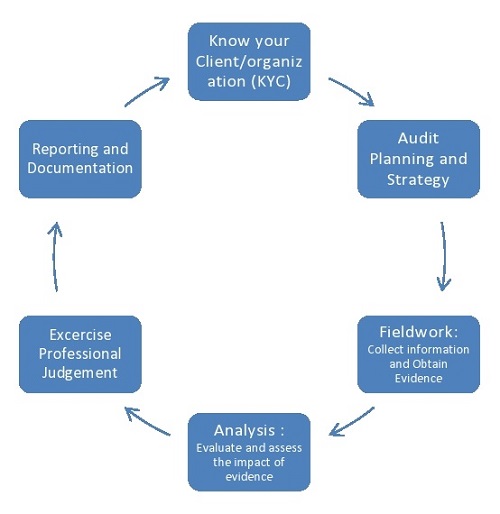

Auditing refers to the critical examination of the financial records or statements of a business or an organization. It is obligatory for all separate legal entities. Auditing is carried out after the final preparation of the financial statements and accounts.

Auditing involves carrying out the inspection and statutory audit of the financial statements, and giving a fair and unbiased opinion on whether the financial statements and records provide a true and fair reflection of the actual financial position of the firm. The auditors, usually external, carry out the task of auditing under the provisions of the applicable laws on behalf of shareholders or regulators. The scope of auditing work is determined by the applicable laws.

Auditing has two main categories viz. internal audit and external audit. Internal audit is conducted by an internal auditor, usually an employee of the organization. External audit is conducted by an external auditor, appointed by the shareholders.

Similarities between Accounting and Auditing:

Many of the basic processes of both accounting and auditing are similar. Both need a thorough knowledge of accounting basics and principles. Both are generally done by the persons with an accounting degree. Both use essential procedures and techniques of book-keeping, computation and analysis.

Both accounting and auditing strive to ensure that the financial statements and records provide a fair reflection of the actual financial position of an organization.

Difference between Accounting and Auditing:

In terms of

- Definition:

Accounting is keeping records of the financial transactions and preparing financial statements; but auditing is critical examination of the financial statements to give an opinion on their fairness.

- Timing:

Accounting is carried out on continuous basis with daily recording of financial transactions; while auditing is basically a periodic process and carried out after the preparation of final accounts and financial statements, usually on yearly basis.

- Beginning:

Accounting starts usually where book-keeping ends; while auditing always starts where accounting ends.

- Period:

Accounting mainly concentrates on the current financial transactions and activities; while auditing concentrates on the past financial statements.

- Coverage:

Accounting covers all transactions, records and statements having financial implications; while auditing mainly covers final financial statements and records.

- Level of Detail:

Accounting is very detailed and captures all details related to financial transactions, records and statements; while auditing generally uses financial statements and records on sample basis.

- Type of Checking:

Accounting involves checking and verifying details related with all financial statements and records; while auditing may be carried out through test checking or sample checking.

- Focus:

The primary focus of accounting is to accurately record and present all financial transactions and statements; while the primary focus of auditing is to verify the accuracy and reliability of the financial statements, and to judge whether the financial statements provide a true picture of the actual financial position of the entity.

- Objective:

Objective of accounting is to determine the financial position, profitability and performance; while objective of auditing is to add credibility to the financial statements and reports of the company.

- Legal Status:

Accounting is governed by Accounting Standards with some degree of discretion; but auditing is governed by Standards on Auditing and does not provide much flexibility.

- Performed by:

accounting is performed by accountants; while auditing is performed generally by qualified auditors.

- Status:

Accounting is usually carried out by an internal employee of the company; but auditing is carried out by an external person or independent agency.

- Appointment:

Accountant is appointed by the management of the company; while the auditor is appointed by the shareholders of the company, or a regulator.

- Qualification:

Any specific qualification is not compulsory for an accountant; but some specific qualification is compulsory for an auditor.

- Remuneration Type:

Accounting is carried out by a company employee who gets a salary; while a specific auditing fee is paid to the auditor.

- Remuneration Fixation:

Accountant’s remuneration, i.e., salary is fixed by the management; while auditor’s fee is fixed by the shareholders.

- Scope Determination:

The scope of accounting is determined by the management of the company; while the scope of auditing is determined by the relevant laws or regulations.

- Necessity:

Accounting is necessary for all organizations in the day-to-day or routine operations; while auditing is not necessary in the day-to-day operations.

- Deliverables:

Accounting prepares financial statements e.g. Income Statement or P/L, Balance Sheet, Cash Flow Statement, etc.; while auditing provides Audit Report.

- Report Submission:

Accounts are submitted to the management of the organization; while audit report is submitted to the shareholders.

- Guidance:

Accountants may make suggestions for the improvement of accounting and related activities to the management; whereas auditor usually does not make suggestions, except in some cases with specific requirements, e.g. improvement in internal controls.

- Liability:

Accountant’s liability generally ends with the preparation of the accounts; while auditor has liability after preparation and submission of the audit report.

- Shareholders’ Meetings:

Accountant does not attend the shareholders’ meeting; while an auditor may attend the shareholders’ meeting.

- Professional Misconduct:

An Accountant is not usually prosecuted for professional misconduct; whereas an auditor can be prosecuted for professional misconduct as per the applicable legal procedure.

- Removal:

Accountant can be removed by the management; while an auditor can be removed by the shareholders.

Difference between Accounting and Auditing with the comparison chart

| Criterion | Accounting | Auditing |

| Definition | Accounting is keeping records of the financial transactions and preparing financial statements | Auditing is critical examination of the financial statements to give an opinion on their fairness |

| Timing | Continuous with daily recording of financial transactions | Periodic process and carried out after the preparation of final accounts |

| Beginning | Starts where book-keeping ends | Starts where accounting ends. |

| Period | Concentrates on the current financial transactions and activities | Concentrates on the past financial statements |

| Coverage | All transactions, records and statements having financial implications | Final financial statements and records. |

| Level of Detail | Very detailed and captures all details related to financial transactions and records | Uses financial statements and records on sample basis. |

| Type of Checking | Checking details related with all financial records | Carried out through test checking or sample checking. |

| Focus | To accurately record and present all financial transactions and statements. | To verify the accuracy of the financial statements |

| Objective | To determine the financial position, profitability and performance. | To add credibility to the financial statements |

| Legal Status | Governed by Accounting Standards | Governed by Standards on Auditing |

| Performed by | Accountants | Auditors. |

| Status | Carried out by an internal employee | Carried out by an external person or independent agency |

| Appointment | By the management | By the shareholders |

| Qualification | Specific qualification is not compulsory | Some specific qualification is compulsory |

| Remuneration Type | Salary | Auditing fee |

| Remuneration Fixation | By the management | By the shareholders |

| Scope Determination | by the management | by the relevant laws |

| Necessity | Necessary for all organizations in the day-to-day or routine operations | Not necessary in the day-to-day operations |

| Deliverables | Financial statements e.g. Income Statement or P/L, Balance Sheet, Cash Flow Statement, etc. | Audit Report |

| Report Submission | To the management | To the shareholders |

| Guidance | Accountants may make suggestions for the improvement of accounting and related activities | Auditor usually does not make suggestions |

| Liability | Generally ends with the preparation of the accounts | Liability after preparation and submission of the audit report |

| Shareholders’ Meetings | Accountant does not attend | Auditor may attend |

| Professional Misconduct | Accountant is not usually prosecuted for professional misconduct | Auditor can be prosecuted for professional misconduct |

| Removal | By the management | By the shareholders |

Summary of difference between Accounting and Auditing

Accounting and auditing both are important for an organization. Accounting and auditing are carried out separately by internal employees and independent third party respectively.

There are many differences between the two. Accounting is continuous; and focuses on accurately recording and preparing all financial transactions and statements. Auditing is independent; and focuses on critical evaluation of financial statements and providing an unbiased opinion on their accuracy.

However, they also complement each other in some respects. Accountants can learn from professional knowledge of an auditor; and implement the best practices in their accounting work. Auditor may get help from the accountants for a thorough knowledge of the accounting system of an organization and technical aspects of the business. If any fraud or error remains undetected; the auditor will be held responsible solely.

- Difference between Limited Liability Company (LLC) and Limited Liability Partnership (LLP) - April 21, 2018

- Difference Between Cost Accounting and Management Accounting - April 6, 2018

- Difference Between Agile and Scrum - March 19, 2018

Search DifferenceBetween.net :

8 Comments

Leave a Response

References :

[0]"Types of Audits." finance.columbia.edu. Columbia University. n.d. Web. 19 Dec. 2017.

[1]Bazerman, Max H., Loewenstein, George, and Moore, Don. "Why Good Accountants Do Bad Audits". hbr.org. Harvard Business Review, November 2002. Web. 19 Dec. 2017.

[2]Larcker, David F. "Financial Reporting and External Audit." gsb.stanford.edu. Stanford Graduate School of Business, n.d. Web. 19 Dec. 2017.

[3]" What is internal audit." iia.org.uk. Chartered Institute of Internal Auditors, n.d. Web. 19 Dec. 2017.

[4]"Image Credit: https://www.flickr.com/photos/sampjb/5821074238/"

[5]"Image Credit: https://en.wikipedia.org/wiki/Audit"

Thanks for sharing 🙂

Thanks for sharing this info

Divine

Accurate information

Thanks for information

Thanks for sharing this information

Thank you

Reference