Difference Between Gross Sales and Net sales

These two terms are mostly used to reflect the financial performance of an organization. Both gross sales and net sales help identify the sales made by the business, they give the complete analysis of the businesses’ sales and they are both calculated for a particular period of time. Most people read financial statements of the companies in which they own shares or are prospective shareholders in order to gauge its performance.

Therefore it is important for such people to understand the difference between gross sales and net sales so as to get the most out of the data. Gross sales is the total amount of money that is received while net sales is the total amount after certain deductions have been made. Some of these deductions include taxes, shipping and fees. Net sales are usually lower than the gross sales since it accounts for additional deductions.

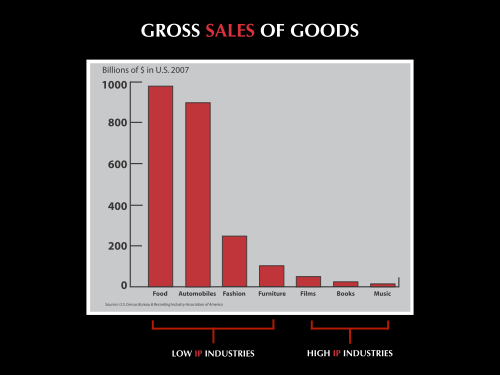

What is Gross Sales?

These are the total unadjusted sales which means that they are the total sales before any discounts, allowances and returns.

Sales discounts are early payment discounts. For example paying 5% less if the buyer pays within 10 days of the invoice note. The discount only applies upon seeing the receipt of cash from the customer since it’s a mystery to the seller on which buyer will get the discount.

Sales allowances describe the reduction in price of a product due to defects of a product. It is granted after the buyer has purchased the product. Sales returns is simply when a customer refunds a product. A return can only be done under a return merchandise authorization.

Gross sales are not the final total revenue generated by a company but they are a reflection of the total amount of revenue generated during a given period.

Gross sales constitute of cash, credit card, debit card and credit sales. They can be misleading if reported as a single line item since they overstate the actual amount of sales.

What is Net Sales?

They are the total amount of sales after deductions are made. These deductions are returns, allowances and discounts. Net sales are in contrast with Gross sales. It is simply Gross sales less discounts, returns and allowances. When the deductions are high then there is a reduction in Net sales and vice versa.

Once the difference between a company’s net sales and the gross sales is greater than the overall industry average, the company could be giving high discounts or there may be excessive returns. Net sales give a more accurate picture of the sales generated by a company as well as show what the company expects to receive at the end of a given period.

They help a company measure its topline. A company can also compare their gross and net sales with other companies in the same industry in order to detect problems earlier rather than dealing with a financial burden later on.

This is the amount that many investors and analysts look at when reviewing the income statement of a company when assessing the health of a company and whether to invest because it helps them predict the future revenue of the company.

Some of the deductions made to get the net sales include:

- Sales Allowances: This is the reduction in the prices paid due to defects.

- Sales discounts: These include discounts such as a 2% deduction if the buyer pays within ten days of an invoice.

- Sales returns: This includes refunds done on pre-purchased merchandise.

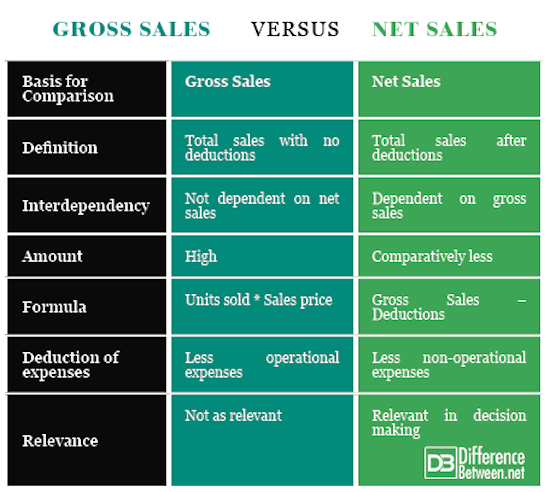

Differences between Gross and Net Sales

-

Definition of Gross Vs. Net Sales

Gross sales are the total amount of sales without any deductions while Net sales are the total amount of sales after deductions from the gross sales.

-

Amount

Gross sales are always higher than the net sales due to the fact that net income is derived from deductions made from the gross sales.

-

Dependency

Net income is always dependent on Gross sales.

-

Calculation of Gross Vs. Net Sales

To get Gross sales, you take the units sold multiply them by the selling price for each unit. To get Net sales you take the Gross sales and less deductions (returns, allowances and discounts).

-

Deduction of expenses

Operational expenses are deducted from the Gross sales while non- operational expenses are deducted from the net sales

-

Relevance

Net sales are much more relevant in decision making than gross sales. The give a better picture of the current financial position of a company.

Comparison table for Gross Vs. Net Sales

Summary of Gross Vs. Net Sales

- These two types of sales are closely intertwined as net sales is a part of gross sales since in order to get net sales, then one has to calculate gross sales.

- They are both calculated for a particular financial year and they are helpful in making comparison both internally and externally.

- These two entities help analyze how effectively and efficiently the company’s resources are being utilized.

- They both influence the decisions made by current shareholders, potential shareholders and investors as well as enable the organization to review their goals and make the necessary plans in order to attain their long term objectives.

- Both have relevance in their own way and they are both an integral part of the financial analysis of the general business income.

- Difference Between S Corp and C Corp - September 9, 2018

- Difference Between Terrace and Balcony - September 9, 2018

- Difference Between Anabaptists and Evangelicals - August 31, 2018

Search DifferenceBetween.net :

Leave a Response

References :

[0]Anthony, R. N. and J. S. Reece (2000), Accounting: Text and Cases, Homewood III.: Irwin

[1]Copeland, T. E., T. Koller, and J. Murrin (2014), Valuation: Measuring and Managing the Value of Companies, Third edition. New York: Willey

[2]Perman, Stephen H. (2005), Financial Statement Analysis and Security Valuation, McGraw-Hill

[3]Pereira, F., E. Ballarin, M. J. Grandes, J. M. Rosanas and J. C. Vasquez (2012), Financial Modeling and Valuation Analysis, 6(12), 123-130

[4]Image credit: https://commons.wikimedia.org/wiki/File:P%26G_ACTUAL_GROWTH.png#/media/File:P%26G_ACTUAL_GROWTH.png

[5]Image credit: https://upload.wikimedia.org/wikipedia/commons/thumb/d/d8/Gross_sales_of_goods_vs_IP_laws_%28USA_2007%29.svg/500px-Gross_sales_of_goods_vs_IP_laws_%28USA_2007%29.svg.png