Difference Between S Corp and C Corp

Corporations are formed after the preparation of the articles of incorporation and the filing of all the registration documents. Shareholders own corporations. The percentage of shares they own determines a shareholder’s position and authority in a company. The shareholders employ directors to manage the business operations. The profits also known as dividends are then shared among the shareholders based on the shares each own.

Once the corporation is formed, limited personal liability is issued to the shareholders. The corporation is recognized as a separate entity independent of the owners. In this separate entity status, only the assets of the corporation are subject to all debts related to the corporation. However, a few exceptions make the shareholders personally liable for, and their assets may not be protected from creditors.

For corporations to operate legally annual shareholders meeting should be held, minutes of the meeting recorded and issuing of the written resolutions with relevant decisions to the appropriate party. The necessary reports should be done according to the regulations of that jurisdiction, and the required annual fees paid. Once they fail to comply with the above, the corporation risks dissolution and losing the liability protection.

What is an S Corp?

An S Corp. is a business structure where double taxation is avoided since the business is not required to pay tax related to profits of a company. The gains and losses are shared directly with the shareholders who then file an income tax on the dividends issued. Corporations which have two or more shareholders are required to file an informational tax return that includes details of the particular shareholder.

Corporations that elect an S structure are only taxed once. With this structure, they can benefit from the advantages of having a corporate structure and tax benefits of partnership businesses. The primary reason why this provision was made was to relieve small businesses off the burden of dual taxation. Any company that would want to become an S-corporation should first make an election, to be treated as one.

In the US, the election process involves filling and submitting Form 2553 to the IRS. The form should also be signed by all the shareholders and submitted by 15th March of the financial year of which the corporation would want to change its structure status. There are other additional criteria the company should adhere to before being granted the status. The business, however, must conform to specific set criteria before it can be changed into an S corporation status.

The company should have less than 100 shareholders of US citizenship or residency. The business should be operating domestically and within any of the US states. The business should have only one stock type meaning the all the shares should be equal and have identical rights for the shareholders regarding liquidation and profit distribution.

What is a C Corp?

A C Corp is a business that is distinguished from others since the profits are taxed differently from the owners. The owners of a C Corporation are referred to as shareholders. A C corporation is required to make financial reports annually to the Attorney General.

Such corporations don’t cease to exist once the shareholders are changed or get sick as it is recognized as a single independent entity. Owners of C corporations have limited liability. Their assets are not subject to use when settling company debts. The individuals can’t also be sued individually for corporate mistakes.

The process of setting up a C Corp involves four steps. First, choose the preferred name for the business. The title should not be in use or be related to any other business. The second step involves filing the articles of association with the state’s official office. Once the incorporation is approved, the board should hold a meeting and have all the minutes recorded. The final step involves obtaining the state required licences.

Differences Between S Corp and C Corp

1) Number of Shareholders

The S Corps can only have a100 shareholders, unlike the C corps that can have an unlimited amount.

2) Nationality of shareholders

The shareholders of the S Corp can be US citizens or residents. Any individual of legal capacity can become a shareholder of a C Corp.

3) Locality of Operation

S Corps can only operate locally and within the domestic states. C Corps can have subsidiaries in different countries.

4) Share Classes

S Corps can have only one class of stock. C Corps can have as many classes of stock as possible. They are allowed to issue different financial rights such as granting preference to distributions to specific shareholders.

5) Formalities

S Corporations have much more internal formalities than the C Corporations.

6) Ownership Transferability

Shares in an S corporation are easily transferable. In a C Corporation, the approval from members is required before transfers can be made.

7) Tax Payment

S Corps don’t are exempt from paying taxes from profits. The profits acquired in a financial year are usually not touched until issued as dividends to the shareholders appropriately. The shareholders then pay taxes on the income received. As for C Corporations taxes are incurred on profits made.

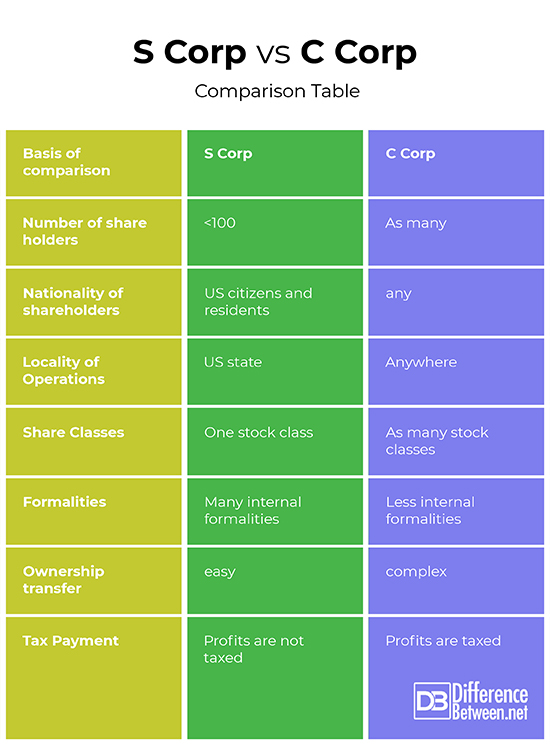

S Corp vs. C Corp; Comparison Table

Summary of S Corp Vs. C Corp

- Corporations are business structures formed after filing of articles of association and the required relevant documents.

- S Corporations are those that don’t pay taxes on profits earned.

- C Corporations pay taxes on profits.

- For a company to convert into S Corporation must have only US residents or citizens as the shareholders. The shareholders should also be less than 100.

- C Corporations can operate anywhere with as many subsidiaries. S corporations can only operate domestically.

- Difference Between S Corp and C Corp - September 9, 2018

- Difference Between Terrace and Balcony - September 9, 2018

- Difference Between Anabaptists and Evangelicals - August 31, 2018

Search DifferenceBetween.net :

Leave a Response

References :

[0]Hupalo, P. I. (2003). How to Start and Run Your Own Corporation: S-corporations for Small Business Owners. HCM Pub.

[1]Harroch, R. D. (2010). Small Business Kit For Dummies. John Wiley & Sons.

[2]Gothard, B. (2017). Business Law: Sole Proprietorship, Partnership, LLC, S Corporation, and C Corporation Taxation, Structure, and Guide. Ben Gothard.

[3]Image credit: https://www.publicdomainpictures.net/en/view-image.php?image=240436&picture=business

[4]Image credit: https://www.flickr.com/photos/criminalintent/2744040362