Difference Between IRA and 401K

How much do you save now so you’ll have enough money to successfully retire? Having enough money to sustain yourself during the next 20 to 30 years after your retirement isn’t easy. This is where a retirement plan comes to your rescue. Fortunately, you now have several options for saving for your retirement, such as an IRA or a 401(k).

Let’s take a look at the two retirement plans and try to understand the difference between an IRA and a 401(k), so you’ll have a better idea of which one’s right for you.

What is an IRA?

An IRA, short for individual retirement account, is a type of retirement savings account that provides you with the opportunity to save for your retirement on a tax-advantaged basis. There are different types of IRAs, but the two most common are Traditional IRAs and Roth IRAs.

- Traditional IRA: Contributions to a traditional IRA may be tax-deductible, meaning you can potentially reduce your taxable income in the year you make the contribution. Withdrawals are generally taxed as ordinary income, and there may be penalties for early withdrawals.

- Roth IRA: Contributions to a Roth IRA are made with after-tax dollars, so they are not tax-deductible. One significant advantage of a Roth IRA is that qualified withdrawals, including earnings, are tax-free.

IRAs typically offer a range of investment options, such as stocks, bonds, mutual funds, and more. The specific rules and benefits can vary, so it’s essential to understand the details of the type of IRA you choose.

What is a 401(k)?

A 401(k) is an employer-sponsored retirement savings plan that’s named after the section of the Internal Revenue Code that governs it. As an employee, you can contribute a portion of your salary to your 401(k) on a pre-tax basis. This means the contribution is deducted from your gross income before income taxes are applied.

When you sign up for a 401(k) plan, you agree to let your employer deposit a small portion of your paycheck into the plan as a pre-tax contribution, a Roth after-tax contribution, or a combination of the two. If you switch jobs, you can choose to roll over your 401(k) funds into a new employer’s plan or an IRA to maintain the tax advantages.

Difference between IRA vs. 401(k)

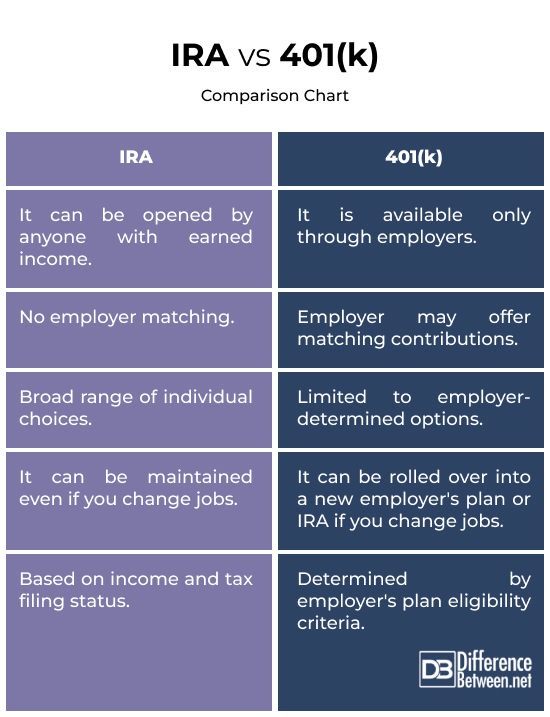

Sponsorship and Access

IRAs are individual retirement accounts that can be opened by anyone with earned income, whether they are self-employed or employed. They are not tied to a specific employer. 401(k) plans are employer-sponsored retirement plans. They are only available through employers who choose to offer them to their employees.

Contribution Limit

If you’re under age 50, the annual contribution limit for both traditional and Roth IRAs is $6,500 for the tax year 2023 and $7,000 for 2024. If you’re 50 or older, your annual contribution limit is $7,500 for 2023 and $8,000 for 2024.

The annual contribution limit for 401(k) plans is generally higher. It’s $22,500 for 2023 and $23,000 for 2024 if you’re under the age of 50. The limit is $30,000 for 2023 and $30,500 for 2024, if you’re 50 or older.

Investment Options

IRAs typically offer a broader range of investment options, as individuals have the flexibility to choose their investment vehicles, such as stocks, bonds, mutual funds, and more. Investment options in a 401(k) are determined by the employer and are usually limited to a set menu of choices.

Employer Matching

IRAs do not involve employer contributions or matching. Contributions are solely made by the individual. You can open an IRA account through banks, brokerage companies, insurance firms, or investment companies.

Some employers offer matching contributions in 401(k) plans, where the employer contributes a certain percentage of the employee’s contribution, up to a specified limit.

Portability

IRAs are portable and can be maintained even if you change jobs. You can roll over funds from employer-sponsored plans like 401(k)s into an IRA. If you change jobs, you can roll over your 401(k) funds into a new employer’s plan or an IRA to maintain the tax advantages.

IRA vs. 401(k): Comparison Chart

Summary

Understanding these differences can help you make informed decisions about which retirement savings option or combination of options suits your financial goals and circumstances. It’s always advisable to consider consulting with a financial advisor for personalized advice. Besides, IRAs and 401(k) plans are both great investment tools, each with its own advantages.

FAQs

Is it better to have an IRA or a 401k?

While a 401(k) is linked to your job and might give you fewer choices in how you invest, it lets you save more money compared to a regular or Roth IRA. The good idea is to use both accounts together to build a complete retirement savings plan.

What is a disadvantage of having an IRA?

One disadvantage of having an IRA, especially a Traditional IRA, is that early withdrawals before the age of 59½ may result in penalties and taxes.

Why is an IRA better?

One advantage of an IRA, especially a Roth IRA, is that qualified withdrawals are tax-free. Additionally, IRAs offer more flexibility in investment choices compared to some 401(k) plans.

Can you have both an IRA and a 401k?

Yes, you can have both an IRA and a 401(k). In fact, many people choose to use both accounts to maximize their retirement savings. However, contribution limits still apply to each account type individually.

At what age should you start an IRA?

There’s no strict age requirement to start an IRA, but the earlier, the better. Many financial experts recommend starting as soon as you have earned income, even in your 20s, to benefit from the power of compounding over time.

Is a 401k safer than an IRA?

It depends on factors like investment choices and market conditions rather than the account type itself. Both 401(k)s and IRAs can hold a variety of investments, including stocks and bonds. The safety of your investments is influenced by your individual risk tolerance, the asset allocation within your accounts, and the performance of the chosen investments.

- Difference Between Caucus and Primary - June 18, 2024

- Difference Between PPO and POS - May 30, 2024

- Difference Between RFID and NFC - May 28, 2024

Search DifferenceBetween.net :

Leave a Response

References :

[0]Benna, Ted. 401(K)s and IRAs for Dummies. John Wiley and Sons, 2021.

[1]Lane, Bill, and Jennifer Lane. The Complete Idiot’s Guide to Protecting Your 401 (K) and IRA. Penguin, 2009.

[2]Yochim, Dayana, and Andrea Coombes. “IRA vs. 401(k): How to Choose.” NerdWallet, 2 Nov. 2023, www.nerdwallet.com/article/investing/ira-vs-401k-retirement-accounts.

[3]Coombes, Andrea. “Can I Have a 401(k) and an IRA?” NerdWallet, 2 Nov. 2023, www.nerdwallet.com/article/investing/can-i-have-a-401k-and-an-ira.

[4]Prinzel, Yolander. “401(k) vs. IRA: What’s the Difference?” Investopedia, 27 Dec. 2023, www.investopedia.com/ask/answers/12/401k.asp.

[5]Image credit: https://www.canva.com/photos/MAFTzs4QJWw-retirement-plans-ira-401k-and-roth-ira-for-choosing-/

[6]Image credit: https://www.canva.com/photos/MAFIyGakze4-three-eggs-with-the-inscription-ira-roth-401k-on-money/