Difference Between Bonds and Stocks

You’ve probably heard of bonds and stocks in terms of investment. When you’re planning to invest your money, you’ll have two options for asset classes: bonds and stocks. They are among the most actively traded assets and are accessible through various platforms, markets, or brokers. Understanding the fundamental difference between stocks and bonds is crucial for making an informed investment decision. So, let’s dive in!

What are Bonds?

Bonds are like loans. When you buy a bond, you’re essentially lending money to a company or the government. In return, they promise to pay you back the amount you lent (the principal) along with interest over a specified period. Investors find bonds attractive for their fixed income and relative stability compared to stocks.

The interest rate, also known as the coupon rate, is predetermined, offering a predictable return on investment. Additionally, bonds are generally considered less risky than stocks, making them a popular choice for conservative investors looking for a steady and secure income stream.

What are Stocks?

Stocks, also known as shares or equities, represent ownership in a company. When you buy a stock, you become a shareholder, which means you own a portion of that particular company. Companies issue stocks to raise capital for various purposes, and investors buy these stocks to become partial owners and share in the company’s success.

Unlike bonds, stocks don’t involve a fixed interest rate or predetermined return. Instead, the value of a stock fluctuates based on various factors, such as the company’s performance, market conditions, and investor sentiment. Investors in stocks may also benefit from dividends, which are payments made by some companies to their shareholders as a share of the company’s profits.

Difference between Bonds and Stocks

Ownership vs. Debt

Stocks represent ownership in a company. When you own stocks, you own a share of the company and have voting rights at shareholder meetings.

Bonds, on the other hand, represent debt. When you own bonds, you are essentially lending money to the issuer (such as a corporation or government) in exchange for periodic interest payments and the return of the principal amount.

Returns

Stocks offer the potential for capital appreciation. The value of stocks can increase over time, providing investors with gains. Stocks may also pay dividends, which are a share of the company’s profits distributed to shareholders.

Bonds provide fixed interest payments at regular intervals (coupon payments) and the return of the principal amount at maturity. The returns from bonds are more predictable than stocks.

Risks Involved

Stocks generally involve higher risk and volatility. The value of stocks can fluctuate significantly based on market conditions, economic factors, and the performance of the issuing company.

Bonds are considered less risky than stocks. The fixed interest payments and the return of principal at maturity provide a more stable investment, making bonds attractive to conservative investors.

Maturity

Stocks have no maturity date. As long as the company exists, the investor holds the stock. Bonds, on the other hand, have a fixed maturity date, at which point the issuer repays the principal amount to the bondholder. Bond maturities can range from short-term (a few months) to long-term (decades).

Purpose

Companies issue stocks to raise capital for various purposes, and investors buy them to become partial owners and share in the company’s success. In contrast, issuers issue bonds to raise funds for specific projects or to meet financial needs. Investors buy bonds as a form of fixed-income investment or to diversify their portfolios.

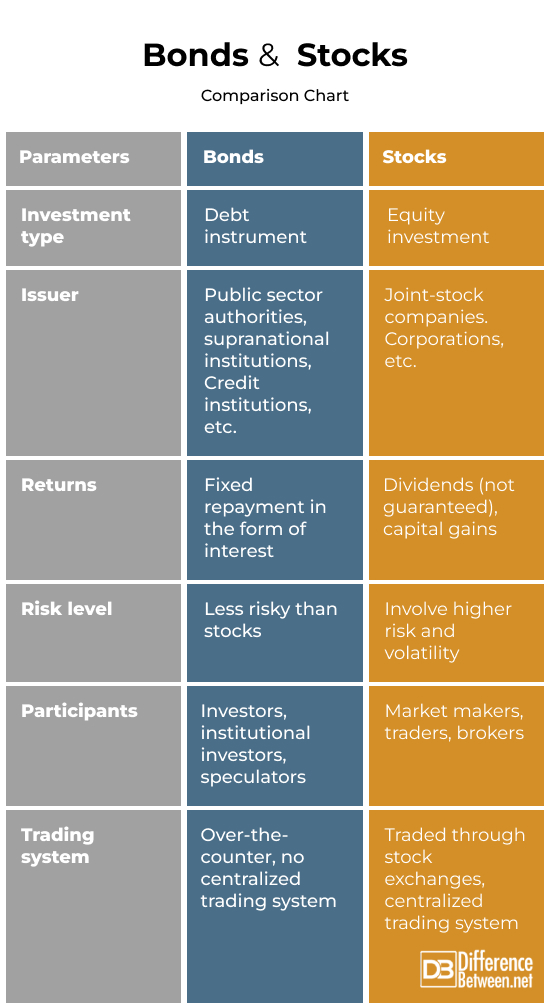

Bonds vs. Stocks: Comparison Chart

Summary

Understanding these differences can help investors make informed decisions when constructing a diversified investment portfolio. Stocks cater to investors with a higher risk appetite, offering greater volatility and an increased likelihood of investment loss. On the other hand, bonds are preferable for investors seeking lower risk exposure while still desiring returns.

FAQs

Which is better, stocks or bonds?

There’s no one-size-fits-all answer; it depends on an individual’s financial goals, risk tolerance, and investment strategy. Stocks offer potential for higher returns but come with higher risk, while bonds provide stability and fixed income but have lower potential returns.

What are the primary differences between a bond and a stock?

Bonds represent debt and provide fixed interest payments, while stocks represent ownership and offer potential for capital appreciation.

Why would someone buy a bond instead of a stock?

You may choose bonds for stability, predictable income, and lower risk. Bonds are often favored by conservative investors or those seeking regular fixed returns, especially during economic uncertainties.

What is the largest difference between stocks and bonds?

The most significant difference is in ownership and returns. Stocks represent ownership in a company with potential for capital gains, while bonds are debt instruments providing fixed interest payments and the return of principal.

Is bond safer than stock?

Generally, bonds are considered safer than stocks because of their fixed income, lower volatility, and higher priority in repayment during liquidation.

How do bonds work for dummies?

Bonds are loans where investors lend money to an issuer (like a government or corporation) in exchange for periodic interest payments and the return of the principal at maturity. It’s a way for investors to earn fixed income over a specified period.

What are the cons of a bond?

Potential cons may include lower potential returns compared to stocks, the impact of inflation on fixed returns, and the risk of default by the issuer. Bond prices can also fluctuate based on interest rate changes.

Do bonds do well in recessions?

Generally, bonds are considered safer during a recession as investors seek stability and fixed income. Bond prices may rise as interest rates fall, providing a cushion against economic downturns.

Do bonds pay dividends?

Bonds pay interest, not dividends. The periodic payments made to bondholders are known as interest or coupon payments. Dividends are associated with stocks and represent a share of the company’s profits distributed to shareholders.

- Difference Between Caucus and Primary - June 18, 2024

- Difference Between PPO and POS - May 30, 2024

- Difference Between RFID and NFC - May 28, 2024

Search DifferenceBetween.net :

8 Comments

Trackbacks

- Difference Between Book value and Market value | Difference Between

- Difference Between eBay and Amazon | Difference Between | eBay vs Amazon

- Difference Between Yield & Coupon Rate | Difference Between | Yield & Coupon Rate

- Difference Between Futures and Options | Difference Between | Futures vs Options

- Difference Between Aggregation and Composition | Difference Between | Aggregation vs Composition

- Difference Between FDI and FPI | Difference Between | FDI vs FPI

- Difference Between Djia and S&P 500 | Difference Between | Djia vs S&P 500

- Difference Between NYSE and Dow Jones | Difference Between | NYSE vs Dow Jones

Leave a Response

References :

[0]“Difference Between Bonds and Stocks.” Groww, groww.in/p/difference-between-bonds-and-stocks. Accessed 4 Jan. 2024.

[1]“Bonds vs Stocks.” Corporate Finance Institute, corporatefinanceinstitute.com/resources/fixed-income/bonds-vs-stocks/. Accessed 4 Jan. 2024.

[2]Morah, Chizoba. “Bond Market vs. Stock Market: What's the Difference?” Investopedia, 22 Feb. 2021, www.investopedia.com/ask/answers/09/difference-between-bond-stock-market.asp.

[3]Davis, Chris. “Bonds vs. Stocks: A Beginner’s Guide.” NerdWallet, 29 Aug 2023, www.nerdwallet.com/article/investing/stocks-vs-bonds.

[4]Hall, Jason. “Bonds vs. Stocks: What's the Difference?” The Motley Fool, 9 Nov. 2023, www.fool.com/investing/how-to-invest/bonds/bonds-vs-stocks/.

[5]Image credit: https://www.canva.com/photos/MADFzrqkgVg-bonds/

[6]Image credit: https://www.canva.com/photos/MAEEvChw3Fc-stock/