Difference Between Organic Growth and Acquisitions

Growth in value is core to any business. Growth is a performance metric that determines the company’s ability to perform in this competitive marketplace. Organic growth is a vital performance metric that demonstrates a company’s capabilities to grow through its in-house operations, as opposed to growth that stems from acquisitions.

What is an Organic Growth?

Organic growth is any business’s in-house recipe for boosting growth. It is the utilization of your own resources to expand and grow the company, as opposed to growth that comes from buying new businesses. Organic growth is basically the cost-effective expansion of business from within rather than by external expansion in the marketplace, such as mergers and acquisitions. It is a strategic business approach that seeks to drive profitability and increase sales and revenue from the existing business – without resorting to acquisitions. Organic growth can also be referred to as internal growth which involves growth opportunities stemming from a business’s internal operations.

For example, if a company produces and sells packaged food products, and sees a 10% increase in sales of those foods, that is considered organic growth. It is a vital performance metric that determines an organization’s ability to grow internally; increase earnings, revenue and market share, using its own expertise, resources and capabilities. Organic growth offers a systematic approach to uncovering growth opportunities of three types: maintenance, sales development, and business development.

What is an Acquisition?

An acquisition, as the name suggests, is when a business entity purchases most or all of the shares or assets of another business entity, thereby acquiring major stakes of the target company. Acquisitions are basically takeovers which refer to a strategic move involving one company buying another company, a division of another company, or a product line or certain assets from another company. This is opposed to when companies grow organically from within by creating and selling products or services. Acquisitions allow a business to simply bypass the growth stage by buying existing sales and profits.

Acquisition is a strategic means of transferring resources to where they are most needed and of removing underperforming managers. It is kind of a transaction when the buyer acquires a company from the seller. It may involve buying another firm’s assets or stocks, while the target firm continues to exist as a legally owned subsidiary. Acquisitions are an important change event and while they are a critical component in the business strategy of some firms, they only represent one of many ways of executing business plans.

Difference between Organic Growth and Acquisitions

Meaning

– Organic growth means internal growth of a company that attributes to the company’s in-house resources, expertise and capabilities. It is basically a cost-effective expansion of business from within rather than by external expansion in the marketplace, such as mergers and acquisitions, which on the other hand, refer to an inorganic expansion involving one company buying another company, a division of another company, or a product line or certain assets from another company.

Control/Ownership

– Organic growth is a smart, long-term strategy for any company which immediately resorts to increased sales, revenue and profits. It allows business owners to gain more market share while allowing them to maintain control of their company. It comes from expanding your organization’s output without resorting to strong strategic measures, such as acquisitions, which allow a business to simply bypass the growth stage by buying existing sales and profits. Acquisitions simply strip away the target firm’s control, affecting their business owners and sometimes, employees.

Investment and Risk

– Organic growth is a cost-effective expansion and growth of business by increasing output and enhancing sales to increase revenue. It is the company’s in-house recipe for boosting growth that doesn’t typically require much upfront costs or investments. Because the source comes from retained profits and the company is able to maintain a greater degree of control, organic growth tends to be less risky than inorganic growth strategies. Acquisition costs involve everything from expenses related to marketing and sales commissions to costs of fixed assets and acquisition costs for customers, and everything in between. This huge investment alone makes them a significant risk.

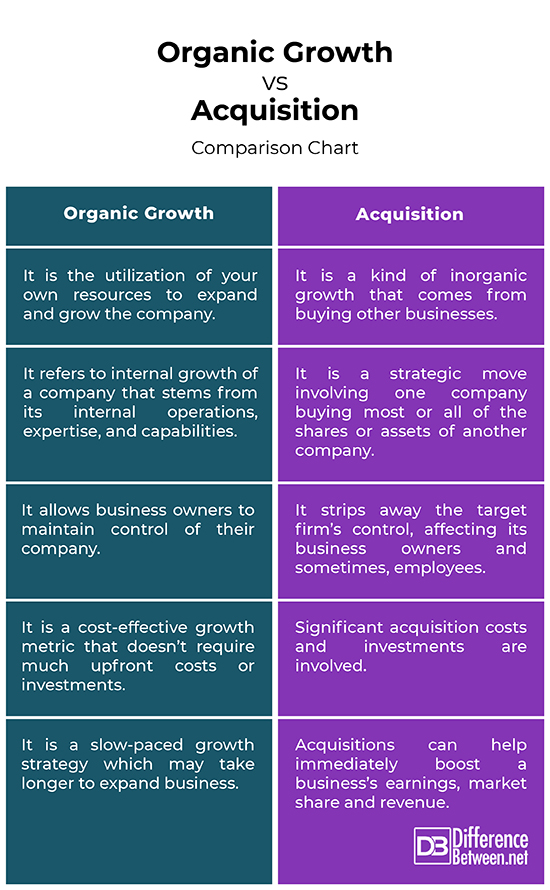

Organic Growth vs. Acquisition: Comparison Chart

Summary

Organic growth is the company’s in-house recipe for boosting growth that doesn’t typically require much upfront costs or investments, as opposed to acquisitions, which involves one company buying most or all of the shares or assets of another company. Organic growth represents the underlying strength and vitality of the core business and is created through strong, increasing sales and cash flow from the business’s internal operations. Acquisitions are an important change event and while they are a critical component in the business strategy of some firms, they only represent one of many ways of executing business plans.

Is acquisition organic or inorganic growth?

An acquisition is an inorganic growth that arises when a business needs external support to grow, as opposed to organic growth that relies on its own in-house operations to grow the business.

What is organic acquisition?

Organic acquisition is when you acquire you a new business through organic or free marketing channels or without paying a direct fee.

What is an example of organic growth?

For example, if a company produces and sells packaged food products, and sees a 10% increase in sales of those foods, that is an example of organic growth.

What are the disadvantages of organic growth?

One of the drawbacks of organic growth is its gradual growth as the company relies on its own operations, which can create some problems for the company on the long run. Also, it may take a while for the business to adapt to the big changes in the market.

- Difference Between Caucus and Primary - June 18, 2024

- Difference Between PPO and POS - May 30, 2024

- Difference Between RFID and NFC - May 28, 2024

Search DifferenceBetween.net :

Leave a Response

References :

[0]Mognetti, Jean-Frédéric. Organic Growth: Cost-Effective Business Expansion from Within. New Jersey, United States: John Wiley & Sons, 2003. Print

[1]Jaworski, Bernard and Bob Lurie. The Organic Growth Playbook: Activate High-Yield Behaviors To Achieve Extraordinary Results - Every Time. Bingley, United Kingdom: Emerald Group Publishing, 2020. Print

[2]Snow, Bill. Mergers & Acquisitions For Dummies. New Jersey, United States: John Wiley & Sons, 2018. Print

[3]DePamphilis, Donald. Mergers and Acquisitions Basics: All You Need To Know. Massachusetts, United States: Academic Press, 2011. Print

[4]Image credit: https://www.thebluediamondgallery.com/hand-held-card/images/acquisitions.jpg

[5]Image credit: https://p1.pxfuel.com/preview/373/534/333/graph-chart-investment-growth-hand-drawing.jpg