Difference Between EBIT and Revenue

Different metrics help us understand something different about the company, which in turn helps evaluating a company. So, we analyze different performance metrics while evaluating financial health of a company. Some metrics are more relevant in certain type of companies. EBIT, as the name suggest, refers to earnings before interest and taxes. It is also called profit before interest and taxes. It represents the operating earnings of a business, hence it’s also called operating income because it represents the operations of a business. Revenue is the money a business receives in a specific time period by selling its goods and services.

What is EBIT?

EBIT, short for Earnings before interest and taxes, is a metric used to calculate how much operating income a company generates before interest and income taxes are paid. EBIT often represents the operating income of a company or firm, with a few exceptions of course. It is a measure of a company’s profit which helps analyze its core operations and how efficient the management is at generating income. EBIT is a financial metric which represents the operating earnings or the operating profit of a company or business. The reason we call it operating income because it reflects the operations of a business. As the name suggests, it excludes interest and taxes. One way of calculating EBIT is by adding net profits, interest and taxes. There’s yet another way that is by subtracting operating expenses from revenue.

What is Revenue?

Growth can be measured using any number of operating metrics. Revenue is the most commonly used metric to calculate a company’s growth or financial performance. It is the top line or gross income figure from which all charges, costs, and income are subtracted to determine the net income of a business. Revenue is also referred to as sales or turnover. In a business, revenue is the value of all sales of goods and services to customers and clients. Revenue is not recognized until earned. A company’s revenue-generating activities involve delivering good, rendering services, or other activities that constitute its ongoing major operations. Revenues are said to be earned when the company is successfully entitled to the benefits represented by the revenues stated. For a healthcare care provider, for example, the revenue is the income generated from the direct provision of healthcare services to patients, clients or residents.

Difference between EBIT and Revenue

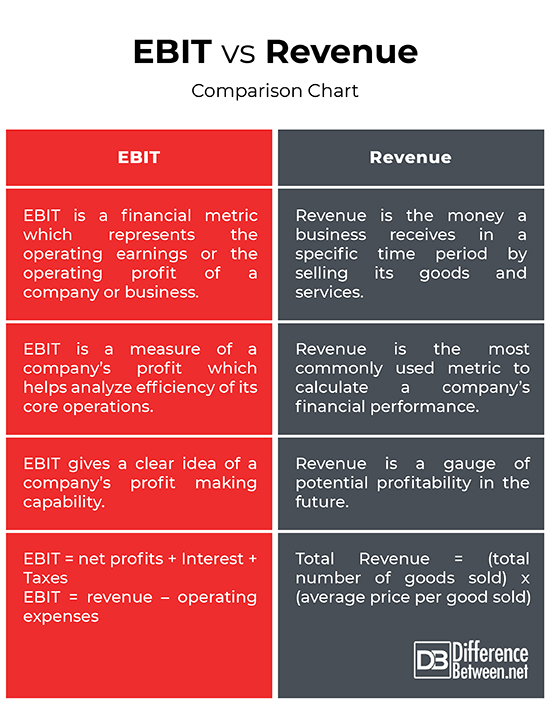

Definition

– Revenue is the most commonly used metric to calculate a company’s growth or financial performance. Revenue represents the total income that a company receives from all sales of goods and services to customers and clients, along with interest received in a specific time period. EBIT, on the other hand, is a metric used to calculate how much operating income a company generates before interest and income taxes are paid. EBIT is a financial metric which represents the operating earnings or the operating profit of a company.

Significance

– EBIT is used to calculate how much operating income a company generates for each dollar of revenue, which in turn gives a clear idea of a company’s profit making capability. EBIT is an indicator of profitability which often represents the operating income of a company or firm, with a few exceptions of course. Revenue is the money earned by a business before the expenses are paid. Calculating revenue is part of drawing an income statement. It is a gauge of potential profitability in the future and serves an important purpose for business owners.

Formula

– EBIT is a company’s operating income excluding interest and taxes. EBIT can be calculated in two ways. One way of calculating EBIT is by adding net profits, interest and taxes. There’s yet another way that is by subtracting operating expenses from revenue. Revenue, on the other hand, is the top line or gross income figure from which all charges, costs, and income are subtracted to determine the net income of a business. Total revenue is the inflow of finances earned and does not reflect debt or borrowed money.

Total Revenue = (total number of goods sold) x (average price per good sold)

EBIT = net profits + Interest + Taxes

EBIT = revenue – operating expenses

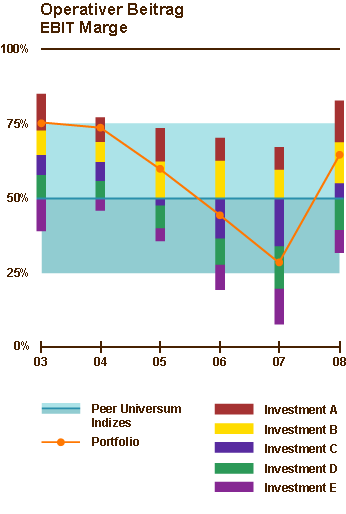

EBIT vs. Revenue: Comparison Chart

Summary of EBIT vs. Revenue

When you’re trying to figure out how profitable a company is, there are several expenses that come out which aren’t truly representative of a company’s financial performance. When you look at a company’s income statement, you can see a number called the EBIT, which is the same number as the net income but excluding the company’s interest expense and taxes. Remove those two equations from the picture; you get a clear picture of the company’s current performance. So, this is EBIT. Revenue is the most commonly used metric to calculate a company’s growth or financial performance. Revenue is also referred to as sales or turnover. It is the money a business receives in a specific time period by selling its goods and services.

- Difference Between Caucus and Primary - June 18, 2024

- Difference Between PPO and POS - May 30, 2024

- Difference Between RFID and NFC - May 28, 2024

Search DifferenceBetween.net :

Leave a Response

References :

[0]Moore, Carlos W. Managing Small Business: An Entrepreneurial Emphasis. Massachusetts, United States: Cengage, 2008. Print

[1]Carmichael, D.R. and Paul H. Rosenfield. Accountants' Handbook, Special Industries and Special Topics. New Jersey, United States: John Wiley & Sons, 2003. Print

[2]Gutmann, Andrew. How to Be an Investment Banker: Recruiting, Interviewing, and Landing the Job. New Jersey, United States: John Wiley & Sons, 2013. Print

[3]Image credit: https://de.wikipedia.org/wiki/Datei:Operativer-beitrag-investitionen.png

[4]Image credit: https://www.needpix.com/photo/747243/revenue-business-growth-profit-financial-graph-finance-analysis-income