Difference Between Tax Credit and Tax Deduction

Tax credits and deductions are crucial components of the tax return process. Both play a significant role in reducing an individual’s tax liability. Both give you a break on taxes but in different ways. While tax credits and deductions may seem like the same thing, they are quite different. In this article, we’ll help you understand the concepts and differences between a tax credit and a tax deduction. Let’s dive in!

What is a tax credit?

A tax credit is a direct reduction in the amount of income tax you owe to the government, dollar for dollar. Unlike tax deductions, which reduce taxable income, tax credits are applied after the tax liability has been calculated. Common tax credits include those for education expenses, child care, energy-efficient home improvements, and the Earned Income Tax Credit (EITC).

For example, if you qualify for a $1,000 tax credit, it means that your overall tax liability is reduced by $1,000. This reduction is applied after your tax liability has been calculated. There are various types of tax credits available, ranging from education credits and child care credits to energy-efficient home improvement credits.

What is a tax deduction?

Tax deductions are like expenses that you can subtract from your total income, thereby lowering the amount of income that is subject to taxation. These expenses may include eligible business expenses, education costs, medical expenses, or charitable contributions. In simpler terms, deductions work by lowering your taxable income, which, in turn, can lead to a decrease in the overall amount of income on which you’re required to pay taxes.

For instance, if you earned $50,000 in a year and have $5,000 in eligible tax deductions, your taxable income for tax purposes would be $45,000. The idea is that you’re taxed on the reduced income amount rather than your full earnings.

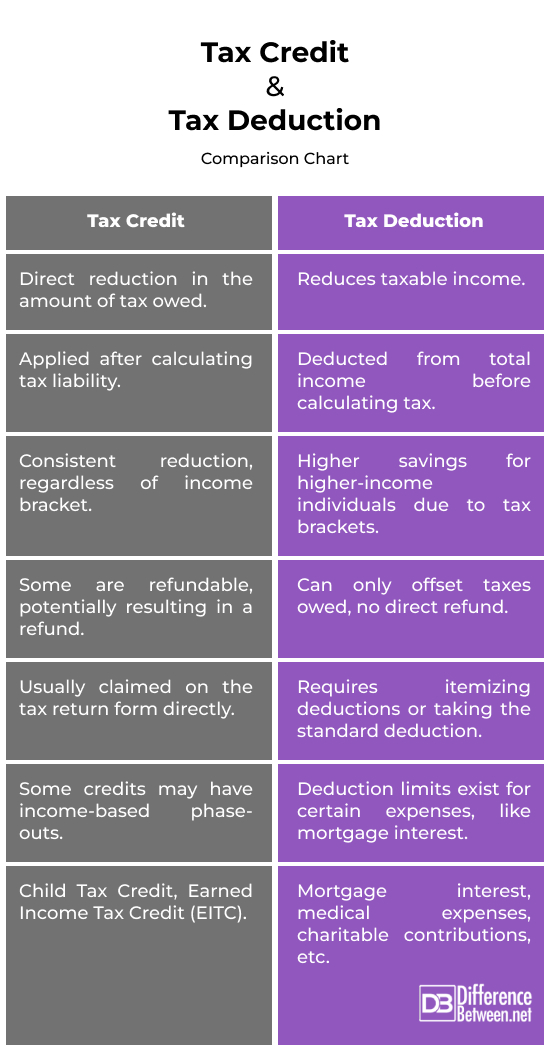

Difference between Tax Credit and Tax Deduction

Nature

Tax credits directly decrease the amount of tax you owe, providing a dollar-for-dollar reduction in your tax liability. In contrast, tax deductions reduce your taxable income, impacting the portion of income subject to taxation rather than directly lowering the tax amount owed.

Timing

Tax credits are applied after calculating your tax liability, offering a direct reduction in the final tax owed. Tax deductions, however, are subtracted from your total income before calculating the tax, influencing the taxable income amount.

Incentive Purpose

Tax credits often serve as incentives for specific behaviors, such as education, energy efficiency, or child care. They aim to encourage beneficial activities by providing a direct financial benefit. On the other hand, tax deductions are designed to offset eligible expenses, promoting deductions for items like business expenses, medical costs, or mortgage interest.

Calculation Consistency

Tax credits provide a consistent reduction regardless of your income bracket, offering the same dollar value for every taxpayer eligible for the credit. Tax deductions, however, offer higher savings for individuals in higher tax brackets, as the deduction amount is subtracted from the taxable income, which is then taxed at the applicable rate.

Refund

Some tax credits are refundable, meaning if the credit exceeds your tax liability, you may receive the excess as a refund. Non-refundable credits, however, can only offset taxes owed. In contrast, tax deductions, once applied, can only reduce your taxable income but don’t directly result in a refund; their impact is limited to lowering the tax amount owed based on the reduced income.

Tax Credit vs. Tax Deduction: Comparison Chart

Summary

To sum it all up, tax credits and tax deductions are distinct mechanisms that play pivotal roles in reducing one’s overall tax liability. Tax credits offer a direct reduction in the amount of tax owed and are applied after calculating the tax liability. Tax deductions, on the other hand, lower taxable income, impacting the portion subject to taxation. Deductions are applied before calculating tax and may vary in impact based on an individual’s income bracket.

FAQs

What is the difference between a tax deduction and a credit?

A tax deduction reduces the taxable income, indirectly lowering the amount subject to taxation. In contrast, a tax credit directly reduces the actual amount of tax owed, providing a dollar-for-dollar reduction.

What is the difference between a tax credit and a deduction in Canada?

In Canada, a tax credit is a direct reduction in the amount of tax payable, while a tax deduction lowers taxable income.

Does a tax credit mean you get money?

A tax credit can result in a refund if it’s refundable and exceeds the tax owed.

What is the difference between a tax credit and a tax deduction quizlet?

On Quizlet, the distinction between tax credits and deductions would likely focus on the direct reduction of tax liability for credits and the indirect impact on taxable income for deductions.

Why are tax deductions better than tax credits?

Tax deductions may be considered better in some cases as they reduce taxable income.

Which is worth more, a $200 deduction or a $200 credit?

A $200 tax credit is generally worth more than a $200 deduction. A credit directly reduces the tax owed by $200, while a deduction reduces the taxable income by $200.

What is an example of a tax deduction?

An example of a tax deduction is the mortgage interest deduction, where homeowners can deduct the interest paid on their mortgage from their taxable income, reducing the portion of income subject to taxation.

What is the highest amount of working tax credit?

While there’s no strict income limit, your earnings heavily influence the WTC amount. Generally, lower earners receive higher credits. The values are subject to change, and individuals should check the latest guidelines from HM Revenue & Customs.

Which is worth more, a $10 deduction or a $10 credit?

Both a $10 deduction and a $10 credit would have an equal impact on reducing the tax liability if the deduction influences the taxable income by $10 and the credit directly lowers the tax owed by $10.

- Difference Between Caucus and Primary - June 18, 2024

- Difference Between PPO and POS - May 30, 2024

- Difference Between RFID and NFC - May 28, 2024

Search DifferenceBetween.net :

Leave a Response

References :

[0]Orem, Tina. “Tax Credit vs. Tax Deduction.” NerdWallet, 9 Nov. 2023, www.nerdwallet.com/article/taxes/tax-credit-vs-tax-deduction.

[1]Segal, Troy. “Tax Credit: What It Is, How It Works, What Qualifies, 3 Types.” Investopedia, 12 Feb. 2023, www.investopedia.com/terms/t/taxcredit.asp.

[2]Lake, Rebecca. “Differences of Tax Credits vs. Tax Deductions.” SmartAsset, 20 Dec. 2023, smartasset.com/taxes/tax-credits-vs-deductions-whats-the-difference.

[3]Ashburn, Nancy. “Tax deductions, tax credits, and tax refunds—what’s the difference?” Britannica Money, www.britannica.com/money/tax-credit-deduction-refund. Accessed 9 Jan. 2024.

[4]Image credit: https://www.canva.com/photos/MADBXAZC4W0-notebook-with-tax-credit-sign-on-a-table-business-concept-/

[5]Image credit: https://www.canva.com/photos/MADRm_a2wiE-tax-deduction-written-on-a-piece-of-paper-/