Difference Between General Partner and Limited Partner

Getting into business with another party may require you to form a partnership. A partnership is the legal abstract between two or more people to get into business for profit or non-profit making reasons. The legal structure of the partnership can take different forms. The structure of the partnership will be solely based on how much each party wants to get involved with the business and what percentage of liability each is willing to take on. There are currently three globally recognized types of partners; general, limited and the limited liability. It is crucial for anyone who is starting a business to carefully analyze each type before selecting the one that will best suit their operations.

Who is a Limited Partner?

The very first trace of limited partnerships can be traced back to the third century BC in Rome. There were many investors and the interests were being publicly traded at that time within the roman Empire, creating the need of establishing partnership structures. The partnership during this time was known as societies publican rum.

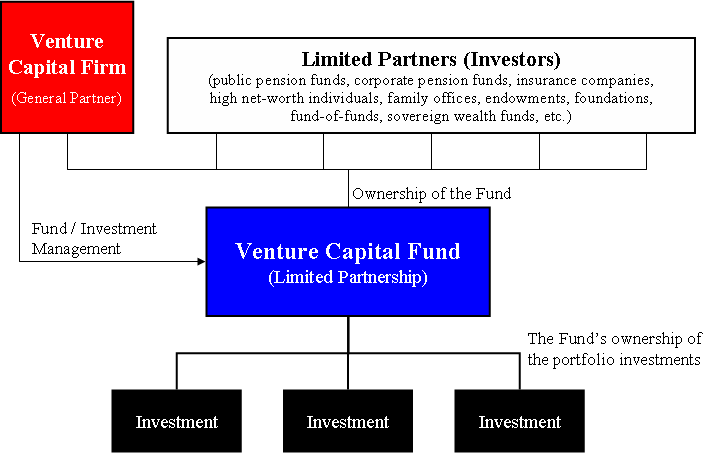

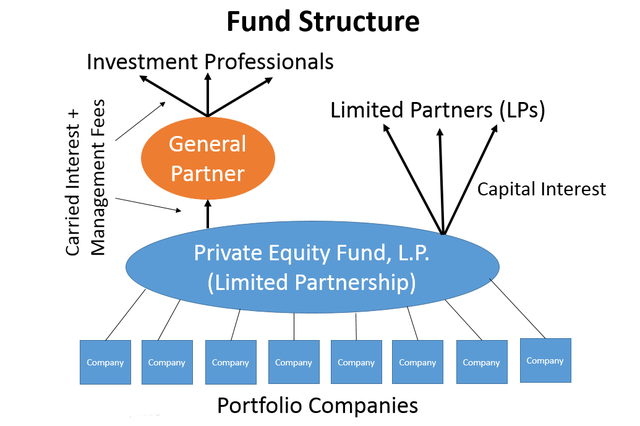

The limited partnership is that which consists of one or more limited or general partners. The acronym for the term is LP. Within this partnership form at least one person is required to have the general partner title. This structure comprises of both limited and general partners. The general partner has full management control, liability for debts and the rights to the property and profits owned by the business.

The limited partners have limited liability, in that they are only accountable for debts based on the amount of investment they have brought into the business. They also, have no management control and make minimal decisions. Their remuneration is a return on their investment which is should be predetermined in the agreements. Profits and losses are shared according to the investment brought in as listed in the contracts and binding agreements. In limited partnerships the partners are legally required to have a legally binding partnership agreement.

Who is a General Partner?

In business, the term partnership often refers to a general partnership. In general partnerships two or more individuals come together to do business as a unit. All are liable to all debts and judgments made by the business. They have no limited liability which means both partners assets can be considered in a lawsuit and be used to settle any debts once the business is rendered insolvent. Any of the partners in a general partnership can be sued for the business debts incurred.

General partners have agency powers, which means either of them can bind the business to a business deal or a contract. General partners have the benefits of control and structure. All the partners have equivalent rights to participate in management and decision making. The profits within a general partnership are shared equally and so are the losses. Usually, a contract is drafted to determine the division of profits and losses.

Partners in this structure have the option of making decisions and resolving disagreements by voting through majority rule, this is referred to as a dispute resolution process. Some partnerships elect a company board to manage the partnership while others don’t. This form of partnership enables freedom of bureaucracy that is associated with other business types such as corporations.

The partners have full discretion over any additional parties joining the partnership, unless it is stated otherwise in the partnership deed. No external party can join the partnership without full consent of the members. Partnerships don’t take much paperwork to start as compared to the limited liability structure. The document required is a general partnership agreement.

Differences Between General and Limited Partner

-

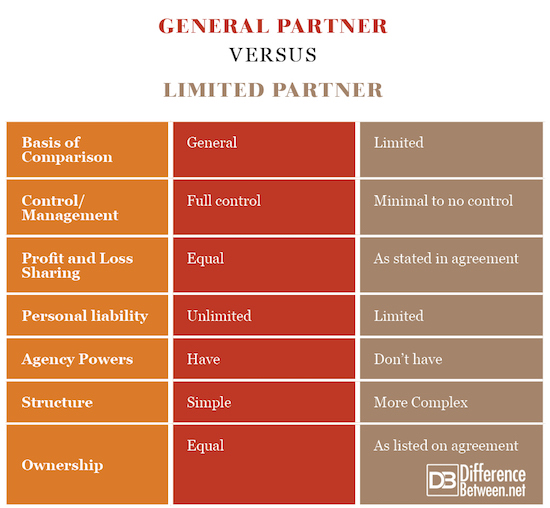

Control/ Management

General partners have full control of the business operations and are responsible for the management of the business. Limited partners have minimal to no control of the business operations.

-

Profit and Loss Sharing

Profits and losses are shared equally by general partners in a general partnership structure. Whereas, where limited partners are involved, the profits and losses are shared according to the amount of investment made or according to the clauses within the binding contracts and agreements.

-

Personal Liability

The assets of general partners can be used to pay off debts during bankruptcy. A general partner can also be sued for debts incurred by the business. Limited partners can only be sued for the percentage of investment made in the business. A limited partner becomes a limited liability partner when they don’t take part in any form of control and have no responsibilities for the business. In this case their personal assets can’t be used to pay off any debts during bankruptcy.

-

Agency Powers

A general partner can make legally binding decisions and bind the business to a contract or a business deal. Limited partners don’t have this ability.

-

Structure

The structure of general partners is less complex than that involving limited partners.

-

Restriction on Ownership

The business ownership of general partners is equal unless stated otherwise. The business ownership of limited partners is as listed in the agreement.

General vs. Limited Partner: Comparison Chart

Summary of General and Limited Partner

- Both the general and limited partners are in legally binding contracts to do business.

- Both types of partners require full consent of all members during the addition of external parties.

- The documentation required for both types of partners is a partnership agreement, it is however more complex if the business involves limited partners.

- General partners share profits and losses equally, where limited partners share them based on the investment percentage or as listed in the agreement.

- During insolvency, personal assets of general partners can be used to pay debts, however with limited partners, not all personal assets can be used.

- General partners have agency powers which allow them to make legally binding decisions while limited partners don’t possess.

- Difference Between S Corp and C Corp - September 9, 2018

- Difference Between Terrace and Balcony - September 9, 2018

- Difference Between Anabaptists and Evangelicals - August 31, 2018

Search DifferenceBetween.net :

Leave a Response

References :

[0]Image credit: https://upload.wikimedia.org/wikipedia/commons/thumb/e/e5/Fund_Structure.png/640px-Fund_Structure.png

[1]Image credit: https://upload.wikimedia.org/wikipedia/commons/7/79/Venture_Capital_Fund_Diagram.png

[2]Grimaldi, Y. (2010). General Partnership vs. Limited Partnership.

[3]Gilmore, E. A. (1908). Cases on the Law of Partnership: Including Limited Partnerships. West Publishing Company.

[4]Warren, E. (2011). Exiting TARP and Unwinding Its Impact on the Financial Markets. DIANE Publishing.