Difference Between Horizontal Analysis and Vertical Analysis

In any business venture, the process of analyzing the critical measures of business performance, for instance, the return on equity, profit margins, and inventory turnover, commonly referred to as financial analysis, can be used as an indicator of the profitability, feasibility and stability of a business. This is because the process establishes the relationship between the items in the profit and loss account and the balance sheet, hence identifying financial strengths as well as weaknesses. Various methods used in the analysis of financial statements include ratio, horizontal and vertical analysis.

Horizontal Analysis

Also referred to as trend analysis, this is the comparison of financial information such as net income or cost of goods sold between two financial quarters including quarters, months or years. Often expressed in percentages or monetary terms, it provides insights into factors that significantly affect the profitability of an organization. For instance, in the year 2015, organization A had 4 million turnover as compared to year the 2014 whereby the turnover was 2 million. The 2 million increase in turnover is a positive indication in terms of performance with a 50% increase from the year 2014. For a better picture of performance, the analysis should be expressed as a percentage as opposed to currency.

Vertical Analysis

This is the analysis of financial data independent of time. It involves identifying the co-relation of items relating to a company’s financial information and how they affect the overall performance of an organization. For instance, vertical analysis can be used in the determination of cost of goods in relation to the organization’s total assets. This type of analysis enables the performance comparison with other firms in the same industry.

Similarities between Horizontal and Vertical Analysis

- Both are used in the analysis of financial statements

Differences between Horizontal and Vertical Analysis

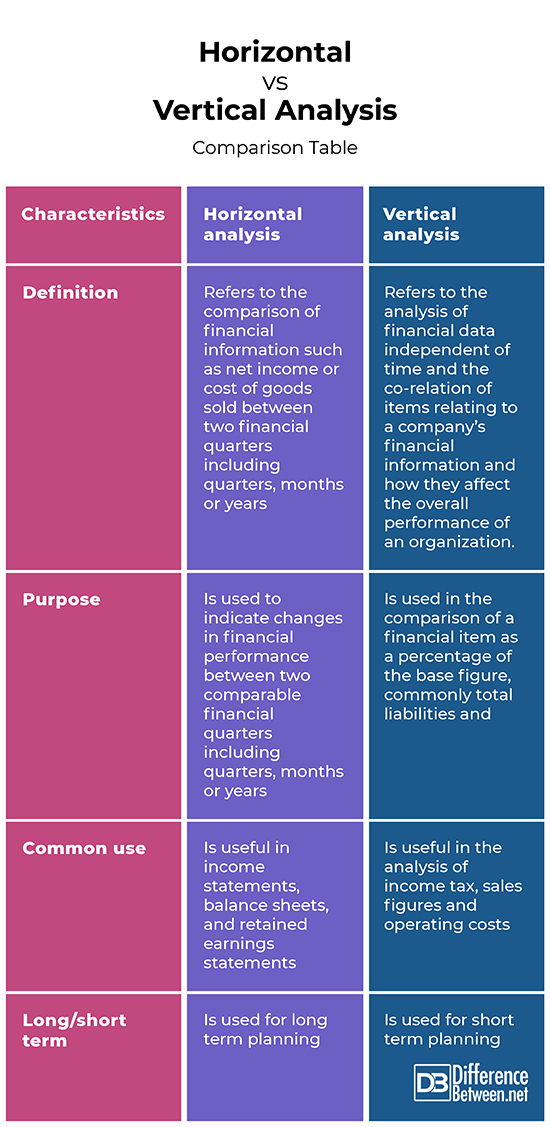

Definition

Horizontal analysis refers to the comparison of financial information such as net income or cost of goods sold between two financial quarters including quarters, months or years. On the other hand, vertical analysis refers to the analysis of financial data independent of time and the co-relation of items relating to a company’s financial information and how they affect the overall performance of an organization.

Purpose

Horizontal analysis is used to indicate changes in financial performance between two comparable financial quarters including quarters, months or years. On the other hand, vertical analysis is used in the comparison of a financial item as a percentage of the base figure, commonly total liabilities and assets.

Common use

While horizontal analysis is useful in income statements, balance sheets, and retained earnings statements, vertical analysis is useful in the analysis of income tax, sales figures and operating costs.

Long/short term

While horizontal analysis is used for long term planning, vertical analysis is used for short term planning.

Horizontal vs. Vertical Analysis: Comparison Table

Summary Between Horizontal and Vertical Analysis

Although both horizontal and vertical analysis is used in the analysis of financial statements, they have several differences. While horizontal analysis refers to the comparison of financial information such as net income or cost of goods sold between two financial quarters including quarters, months or years, vertical analysis involves the analysis of financial data independent of time and the co-relation of items relating to a company’s financial information and how they affect the overall performance of an organization. Both, however, are important when it comes to business decisions based on the performance.

- Difference Between Profit Center and Investment Center - July 2, 2022

- Difference Between Anti-Trust and Anti-Competition - June 6, 2022

- Difference Between Stocktaking and Stock Control - June 6, 2022

Search DifferenceBetween.net :

Leave a Response

References :

[0]Entrepreneur Press. Start Your Own Coaching Business: Your Step-By-Step Guide to Success. Entrepreneur Press, 2012. https://books.google.co.ke/books?id=G7O-k3XtQkcC&pg=PA69&dq=Difference+between+Horizontal+and+Vertical+Analysis&hl=en&sa=X&ved=0ahUKEwiIsJDJmrzjAhWQUcAKHalDAZk4FBDoAQg4MAQ#v=onepage&q=Difference%20between%20Horizontal%20and%20Vertical%20Analysis&f=false

[1]SBPD Editorial Board. Accountancy: Model Paper (2014-15). SBPD Publications, 2016. https://books.google.co.ke/books?id=1bZtDQAAQBAJ&pg=PA77&dq=Difference+between+Horizontal+and+Vertical+Analysis&hl=en&sa=X&ved=0ahUKEwi_ndjbmbzjAhWSyoUKHZhcB4kQ6AEILjAB#v=onepage&q=Difference%20between%20Horizontal%20and%20Vertical%20Analysis&f=false

[2]Gentene D & Gilbertson C. Century 21 Accounting: Multicolumn Journal, Introductory Course, Chapters 1-17. Cengage Learning Publishers, 2013. https://books.google.co.ke/books?id=UJ90AgAAQBAJ&pg=PA299-IA180&dq=Difference+between+Horizontal+and+Vertical+Analysis&hl=en&sa=X&ved=0ahUKEwjwj9m7mrzjAhWNasAKHWyDCQI4ChDoAQhMMAY#v=onepage&q=Difference%20between%20Horizontal%20and%20Vertical%20Analysis&f=false

[3]Image credit: https://www.maxpixel.net/Computer-Connection-Analysis-Chart-Business-3753757

[4]Image credit: https://www.maxpixel.net/Computer-Analytics-Analysis-Business-Chart-Charts-1841158