Difference Between Residual Risk and Inherent Risk

We live in a world full of risks. We constantly calculate the risks at every instance of our lives. Should we jump that red light? Should we invest in that stock? These are potential risk factors that we anticipate every single day. Organizational risks work in much the same manner. In fact, risks are at the very heart of a business or organization. When it comes to risk analysis, organizations deal with two types of risk: inherent risk and residual risk.

What is Inherent Risk?

Inherent risk, as the name suggests, is the magnitude of risk based on the nature of an organization’s business without any security measures or controls in place. The term refers to the likelihood that you’ll arrive at an inaccurate conclusion based on the organization’s type and complexity. While assessing this level of risk, you ignore whether the business has internal controls in place in order to help mitigate the inherent risk.

Imagine your digital online presence without any passwords, privacy or security controls to keep your confidential and personal data safe; this is a great example of inherent risk of technology. Simply taking a flight is an example of an inherent risk you take and the risk of flying in an airplane is extremely high.

What is Residual Risk?

Residue means anything that remains after a part is separated or removed from the process. It is a small amount of something that is left behind. The black substance that remains after a fire is an example of a residue. Similarly, residual risk is the amount of risk that remains after all precautions and measures are accounted for. It is the risk left over after all security controls and risk factors have been calculated. It is the risk associated with an action or process which remains after efforts have been made to determine and eliminate risks.

Residual risk is when you’ve tried to cover as much as possible to mitigate the risk but beyond that whatever risk remains is residual risk. During a business process, lots of risk factors are involved and the entity takes into consideration all such factors to eliminate all the known risks of the process. But there are still so many risks that remain due to unknown factors and which cannot be hedged or countered. Such risks are called residual risks.

Difference between Residual Risk and Inherent Risk

Meaning

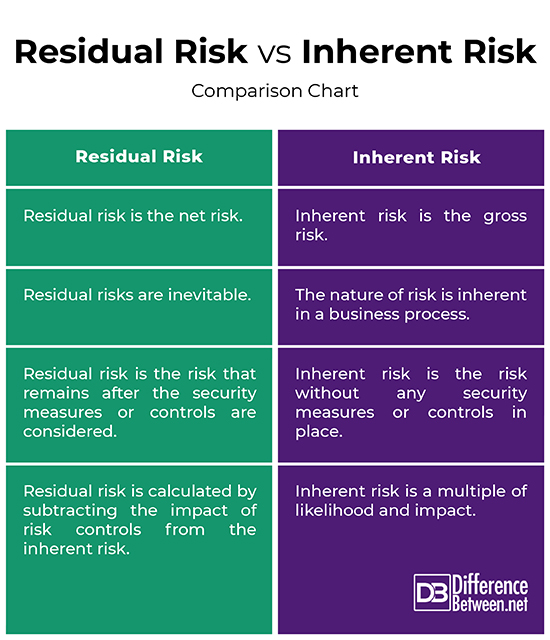

– Inherent risk is the risk based on the nature of an organization’s business without any security measures or controls in place. In the financial world, inherent risk is the risk posed by some errors in the financial statements without considering internal controls. Residual risk, on the other hand, is the level of risk that remains after the controls or risk treatments are considered. It is the amount of risk that remains after all precautions and measures are accounted for.

Nature

– Inherent risks represent all risks that are established only after an organization’s key objectives have been defined, and steps have been taken to identify the potential risks that can directly affect those objectives. Like the name suggests, the nature of inherent risk is inherent in a business process. Residual risks, on the other hand, are inevitable because despite of the many security controls or measures in place, some risks remain there which cannot be hedged.

Residual Risk vs. Inherent Risk: Comparison Chart

Summary of Residual Risk and Inherent Risk

In a nutshell, inherent risk is the measure of a risk before any security measures or controls are applied to mitigate it. When you identify the risks involved in a business process or activity, you’ve not taken any steps to manage it. This is called as the inherent risk score. It is the risk score before you take an action. Residual risk, on the other hand, is the risk that remains even after proper measures and control have been considered. It is important that how you manage the risk should have brought the risk score to an extent where it is lower than the inherent risk.

Can residual risk be higher than inherent risk?

Residual risk is always less than or equal to inherent risk. But there are instances where residual risk score is higher than the inherent risk. This mostly depends on the controls in place to manage the risks

What is an example of residual risk?

An example of residual risk is the use of airbags. The installation and the use of airbags can reduce the overall risk factor of an injury in case of an accident. However, there’s still some risk involved when they are in use, that is, a remainder of residual risk.

What is an example of inherent risk?

Inherent risks are quite common in the financial sector. Financial institutions such as banks may encounter some errors in their financial statements due to some factor other than failure of the internal controls. This is the natural level of risk which cannot be controlled.

What is the meaning of inherent risk?

Inherent risk is the measure of a risk based on the nature of an organization’s business before any risk control measures are applied to mitigate the risks. While assessing this level of risk, you ignore whether the business has internal controls in place in order to help mitigate the inherent risk.

- Difference Between Caucus and Primary - June 18, 2024

- Difference Between PPO and POS - May 30, 2024

- Difference Between RFID and NFC - May 28, 2024

Search DifferenceBetween.net :

Leave a Response

References :

[0]Spedding, Linda S. and Adam Rose. Business Risk Management Handbook: A Sustainable Approach. Amsterdam, Netherlands: Elsevier, 2007. Print

[1]Freund, Jack and Jack Jones. Measuring and Managing Information Risk: A FAIR Approach. Oxford, United Kingdom: Butterworth-Heinemann, 2014. Print

[2]Loughran, Maire. Auditing for Dummies. New Jersey, United States: John Wiley & Sons, 2010. Print

[3]Image credit: https://www.canva.com/photos/MADBPj911co-business-investment-planning-graphs-/

[4]Image credit: https://www.canva.com/photos/MAC9HQSNaL4-business-investment-analysis/