Difference Between Value Stocks and Growth Stocks

Investors are driven to purchase stocks for either of these two reasons; one they believe the stock price will rise significantly allowing them to sell at a profit. Two they are more interested in collecting dividends paid. Whatever the reason, it is important to keep in mind that there’s more than one way of making profits in the stock markets.

Even more crucial is understanding the potential risks and the approaches to take in making investment decisions. In this short informative blog, we will discuss growth and value stocks. Pay attention, you’ll need this information in order to build your portfolio efficiently.

What is Value Stocks?

Stock investors think of these stocks as bargains. They are often described as those stocks which have fallen victim to market forces and ended up undervalued, the investor comes in to purchase it before the price rises. They are identified using certain measures and characteristics. Here are the criteria used:

- Price Earnings Ratio. The price earnings ratio should fall under the bottom 10% of the list of companies within the industry.

- Price Earnings Growth Ratio. This is calculated by. The amount should be >1 indicating the price is undervalued.

- Equity Debt Ratio. The equity should be twice the amount of debt

- Current assets vs. Current Liabilities. The assets should be double the current liabilities.

- Share Price. The price per share should be at the tangible book value or lower.

What is Growth Stocks?

Growth stocks are identified by their common characteristics. Certain indicators are used to differentiate between growth stocks and value stocks. The following criteria is used to classify them:

- Historical and Projected growth rate. The historical data of small companies should indicate an average growth rate of 10% over the past five years. For larger companies a growth rate of 5 -7% is the criteria used for the stock to fall under this category. The rate is lower for larger companies as they can’t grow at the same pace as smaller ones would.

- Return on Equity. The second criteria used is the rate of return. A comparison of the rate of return of the company with other competitors over the past five years is done. The subject company should be within the industry’s average rate of return if it doesn’t surpass.

- Earnings Per share. The company should be translating sales to earnings. The pre-tax profit margins should surpass the industry average within the past five years. Another factor to be considered here is the management is controlling costs.

- Projected Stock Price. What is the future estimate on the stock price? Can it be doubled within five years? The market position of a company and estimated future position assist analysts in determining whether a stock is a growth or value in nature.

Most growth companies are found in the technology, alternative energy or biotechnology industry. They almost always happen to be companies that are new and offer innovative products that are expected to shake up the industry.

The above criteria form the benchmark to test the nature of a stock. However, in certain instances the stock may not meet all the above requirements which should not disqualify it fully from the category. A company may not hold the five year projections of stocks within the growth category, but if it holds a significant market share within a rapidly growing industry then it probably belongs here.

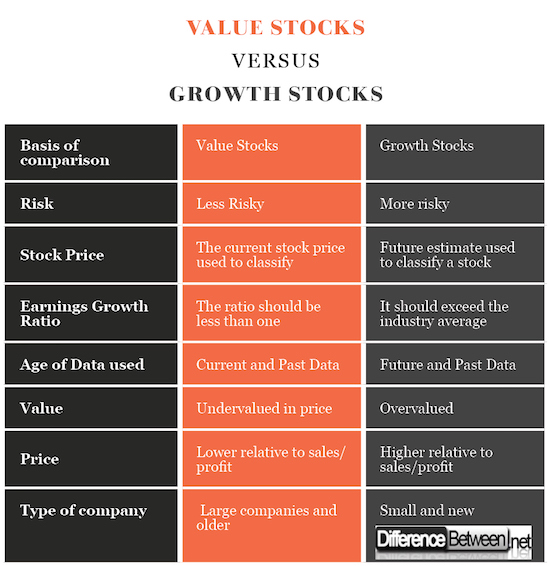

Differences between Growth Stock and Value Stock

Risk involved in Growth Stock vs Value Stock

Growth stocks are much riskier than value stocks. This is because they are fast growing stocks mostly within new companies whose future may be hard to determine.

Projected Stock Price of Growth Stock and Value Stock

In growth stocks a future estimate is determined in order to classify the stock. The price should be estimated to be very high and should at least double up within the next five years. In Value stock the current share price is used to classify the stock. It should be lower than the book value.

Price to Earnings Growth ratio for Growth Stock and Value Stock

In growth stocks the price to earnings ratio should just surpass the industry average. In value stocks the ratio should be less than one, indicating the stock is underpriced.

Age of data used in Growth Stock and Value Stock

In growth stocks the future estimates is used more to classify the stocks. In growth stocks data of the current situation is used.

Value of Growth Stock and Value Stock

Value stocks are undervalued in price while the growth stocks are overvalued with a rapid growth rate.

Price of for Growth Stock and Value Stock

The price of growth stocks is higher than that of value stocks compared to the amount of sales or profit.

Type of company

Most companies with growth and new and smaller in size. Value stocks are mostly from larger companies which have existed for a number of years.

Value vs. Growth Stocks: Comparison Chart)

Summary of Growth Stock and Value Stock

Value and Growth stocks are both ways of classifying stock types, they are however not the only means to.

Both growth stocks and value stocks are used creating a well-diversified portfolio.

Both the stocks carry risk within them which differs based on the industry and economic factors. The growth stocks are less sensitive to economic conditions.

The potential income from growth rate is much higher than value and so is the potential of loss.

- Difference Between S Corp and C Corp - September 9, 2018

- Difference Between Terrace and Balcony - September 9, 2018

- Difference Between Anabaptists and Evangelicals - August 31, 2018

Search DifferenceBetween.net :

Leave a Response

References :

[0]Tengler, Nancy. New Era Value Investing: A Disciplined Approach to Buying Value and Growth Stocks. John Wiley & Sons, 2003.

[1]Schießl, Christian. Value Stocks Beat Growth Stocks: An Empirical Analysis for the German Stock Market. Anchor Academic Publishing (aap_verlag), 2014.

[2]Martin, Frederick K., et al. Benjamin Graham and the Power of Growth Stocks: Lost Growth Stock Strategies from the Father of Value Investing. McGraw Hill Professional, 2011.

[3]Image credit: https://upload.wikimedia.org/wikipedia/commons/thumb/f/f8/Nintendo_Stock_Value_July_2016.png/640px-Nintendo_Stock_Value_July_2016.png

[4]Image credit: https://pixabay.com/en/graph-growth-progress-diagram-3078546/

[5]Image credit: https://pixabay.com/en/graph-growth-progress-diagram-3078546/