Differences Between Real Accounts and Nominal Accounts

A financial year’s end statement contains a composition of several transactions within different accounts recorded in that period. Businesses record transactions in numerous accounts some of them include assets, equity, liabilities, gains, incomes, losses and expenses.

The balances in the incomes, losses and gains accounts are then closed up at end of the year and are also called the nominal accounts. Balances from the assets, equity and liability accounts are pushed forward to the next accounting year. These accounts are classified under the real accounts.

What is a Nominal Account?

Nominal accounts are those whose balances are closed at the end of the financial year. These accounts are also recorded in the income statement. The income statement is a summary of revenues and expenses incurred within a given period. The nominal accounts begin a new accounting or financial year at a nil balance. This is because the balance was closed at the previous year and will not be pushed onto the next year.

The other name for a nominal account is temporary account. The balances that are noted in the income statement are the accounts that have completed transactions within that period. The end amount recorded in the financial statement is then transferred to the equity category in an income statement. This final amount is called net profit or net loss. The main aim of recording the nominal accounts is to determine the financial year’s net loss or profit.

What is a Real Account?

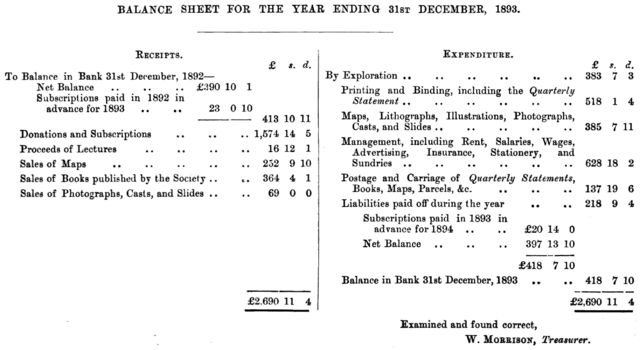

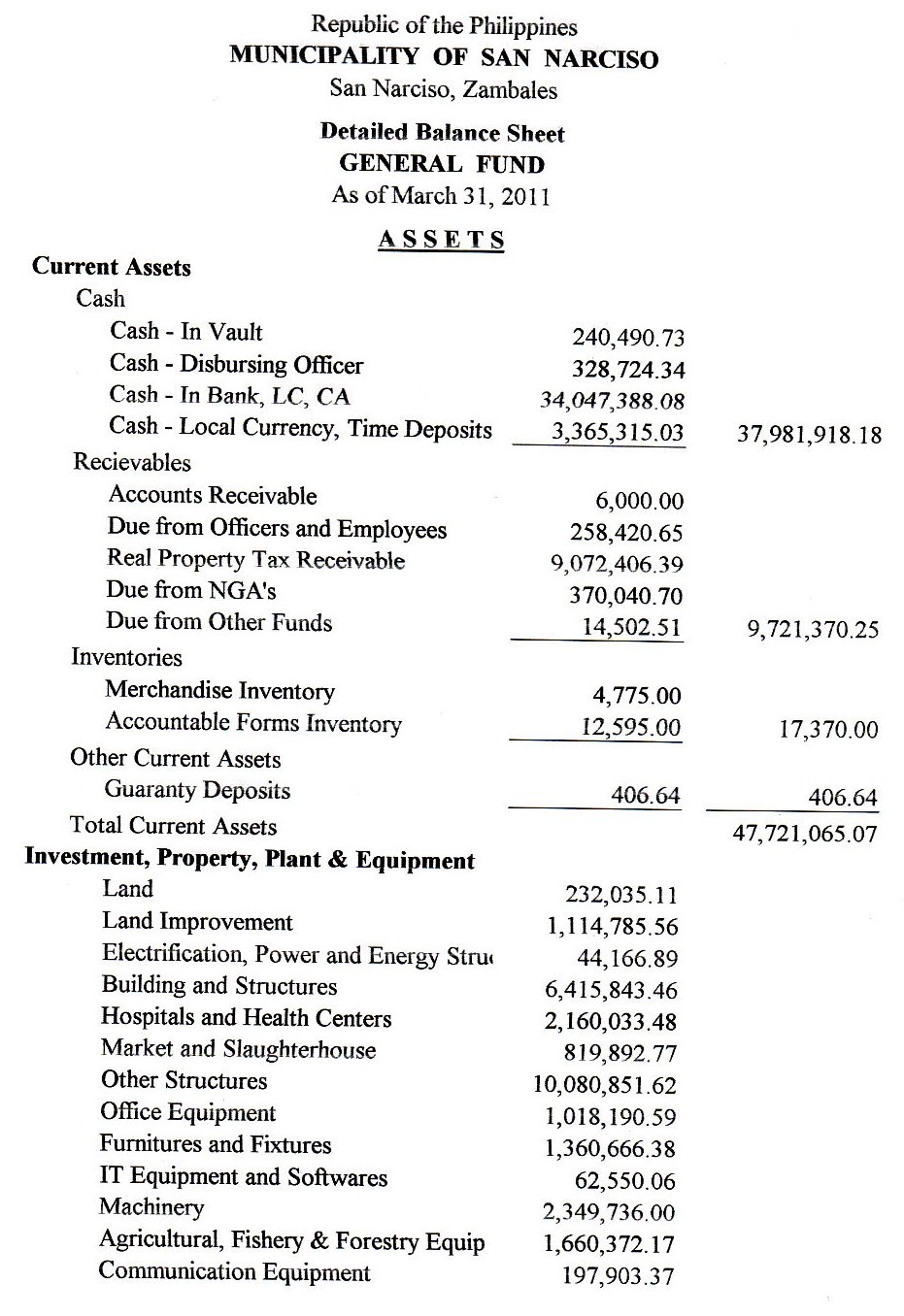

Real accounts are those that are not closed in the end of an accounting year. The real accounts are reported in the balance sheet. A balance sheet is the summary of assets, equity and liabilities of the business. ‘Real’ as used in this account refers to the continuous nature of the account type. This account type is active throughout the accounting year. It is also known as the permanent account. The accounting year balances are carried forward into the next year since they are not closed at the end of a period.

Differences Between Nominal and Real Accounts

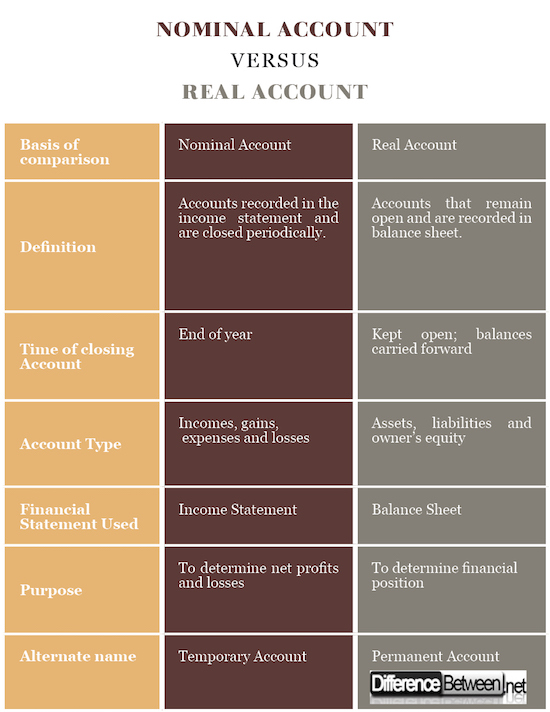

Definition

Nominal accounts are also called temporary accounts and are defined as the account types that determine the net loss and profits in the balance sheets.

The real accounts are also known as permanent accounts and are kept open throughout a year and its balances are carried forward to the next accounting year.

Time of Closing Account

Nominal accounts are closed at the end of the year.

Real accounts are not closed at the end of an accounting period. They are left open and the balances carried forward to the next year’s accounting statement.

Account Type

The Nominal Account contains accounts like the incomes, gains, expenses and losses.

The real account consists of the assets, owner’s equity and liabilities account types.

Financial Statement Used

The nominal accounts are noted in the business’s income statement.

The real account transactions are noted in a balance sheet.

Purpose

The main purpose of a nominal account is to determine the net profits and losses of a business.

The main aim of real accounts is to determine the company’s financial standing in terms of what it owns vs. what it owes.

Summary of Nominal vs. Real Accounts

- The main difference between real and nominal accounts are the type of accounts each hold.

- Nominal accounts are short term in nature and only last for the accounting period the transactions are happening. Real accounts continue to the following year.

- Nominal accounts are then recorded in the income statement while the real accounts are recorded in the balance sheet.

- Nominal accounts are known as temporary accounts while real accounts are permanent accounts.

- The account types for the nominal account are the incomes, expenses, losses and gains.

- The account types under real accounts are assets, liability and equity.

- Different businesses and organizations treat the two accounts differently, based on the nature of transactions, the accounting principles followed and the overall impact on their operations.

- Difference Between S Corp and C Corp - September 9, 2018

- Difference Between Terrace and Balcony - September 9, 2018

- Difference Between Anabaptists and Evangelicals - August 31, 2018

Search DifferenceBetween.net :

Leave a Response

References :

[0]Delaney, P. R., & Whittington, O. R. (2010). Wiley CPA Examination Review, Outlines and Study Guides. John Wiley & Sons.

[1]Kollman, R. M. W. K. (1997). The Exchange Rate in a Dynamic-Optimizing Current Account Model with Nominal Rigidities: A Quantitative Investigation. International Monetary Fund.

[2]Panigrahy, S. R., Kumar, S., & Singh, R. (2017). Objective agribusiness management 2nd. edition. scientific publishers.

[3]Image credit: https://upload.wikimedia.org/wikipedia/commons/8/8f/06_Statement_Cash_Flows_Trust_Funds.jpg

[4]Image credit: https://upload.wikimedia.org/wikipedia/commons/thumb/1/1f/PEF_D122_balance_sheet_for_the_year_ending_1893-12-31.png/640px-PEF_D122_balance_sheet_for_the_year_ending_1893-12-31.png