Difference Between FHA and Conventional Loans

Are you looking to buy a house but don’t have all the money upfront? That’s where a mortgage comes in. It’s like a loan to help you finance the purchase. Instead of paying the whole price at once, you pay back the loan over time in smaller, manageable chunks. Now, there are various types of mortgages available, with FHA loans and conventional loans being two excellent options.

Let’s simplify it for you. We break down the key differences between FHA and conventional loans to assist you in making an informed decision.

What is an FHA loan?

There is a specific type of mortgage that is backed by the United States government through the Federal Housing Administration, and it is known as an FHA loan. People with little income or credit ratings that are lower are able to purchase a property more easily as a result of this. This is the greatest part: the minimum down payment required for FHA loans is lower than the minimum required for conventional loans.

If you have a credit score of at least 580, you will be eligible to borrow up to 96.5% of the value of a property with an FHA loan beginning in the year 2022. It is just necessary for you to make a down payment of 3.5% now. In the event that your credit score falls between 500 and 579, it is still possible to obtain an FHA loan with a down payment of 10%.

Instead of the Federal Housing Administration (FHA) directly issuing the loan, a bank or other recognized financial institution does it. The Federal Housing Administration (FHA) guarantees the loan, which makes it simpler to obtain permission from the bank because the bank is not taking on the risk of defaulting on the credit. This is the reason why some people refer to it as an FHA-insured loan.

What is a conventional loan?

The loan that a homeowner receives from a private lender is known as a conventional mortgage. When applying for a conventional loan, you will typically require a higher credit score than you would for an FHA loan.

It is not the government that provides backing for conventional loans. Private lenders, such as banks, credit unions, and mortgage companies, are the ones who contribute these funds instead. Furthermore, the Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac) are two examples of government-sponsored organizations that have the ability to provide financial support for traditional mortgages.

It is common for individuals who have a strong financial standing and the ability to manage a greater initial payment to be the best candidates for these loans. If you want to be eligible for this loan, you need to have a higher credit score and a lower ratio of your debt to your income.

Difference between FHA and Conventional Loans

Credit Score

FHA loans are often more lenient and allow borrowers with lower credit scores to qualify. You might get the nod with a credit score as low as 500, but a score of 580 is preferable. Many lenders demand a minimum credit score of 580 for an FHA loan.

Generally, conventional loans require a higher credit score. You need a credit score of 620 or higher to be qualified for a conventional loan.

Minimum Down Payment

FHA loans are known for their friendliness in this department. You could be looking at a down payment as low as 3.5% if you have a credit score of 580 or higher. However, you have to pay 10% if your credit score is in the range of 500 to 579.

Conventional loans often demand a more substantial down payment, usually around 5%. Some lenders offer a minimum down payment of at least 3% for first-time homebuyers.

Debt-to-Income Ratio

The debt-to-income ratio is like a financial health check. It’s the percentage of your monthly income that goes towards paying debts. The lower, the better—it means you have more money to cover everyday expenses and save.

FHA loans may be more forgiving when it comes to your debt-to-income ratio. You can qualify for an FHA loan with a DTI ratio of 50% or less, but some lenders may demand over 50%. Conventional loans typically require a DTI of 36% or less in most cases.

Mortgage Insurance

FHA loans often come with mortgage insurance, both upfront and as part of your monthly payments. If you throw down 10% or more, you’re in for these premiums for 11 years. Drop below that 10%, and you’re stuck with these premium payments for the whole mortgage.

When it comes to conventional loans, you have to pay private mortgage insurance (PMI) if your down payment is less than 20%. You can request your lender to drop the PMI when your mortgage balance hits 80% of your home’s original value. This value is based on what you paid for the home or its appraised value when you bought it.

Loan Limit

Both conventional and FHA loans have a cap on the amount you can borrow, and these maximum loan sizes differ from one county to another. In 2024, the FHA loan limit stands at $498,257 in low-cost areas and rises to $1,149,825 in pricier markets.

Conventional loans adhere to the conforming loan limit established by the Federal Housing Finance Agency. In 2024, the loan limit is $766,550 for most areas in the U.S. If your mortgage exceeds this threshold, it falls into the category of jumbo loans, which come with stricter underwriting standards.

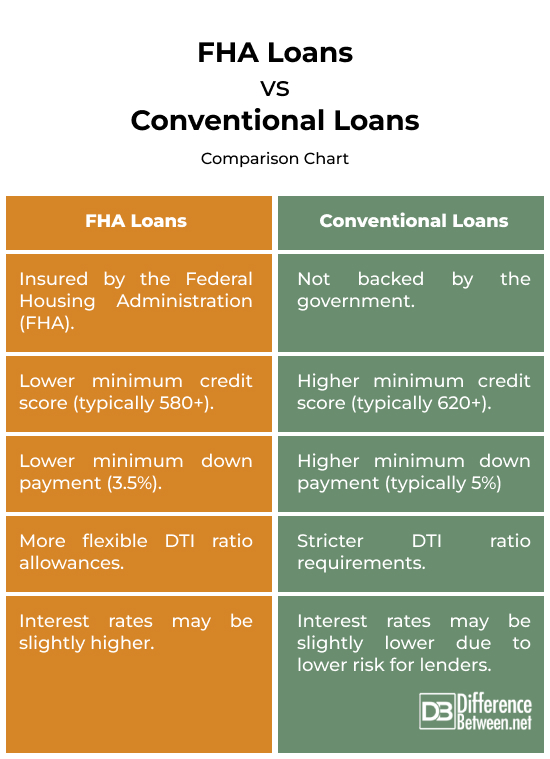

FHA Loans vs. Conventional Loans: Comparison Chart

Summary

If you have a lower credit score, limited savings for a down payment, or a higher DTI ratio, an FHA loan might be the best option for you. However, if you have a strong credit score, a healthy down payment, and a low DTI ratio, a conventional loan might offer you lower interest rates and lower closing costs. Also, FHA loan limits vary by location, while conventional loan limits are the same nationwide. Remember, the best loan for you depends on your individual financial situation and goals.

FAQs

What is the difference between a conventional and a FHA loan?

- FHA: Easier to qualify for with lower credit scores and smaller down payments (3.5%). Government-backed, so lenders take less risk. Requires mortgage insurance.

- Conventional: Harder to qualify for, needing higher credit scores and down payments (typically 20%). No government backing, potentially lower interest rates, and closing costs.

Can you turn a FHA loan into a conventional loan?

Yes, it is possible to refinance an FHA loan into a conventional loan. This process is known as an FHA to conventional refinance.

Is a conventional mortgage better?

It depends on your situation. Conventional is “better” for those with strong finances and lower interest rates.

What is the difference between a conventional and non-conventional mortgage?

Conventional loans conform to specific standards set by Fannie Mae and Freddie Mac. Non-conforming loans exceed those limits or have other differences. They might offer more options but could have higher interest rates.

Why would someone switch from conventional to FHA?

It is rare but possible if your financial situation changes and you need easier repayment terms. It’s not ideal due to extra fees and paperwork.

Why is a conventional loan better?

Conventional loans lower interest rates and closing costs, and there is no mortgage insurance after reaching 20% equity.

What are the disadvantages of a conventional loan?

- Harder to qualify for.

- Higher upfront costs (down payment and closing costs).

- Potential for PMI payments.

Who should use a conventional loan?

Individuals with a strong credit score and income can opt for a conventional loan.

Which mortgage type is best?

There is no one-size-fits-all type when it comes to choosing the right mortgage. It depends on your individual needs and financial situation.

What do I do when the interest rate goes up?

Reassess your budget and adjust spending to accommodate higher payments. Consider refinancing if rates drop significantly. Consult a financial advisor for personalized advice.

- Difference Between Caucus and Primary - June 18, 2024

- Difference Between PPO and POS - May 30, 2024

- Difference Between RFID and NFC - May 28, 2024

Search DifferenceBetween.net :

Leave a Response

References :

[0]Image credit: https://www.canva.com/photos/MADCRf-7U7o-paper-with-words-fha-loan-on-a-wooden-background-/

[1]Image credit: https://www.canva.com/photos/MADwOmOspaI-manager-holds-conventional-loan-agreement-form-/

[2]Green, Dan. “Conventional Loan vs. FHA Loan: 2024 Rates and Guidelines.” The Mortgage Reports, 16 Jan. 2024, themortgagereports.com/17168/fha-conventional-97-low-downpayment-comparison#fha.

[3]Kielar, Hanna. “FHA Vs. Conventional Loans: Definition And Differences.” Rocket Mortgage, 22 Apr. 2023, www.rocketmortgage.com/learn/fha-vs-conventional.

[4]Bundrick, Hal M. and Kate Wood. “FHA vs. Conventional Loans: Pros, Cons and Differences.” NerdWallet, 19 Dec. 2023, www.nerdwallet.com/article/mortgages/fha-loan-vs-conventional-mortgage.

[5]Folger, Jean. “FHA Loans vs. Conventional Loans: What’s the Difference?” Investopedia, 20 May 2023, www.investopedia.com/ask/answers/082616/whats-difference-between-fha-and-conventional-loans.asp.