Difference Between HSA and PPO

If you’re looking for the right health insurance policy, you’ve probably come across the health savings account (HSA) and the preferred provider organization (PPO). A Kaiser Family Foundation survey found that about 46% of U.S. employees go for the PPO, while approximately 28% opt for the HDHP with the HSA. But which one’s right for you?

Here’s a breakdown of the main differences between HSA and PPO.

What is an HSA?

An HSA is a tax-advantaged savings account paired with a high-deductible health plan (HDHP). It’s a tax-friendly way to save for your current and future medical expenses. You and/or your employer can contribute to your HSA. Contributions are tax-deductible, meaning they reduce your taxable income for the year in which you make the contribution.

Funds from an HSA can be used for a wide range of qualified medical expenses—deductibles, copayments, prescriptions, dental and vision care, you name it. HSAs are portable, meaning you own the account; it stays with you even if you change jobs or health insurance plans.

What is a PPO?

A PPO (preferred provider organization) is a type of health insurance plan that gives you access to a wide network of healthcare providers and medical facilities in the U.S. at reduced prices. PPOs have a network of preferred healthcare providers, including doctors, specialists, and hospitals. You can choose to see any healthcare provider, whether in-network or out-of-network.

Unlike some other plans that make you pick a main doctor or get permission for specialist visits, the PPO does not require you to choose a primary care physician (PCP) or obtain referrals to see specialists. You can see any healthcare provider or specialist you want.

Of course, there’s a catch—there’s always a catch. PPOs bring along some costs you need to deal with, like copayments, coinsurance, and deductibles. The costs can vary based on whether you go with in-network or out-of-network providers.

Difference between HAS and PPO

Account Type

An HSA is a savings account paired with a high-deductible health plan (HDHP). It’s there to help you save money on a tax-friendly basis for all your medical needs.

A PPO is like a flexible health insurance plan. You get to pick your healthcare providers, whether they’re in-network or out-of-network. You get a lot of choices.

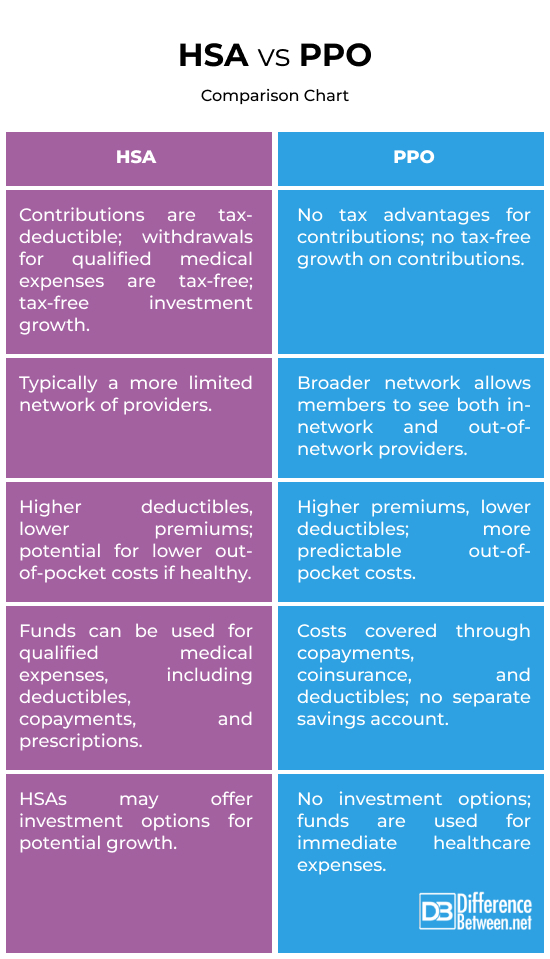

Tax Advantages

Contributions to an HSA are tax-deductible and withdrawals for qualified medical expenses are tax-free. Additionally, HSA funds can grow tax-free through investments.

Now, PPO plans are great, but they don’t throw around tax advantages like the HSA does. No tax breaks on contributions, and no tax-free growth. It’s more straightforward but less tax-friendly.

Flexibility

An HSA is typically associated with high-deductible health plans and offers a more limited network of providers. However, you have the flexibility to choose healthcare providers within the network.

PPO plans provide greater flexibility in choosing healthcare providers. You can see any healthcare provider without needing a referral, both in-network and out-of-network, although in-network providers are more cost-effective.

Cost Structure

HSAs are often associated with higher deductibles and lower premiums. You may have more out-of-pocket expenses before insurance coverage begins.

PPO plans may have higher premiums compared to HDHPs but often offer lower deductibles. You typically have more predictable out-of-pocket costs for medical services.

Use of Funds

Funds in an HSA can be used for qualified medical expenses, including deductibles, copayments, prescription medications, and certain other healthcare-related costs.

PPO plans do not involve a separate savings account. Instead, you have to pay for healthcare services through copayments, coinsurance, and deductibles, with no opportunity for tax-advantaged savings.

Out-of-Pocket Limits

In 2022, the annual contribution limit for an individual with self-only coverage is $7,050, and for family coverage, it’s $14,100. Individuals aged 55 and older can make an additional “catch-up” contribution. For 2023, the limits rise to $7,500 for individuals and $15,000 for families.

For 2022 PPO, the maximum out-of-pocket cost is $8,700 for an individual and $17,400 for a family. The limits are $9,100 for an individual and $18,200 for a family.

HSA vs. PPO: Comparison Chart

Summary

If you’re generally healthy and prefer lower premiums, an HSA with an HDHP might be a good fit. If you anticipate higher medical expenses and want more flexibility in choosing providers, a PPO could be better. Evaluate your ability to handle out-of-pocket costs. With an HSA, you need to be prepared for higher deductibles and potential upfront expenses. PPOs typically have lower deductibles but higher premiums.

FAQs

Is an HSA the same as a PPO?

An HSA is a type of savings account paired with an HDHP, which provides tax advantages for medical expenses. A PPO, on the other hand, is a type of health insurance plan that lets you pick and choose your healthcare providers.

Can I keep my HSA if I switch to PPO?

Yes, you can generally keep your HSA even if you switch to a PPO.

What’s better, a PPO or an HMO?

It depends on individual preferences and healthcare needs. PPOs offer more flexibility in choosing healthcare providers, including out-of-network options, while HMOs often have a more structured network but may have lower out-of-pocket costs.

What can you use HSA for?

Your HSA is a jack-of-all-trades for medical bills—deductibles, copayments, prescriptions, dental and vision care, and other health-related stuff. Just keep those receipts safe.

Can you use HSA for dental?

Yes, you can use funds from your HSA to cover qualified dental expenses.

Should I max out my HSA contributions?

It can be a financially prudent decision if you can afford it. Contributions to an HSA are tax-deductible, and the funds can be used for qualified medical expenses tax-free. Additionally, HSA contributions can be invested, potentially providing long-term growth.

- Difference Between Caucus and Primary - June 18, 2024

- Difference Between PPO and POS - May 30, 2024

- Difference Between RFID and NFC - May 28, 2024

Search DifferenceBetween.net :

2 Comments

Leave a Response

References :

[0]Image credit: https://www.canva.com/photos/MAEmxrC0Y-M-hsa-health-savings-account-stethoscope-and-piggy-bank-/

[1]Image credit: https://www.canva.com/photos/MAE_Ljrqu9Y-a-hand-in-a-medical-glove-puts-cubes-with-the-abbreviation-ppo-on-the-background-of-a-stethoscope/

[2]Simon, Javier. “HSA vs. PPO – All You Need to Know.” SmartAsset, 21 Mar. 2023, smartasset.com/checking-account/hsa-vs-ppo.

[3]Sandroff, Ronni. “Health Savings Account (HSA) vs. Preferred Provider Organization (PPO).” Investopedia, 5 Feb. 2023, www.investopedia.com/hsa-vs-ppo-5191333.

[4]Hartill, Robin. “HSA vs. PPO Plans: Which One Benefits You More?” The Motley Fool, 10 Nov. 2023, www.fool.com/retirement/plans/hsa/hsa-vs-ppo/.

[5]“Health Savings Account Basics: What is an HSA? Is an HSA Right for Me?” Bend, www.bendhsa.com/hsa-basics. Accessed 17 Jan. 2024.

One of the most important things to note about a HSA is that it is the employees responsibility to manage their healthcare expenses. Since it is a high deductible plan out of pocket costs can be considerable. Our site was developed with the aim of helping people become more educated about their healthcare options and to save on out of pocket expenses. See how it can help you save on out of pocket healthcare costs.

Thanks for the informative post about the difference in HSA’s vs PPO’s. While a HSA must accompany a high deductible health plan, it should be noted that the average PPO deductible is now over $1,000. Now matter which plan you decide on, there is great potential for high out of pocket expenses. INSNET, LLC was formed to assiste individuals by helping them save money on their medical bills. Any medical bill with a patient balance exceeding $200 is eligible to be submitted for risk free medical bill review and negotiation. If INSNET saves you money on your bill, they keep a percentage of the savings, there is no fee if there is no savings. Visit http://www.myinsnet.com to learn more.