Difference Between Broad Money and Base Money

Money plays a vital role in the economy. And we are all running around trying to secure sources of money and earn a living. Since ages ago, the different forms of money have been used as a medium of exchange, a means of holding wealth, a standard of deferred payment and a unit of account. While the definitions of money vary by country, each country has a measure for broad money and narrow money. In this article, we will discuss the difference between broad money and base money.

What is Broad Money?

Broad money is the most inclusive measure of a nation’s money supply. It includes narrow money and other assets that can be converted to cash easily. Being the most flexible method used in measuring money supply in an economy, central banks are keen on keeping tabs on broad money to help them forecast inflation.

Cash is always in circulation. As such, it is not easy for economists to estimate the amount of money in circulation using cash. And here comes broad money. Since it is the broadest measure of money, it encompasses narrow money (checkable deposits & cash) and less liquid assets such as foreign currencies, certificates of deposit, treasury bills and other items that can be converted to cash easily.

The formula for calculating broad money varies by nation. Here are some of the ways that nations calculate broad money:

- Canada- Broad money (M2) in Canada includes all narrow money, market deposit accounts, savings deposits, time deposit accounts and retail money market mutual funds balances.

- Europe- The broadest money (M3) includes all M2 items, money market base shares, repurchase agreements, debt securities and money market paper.

- The United Kingdom- The broadest money (M3H) includes all narrow money and foreign currency deposits in building societies and banks.

- Japan- Broad money (M3) includes all narrow money, deposits in post offices, financial institutions and savings.

What are the benefits of broad money?

The main benefit of broad money is its use by economists to spot potential inflation trends.

What is Base Money?

Also referred to as monetary base, base money is the total amount of currency in circulation. Base money, which is abbreviated as M0, includes the amount of money in circulation and the bank reserves. Base money is barely used since it also includes other forms of non-currency money that are available in the modern economy.

Most often, economists consider other monetary aggregates such as M1 and M2. Despite this, base money is a vital component of a country’s money supply as it provides a measure of the amount of cash that is circulating in an economy. It is created and circulated by monetary authorities or central banks. If the central bank wants to encourage inflation, it can increase the amount of base money in circulation. And if they want to encourage deflation, they can reduce the base currency in circulation.

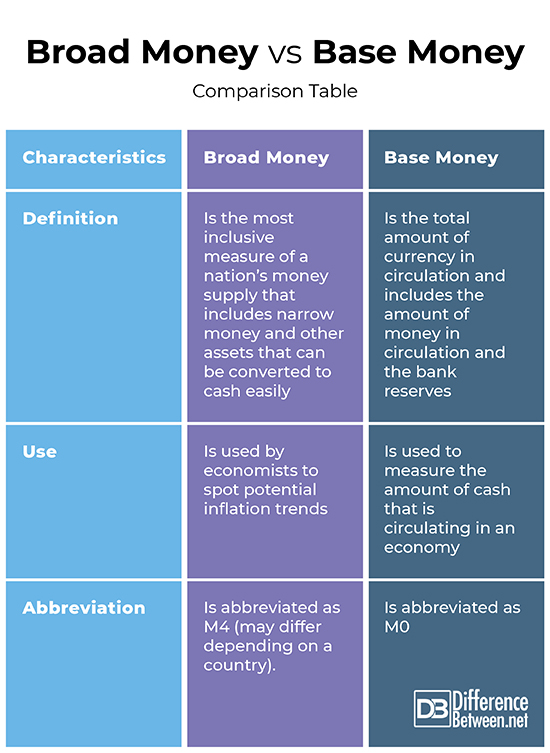

Differences between Broad money and Base money

Definition

Broad money is the most inclusive measure of a nation’s money supply that includes narrow money and other assets that can be converted to cash easily. On the other hand, base money is the total amount of currency in circulation and includes the amount of money in circulation and the bank reserves.

Use

Broad money is used by economists to spot potential inflation trends. On the other hand, base money is used to measure the amount of cash that is circulating in an economy.

Abbreviation

Broad money is abbreviated as M4 (may differ depending on a country). On the other hand, base money is abbreviated as M0.

Broad money vs. Base money: Comparison Table

Summary of Broad money vs. Base money

Broad money is the most inclusive measure of a nation’s money supply. It includes narrow money and other assets that can be converted to cash easily such as foreign currencies, certificates of deposit, treasury bills. On the other hand, base money is the total amount of currency in circulation and includes the amount of money in circulation and the bank reserves.

FAQs

Does broad money include base money?

Yes.

What is called broad money?

It is a measure of the amount of money supply that includes narrow money and other less liquid money.

What are the 4 types of money?

The four types of money include commercial money, commodity money, fiduciary money and fiat money.

Is M4 broad money?

Yes, M4 is broad money.

- Difference Between Profit Center and Investment Center - July 2, 2022

- Difference Between Anti-Trust and Anti-Competition - June 6, 2022

- Difference Between Stocktaking and Stock Control - June 6, 2022

Search DifferenceBetween.net :

Leave a Response

References :

[0]Harutyunyan A & Cartas J. Monetary and Financial Statistics Manual and Compilation Guide. International Monetary Fund, 2017. https://books.google.co.ke/books?id=UrMaEAAAQBAJ&printsec=frontcover&dq=broad+money+vs.+base+money&hl=en&sa=X&ved=2ahUKEwjZ-76d96n2AhX157sIHdo5CzcQ6AF6BAgKEAI#v=onepage&q=broad%20money%20vs.%20base%20money&f=false

[1]Mr.Volker Treichel. Broad Money Demand and Monetary Policy in Tunisia. International Monetary Fund, 1997. https://books.google.co.ke/books?id=m4YYEAAAQBAJ&printsec=frontcover&dq=broad+money+vs.+base+money&hl=en&sa=X&redir_esc=y#v=onepage&q=broad%20money%20vs.%20base%20money&f=false

[2]Goodhart E & Albert C. Monetary Theory and Practice: The U-K-Experience. Macmillan International Higher Education, 1983. https://books.google.co.ke/books?id=PEFdDwAAQBAJ&printsec=frontcover&dq=broad+money+vs.+base+money&hl=en&sa=X&redir_esc=y#v=onepage&q=broad%20money%20vs.%20base%20money&f=false