Difference Between Employee and Independent Contractor

The allure of flexible schedules and diverse projects has drawn many professionals towards independent contracting. This trend not only offers individuals the freedom to choose their projects but also challenges the conventional 9-to-5 work model. Fueled by the gig economy, individuals are now opting for flexible, project-based work over traditional employment. This paradigm shift makes it even more important to understand the differences between employees and independent contractors.

What is an employee?

Employees are typically full-time workers who work under the direct supervision and control of an employer. They follow set schedules, use company-provided tools, and may receive benefits such as health insurance, paid time off, and retirement plans. Employers also withhold taxes from employees’ paychecks.

What is an independent contractor?

Independent contractors, often referred to as freelancers, are self-employed individuals who provide services to clients or companies on a project basis. They have greater control over their work, determining their own schedules and methods to accomplish tasks. Contractors are typically responsible for their own taxes, benefits, and equipment. They often own their own business.

Differences between Employees and Independent Contractors

Independence

Employers exert significant control over employees, dictating work hours, methods, and tools used. Employees often work in a structured environment. Independent contractors, on the other hand, retain more control over their work. They determine their schedules, methods, and tools, operating with greater autonomy.

Onboarding and Training

Full-time employees typically undergo a comprehensive onboarding process that extends beyond the immediate requirements of a specific project. They often receive extensive training to integrate them into the company’s ecosystem and ensure they understand their roles within the larger framework. Contractors are usually brought up to speed quickly on project-specific details, minimizing the time spent on broader organizational goals.

Benefits

Employees enjoy a range of benefits provided by the employer, such as health insurance, retirement plans, and paid time off. They are covered by various employment laws that grant them protections, including workers’ compensation in case of workplace injuries. Independent contractors are not covered by most employment laws, and they are responsible for their own liability and insurance coverage.

Employment Relationship

Employees maintain an ongoing and often long-term relationship with the employer. Their work is integral to the core functions of the business, and they contribute to the day-to-day operations. Contractors usually engage in a temporary or project-based relationship with clients or companies. Their work is often supplemental and focused on specific tasks or projects that are not central to the client’s regular business operations.

Tax Responsibilities

Employers withhold income taxes, Social Security contributions, and Medicare taxes from employees’ paychecks. Employees receive a W-2 form at the end of the year, summarizing their income and taxes withheld. Contractors are responsible for handling their own taxes. This includes income tax as well as self-employment tax, which covers Social Security and Medicare contributions. They receive a 1099 form from clients, detailing the total compensation received during the year.

Expenses

Employers typically cover work-related expenses. This may include providing necessary equipment and tools and reimbursing employees for work-related travel or other costs. Contractors need to provide their own tools and equipment and cover costs associated with performing the contracted work, including transportation and any other relevant expenses.

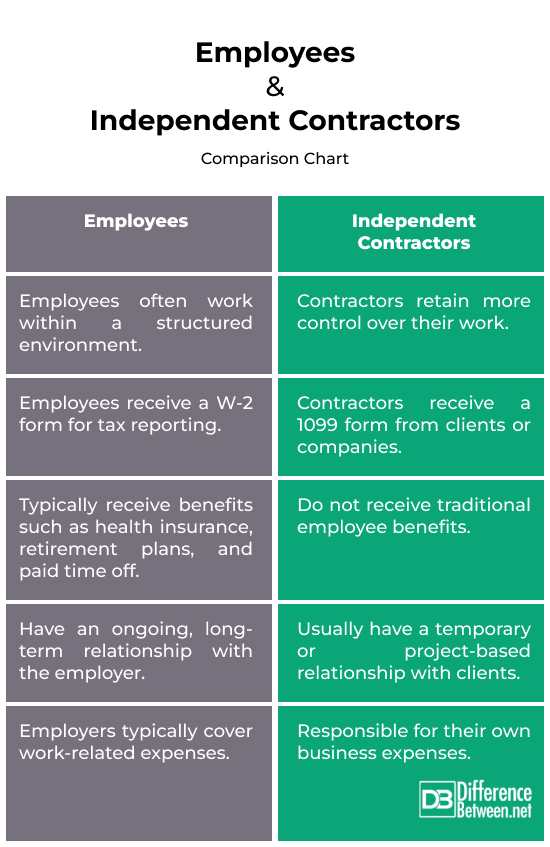

Employees vs. Independent Contractors: Comparison Chart

Summary

The key distinctions lie in control, autonomy, and the employer-employee relationship. Independent contractors have more independence but are responsible for managing their business aspects, while employees trade some autonomy for the benefits and stability provided by the employer. The classification is crucial for legal and tax purposes, impacting issues like labor laws, taxes, and liability.

FAQs

What are the four factors used to determine whether someone is an independent contractor?

Key considerations include the level of control the employer has over the worker, the independence of the worker, the method of payment, and whether the worker provides their tools and equipment.

What is an independent contractor in Canada and the USA?

In both Canada and the USA, an independent contractor is a self-employed individual or business entity hired by a client or company to perform specific tasks or complete a project. They are not considered employees of that client. While both countries require self-employment taxes for contractors, specific rates and deductions may vary.

What is the difference between a dependent contractor and an employee?

A dependent contractor is an intermediary classification that falls between an independent contractor and an employee. While employees have a more permanent and ongoing relationship with the employer, dependent contractors have a somewhat dependent relationship, often working exclusively for one client or company.

What qualifies you as an employee?

If the employer dictates work hours, provides tools and equipment, and withholds taxes, the individual is likely to be classified as an employee. Employees often receive benefits, have long-term relationships with the employer, and contribute to the core functions of the business.

Is it better to be an employee or an independent contractor in Canada and the USA?

Typically, employees do not bear financial risks, as any incurred expenses are reimbursed, and they are not burdened by ongoing fixed costs. In contrast, self-employed individuals may face financial risks and potential losses since they often bear fixed monthly costs, regardless of whether active work is currently underway.

How do independent contractors pay taxes in Canada?

They need to keep detailed records of their business expenses and may be eligible for certain tax deductions. In Canada, independent contractors often file a T1 personal income tax return and may need to register for the Goods and Services Tax/Harmonized Sales Tax (GST/HST) depending on their income levels.

- Difference Between Caucus and Primary - June 18, 2024

- Difference Between PPO and POS - May 30, 2024

- Difference Between RFID and NFC - May 28, 2024

Search DifferenceBetween.net :

Leave a Response

References :

[0]Miller, Sterling. “Employee vs. independent contractor: What’s the difference?” Thomson Reuters, 21 Mar. 2022, legal.thomsonreuters.com/en/insights/articles/independent-contractor-vs-employee-what-does-it-matter.

[1]“W2 vs 1099: 10 Differences Employers Need to Know.” MBO Partners, 20 Oct. 2023, www.mbopartners.com/blog/misclassification-compliance/10-differences-between-independent-contractors-and-employees/.

[2]Post, Jennifer. “Contract Workers vs. Employees: What Your Business Needs to Know.” Business News Daily, 20 Nov. 2023, www.businessnewsdaily.com/770-contract-vs-employees-what-you-need-to-know.html.

[3]Marfice, Christina. “Employee vs. contractor: how to classify workers in Canada (quiz included).” Rippling, 20 Apr. 2023, www.rippling.com/blog/worker-classification-in-canada.

[4]Image credit: https://www.canva.com/photos/MAEdGu9Ff3k-photo-of-employees-brainstorming-together/

[5]Image credit: https://www.canva.com/photos/MADL4IFKhWM-independent-contractor-agreement-pen-glasses-and-calculator/