Difference Between Fintech and Proptech

In the recent years, technological innovations have disrupted nearly every sector of business, from banking and insurance to retail, food, fashion, and even the real estate market. Businesses are now implementing modern-day technologies and innovations to drive their business operations and processes in order to achieve better productivity and maximum profitability. Fintech is in the spotlight in today’s digital world. Every sector is seeing progress thanks to the digitization of modern world, where everything is now available at your fingertips. Two such disruptive technologies that have revolutionized the way companies do business are Fintech and Proptech.

What is Fintech?

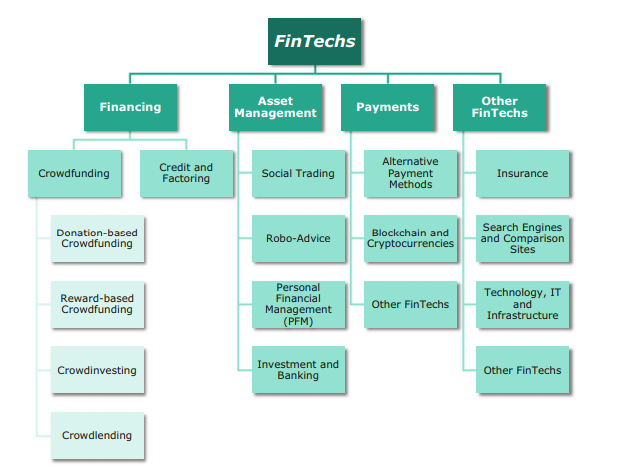

Financial technology, commonly referred to simply as fintech, refers to any business that uses technology and innovation to provide automated and improved financial services. Fintech is a rapidly growing industry comprising of a group of companies that help financial services organizations better serve their customers through the use of software and other modern technologies. Fintech is redefining financial services in this digital age using modern-day tools such as blockchain, data science, machine learning, artificial intelligence, biometrics, and e-commerce. The concept is not new; in fact, it can be traced back to the early 1990s, but now refers to a rapidly growing revolutionary process across financial services. Fintech is not just a technology or a name but a collective term for all the emerging financial services technologies. Fintech is driving the financial industry to make them smarter and more agile to deal with important problems in the world.

What is Proptech?

Technological developments have profoundly impacted nearly every sector, from banking and insurance to fashion, food, and retail. These new technologies are changing the way markets communicate and do business in dramatic ways, and as a result, these disruptive tech innovations are driving new business models even outside the incumbent financial services institutions. And the real estate sector is no exception. Proptech is a portmanteau of two terms – property and technology – and refers to the disruptive new technologies and innovative ideas that seek to revolutionize the real estate markets. Also known as real estate technology, Proptech optimizes the way people rent, buy, sell, lease and manage a property. Proptech is reshaping the ways property is bought, sold, leased, designed, managed, and marketed. With Fintech often regarded as being at the forefront of digital innovations, Proptech is widely seen as coming second in place.

Difference between Fintech and Proptech

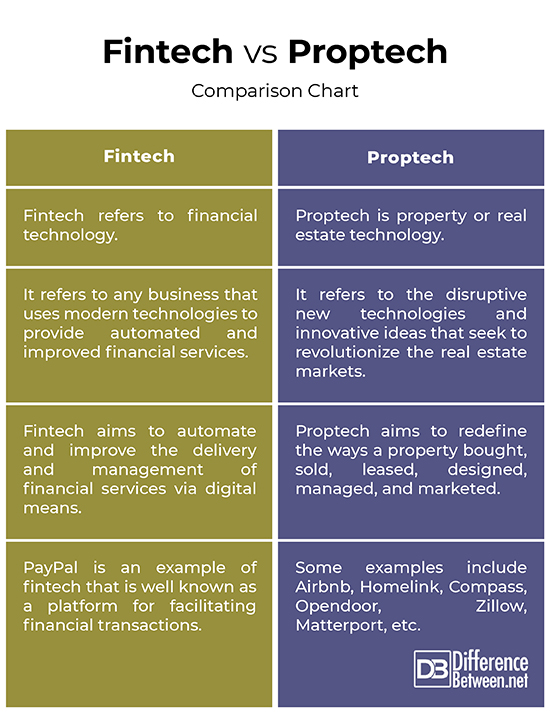

Meaning

– Fintech is a portmanteau of the terms finance and technology, and refers to any business that uses modern technologies and innovative ideas to provide automated and improved financial services. Fintech is not just a technology or a name but a collective term for all the emerging financial services technologies. Proptech, also referred to as property technology or real estate technology refers to the disruptive new technologies and innovations of the digital age that seek to revolutionize the real estate markets. Proptech is to real estate market what Fintech is to finance and banking sector.

Technology

– Fintech is the disruption of financial services using modern-day tools such as blockchain technology, data science, advanced machine learning, artificial intelligence, biometrics, e-commerce, and so on. Fintech as a discipline relies on data gathering, data analysis, and intelligence and implementation to create new services that complement the current business models. Proptech uses the same technologies and tools to disrupt the property and real estate markets, pretty much in the same way fintech has transformed the finance sector. Proptech is the use of both software and hardware such as data virtualization, blockchain, AI, 3D printing, etc. to make buying, selling, and managing property easier.

Goal

– Fintech addresses a variety of product and service needs in ways that can be facilitated via digital means. Using new tech and innovation, fintech aims to automate and improve the delivery and management of financial services. The goal of fintech companies is to create services and implementations for those segments which are not part of the traditional financial service models. Proptech, on the other hand, is an innovative approach to the real estate sector that aims to redefine the ways a property bought, sold, leased, designed, managed, and marketed.

Example

– Fintech is shifting the financial landscape through electronic means. For example, consumers now use online banking to transfer and receive funds, pay bills, receive paychecks, mange loans, and so much more. PayPal is an interesting and great example of fintech that is well known as a platform for facilitating financial transactions through collaboration with actual banks. Proptech follows a similar trajectory with companies specializing in digitization of the real estate industry. Some examples include Airbnb, Homelink, Compass, Opendoor, Zillow, Matterport, etc.

Fintech vs. Proptech: Comparison Chart

Summary of Fintech vs. Proptech

In a nutshell, Proptech is to real estate market what Fintech is to finance and banking sector. Fintech is often regarded as being in the first place with digital innovations, followed by Proptech. Fintech is redefining financial services in this digital age using modern-day tools such as blockchain, data science, machine learning, artificial intelligence, and so on. Proptech follows the same trajectory wit companies specializing in digitization of the real estate industry. Proptech is reshaping the ways property is bought, sold, leased, designed, managed, and marketed. Fintech has been around for more than a decade, whereas Proptech is a recent development that has just started gaining traction.

- Difference Between Caucus and Primary - June 18, 2024

- Difference Between PPO and POS - May 30, 2024

- Difference Between RFID and NFC - May 28, 2024

Search DifferenceBetween.net :

Leave a Response

References :

[0]Gupta, Pranay and T. Mandy Tham. Fintech: The New DNA of Financial Services. Berlin, Germany: Walter de Gruyter, 2018. Print

[1]Barberis, Janos et al. The REGTECH Book: The Financial Technology Handbook for Investors, Entrepreneurs and Visionaries in Regulation. New Jersey, United States: John Wiley & Sons, 2019. Print

[2]Rubini, Agustin. Fintech in a Flash: Financial Technology Made Easy. Berlin, Germany: Walter de Gruyter, 2018. Print

[3]Poleg, Dror. Rethinking Real Estate: A Roadmap to Technology’s Impact on the World’s Largest Asset Class. Berlin, Germany: Springer, 2019. Print

[4]Chishti, Susanne and Janos Barberis. The FINTECH Book: The Financial Technology Handbook for Investors, Entrepreneurs and Visionaries. New Jersey, United States: John Wiley & Sons, 2016. Print

[5]Beaumont, Perry H. Digital Finance: Big Data, Start-ups, and the Future of Financial Services. Abingdon, United Kingdom: Routledge, 2019. Print

[6]Image credit: https://commons.wikimedia.org/wiki/File:FinTech_Segments.png

[7]Image credit: https://www.nreionline.com/sites/nreionline.com/files/proptech-firms.jpg