Difference Between Fintech and Digital Banking

For half a century, the traditional retail banking has been challenged to move towards a more digital approach. We have finally reached the point where digital business model is matured and is proven. The population has already moved to the digital era in which the majority is digital natives. Today, the foundation of almost every bank and financial institution is based on digital networking, and Internet, mobile, and digital banking are the cream on the top of the cake. Many retail banks around the world are now digital banks dominated by fintech trends.

What is Fintech?

Fintech, a portmanteau of ‘financial technology,’ refers to a new wave of companies that are revolutionizing financial services through the use of innovative new technologies. It is an economic industry comprises of companies that aim to compete with the traditional financial methods to shape the future of banking. It encompasses a huge range of technologies, products, and business models that are changing the way people pay, send money, lend, borrow, and invest.

The industries are adopting fintech as a technique that makes the existing delivery process more efficient in every aspect. For example, if you pay for something using your phone, transfer money using an app or check statements online, then you’re already part of this multi-billion industry called fintech. It is already changing economies around the world. It started with the financial crisis and the people’s distrust in the banking system which ultimately gave rise to this financial revolution.

What is Digital Banking?

Digital banking is the perfect example of how financial innovative technologies are shaping the future of banking through digitization. This begs the question – what is digital banking? In Simple terms, digital banking is the digitization of all traditional banking activities, where banking services can be availed online without having to be physically present at the bank.

Digital banking is a move from physical to online, providing high-levels of automation and web-based services via a web interface or mobile application. It is the ability to access your financial data through mobile and ATM services. The term ‘online’ emerged in the 1980s and originally referred to the use of a terminal, keyboard and monitor to access the banking system through a standard telephone line. The culmination of financial innovations in banking over the past few years has triggered a paradigm shift away from the conventional banking model to a modern-day digital banking ecosystem.

Difference between Fintech and Digital Banking

Basics of Fintech and Digital Banking

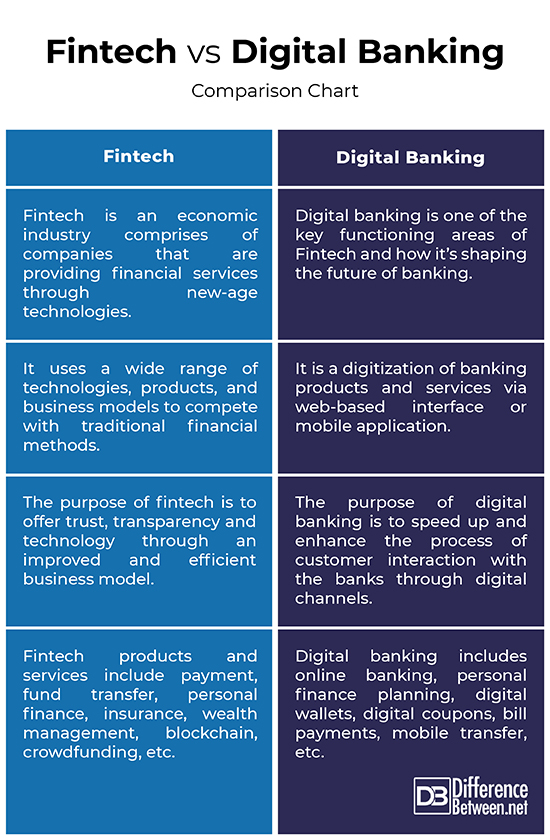

– Fintech, the abbreviation for financial technology, is an economic industry comprises of companies that are revolutionizing financial services through the use of innovative new technologies. Fintech is a broad category that refers to the innovative use of technologies, products, and business models in the delivery process of financial services and products.

Digital banking, on the other hand, is a step up from the traditional banking system to digital channels such as online, social and mobile. It is a digitization of banking products and services via web-based interface or mobile application.

Purpose of Fintech and Digital Banking

– The purpose of fintech is to offer trust, transparency and technology through an improved and efficient business model wherein the consumer stands to benefit from the increased efficiency. It is a revolution in financial services that aim to compete with the traditional financial methods, allowing for automation of processes and eliminating the middlemen for the sole purpose of enhancing customer experience.

The purpose of digital banking is to speed up and enhance the process of customer interaction with the banks through digital channels such as mobile payment, bill pay, etc.

The Scope Fintech and Digital Banking

– Digital banking represents a virtual process that full integrates with the core banking solution while doing away with all the paperwork such as checks, pay-in slips, loan applications, etc. The scope of digital banking is limited to the banking related activities such as online banking, personal finance planning, digital wallets, digital coupons, bill payments, and mobile transfer.

Fintech, on the other hand, is a financial service industry comprised of multiple business models that are wither within or outside the scope of the financial services institutions.

Technology Perspective

– Digital banking redefines the retail banking experience to become customer-centric in terms of distribution channels, products and services delivery using technologies such as robotic process automation, chatbots, blockchain, machine learning, CRM, etc. Ease of use and flexibility are at the heart of digital banking model.

Fintech, as the name suggests, aims to shape the fundamental functions provided by financial services using technologies such as automation, machine learning, artificial intelligence (AI), Big Data, crowdfunding platforms, Blockchain Bonds, robo-advising, and more.

Fintech vs. Digital Banking: Comparison Chart

Summary of Fintech and Digital Banking

Fintech has redefined the financial system and changed the way people pay, send money, lend, borrow, and invest. The growth of fintech companies is fueled by the complexity in the traditional financial system which allowed fintech to find opportunity in the poor banking experiences. Fintech providers offer new and fresh services at affordable costs, through well-designed platforms or mobile apps. Fintech drives the financial industry to be smarter and more agile, allowing it to make processes faster than ever. Digital banking is a move from traditional banking activities to a digital one where consumers can avail the banking services online through their mobile phones or laptop.

- Difference Between Caucus and Primary - June 18, 2024

- Difference Between PPO and POS - May 30, 2024

- Difference Between RFID and NFC - May 28, 2024

Search DifferenceBetween.net :

Leave a Response

References :

[0]Gupta, Pranay and T. Mandy Tham. Fintech: The New DNA of Financial Services. Berlin, Germany: Walter de Gruyter, 2018. Print

[1]Gupta, Pranay and T. Mandy Tham. Fintech: The New DNA of Financial Services. Berlin, Germany: Walter de Gruyter, 2018. Print

[2]Chishti, Susanne and Janos Barberis. The FINTECH Book: The Financial Technology Handbook for Investors, Entrepreneurs and Visionaries. Hoboken, New Jersey: John Wiley & Sons, 2016. Print

[3]Rubini, Augustin. Fintech in a Flash: Financial Technology Made Easy. Berlin, Germany: Walter de Gruyter, 2018. Print

[4]Henderson, John. Retail and Digital Banking: Principles and Practice. London, United Kingdom: Kogan Page, 2018. Print

[5]Skinner, Chris. Digital Bank: Strategies to launch or become a digital bank. Singapore: Marshall Cavendish, 2014. Print

[6]Wewege, Luigi and Michael C. Thomsett. The Digital Banking Revolution. Berlin, Germany: Walter de Gruyter, 2019. Print

[7]Image credit: https://live.staticflickr.com/65535/49393885627_8b461bdfe0_b.jpg

[8]Image credit: https://p1.pxfuel.com/preview/676/967/773/login-mobile-banking-account-smartphone-bank.jpg