Difference Between Venmo and PayPal

The world around us has changed as a result of the proliferation of the Internet, and the realm of finance is no exception. The rise of mobile devices and electronic payment systems forced a new paradigm shift towards digital only payments as more and more transactions now take place electronically without using cash. This digitization of payments has been driven by consumers who wish to make purchases or transfer funds using their mobile digital wallet. Digital wallets make shopping more efficient, giving consumers the benefit of added convenience than carrying a traditional wallet. PayPal is one of the widely used examples of this type of cashless payment system.

PayPal is a global leader in the digital wallet ecosystem that enables consumers around the world to pay, send money, and receive payments. The great idea behind the digital wallet was to provide a host of functionality of services to embrace digital identity through authentication coupled with extra layers of security for secure transactions. Venmo is yet another popular digital payment service by PayPal Holdings Inc. and a popular peer-to-peer mobile payment application. PayPal and Venmo are the two big names in the digital wallet game that have a number of features in common. However, they do have their fair share of differences.

What is PayPal?

PayPal is a digital money platform and a global leader in the digital wallet ecosystem that enables consumers around the world to pay, send money, and receive payments. It started as an online payment system embedded into eBay, but later evolved into a robust payment system for Internet and mobile transactions. PayPal was acquired by eBay in October 2002. This was after eBay’s attempt to launch its own payment service called BillPoint, which was not well received by the eBay community and finally fizzled out completely. PayPal is now a widely accepted form of payment through smartphones or an Internet service, integrating its service with local bank establishments, currencies, and standards from countries around the world.

What is Venmo?

Venmo is a peer-to-peer digital payment service owned by PayPal and is specially designed to facilitate transactions between smartphones. It keeps a digital wallet you can use for other Venmo transactions, or you can transfer funds to and from your bank accounts and debit cards. Founded in 2009, Venmo operates in the United States and has successfully transformed financial transactions into sharing experiences. The selling point of Venmo is its social aspect. Users can get access to a Facebook-like news feed, which is composed of public transactions. It allows users to connect with their friends, send payments, charge other users and choose to publicize their transactions under various privacy settings.

Difference between Venmo and PayPal

Basics

– Both PayPal and Venmo are the two big players in the digital wallet game. PayPal is the most trusted, long-standing and widely used digital payment service that has grown faster than almost any other business in history and it continues to expand with a vision to become the global leader in electronic payment systems. Venmo is a subsidiary of PayPal and a peer-to-peer digital payment service specially designed to facilitate transactions between smartphones. Venmo was acquired by PayPal which is owned by eBay. What makes Venmo stand out is its social nature.

Fee Structure

– Both the digital payment services’ applications are free to download and use. However, both PayPal and Venmo charge a 2.9% fee for a credit card funded personal payment. PayPal, however, charge an additional 30 cents for the credit payments, but the sender chooses who pays it. The best thing about PayPal’s fee structure is that users can send and receive personal payments without paying fees. The only time fees apply to personal payments is when you use a credit card as payment method. In addition, both offer free transfer of funds to and from bank accounts.

Users

– PayPal offers three types of accounts to fulfill the needs of all kinds of users: Personal, Premier and Business. Fees and features associated with each account are different. Personal account is for individuals looking to buy stuff or send and receive money between friends and family. The Premier account is useful when you wish to sell things or accept money, while the Business account, as the name suggests, is strictly for serious business users. Venmo, on the other hand, is a mobile payment service which is less business-oriented and is more focused towards P2P transactions.

Ease of Use

– PayPal does more than just process everyday payments. Although, millions of buyers prefer the simplicity and security that PayPal offers, Venmo is known for its ease of use. And the one thing that makes Venmo stand out from other digital payment services is its social nature. Venmo is a great tool among friends to pay each other electronically such as sharing rent or splitting bills, and just anything else. Additionally, it allows users to connect with friends, send and receive payments, and publicize their transaction under various privacy settings.

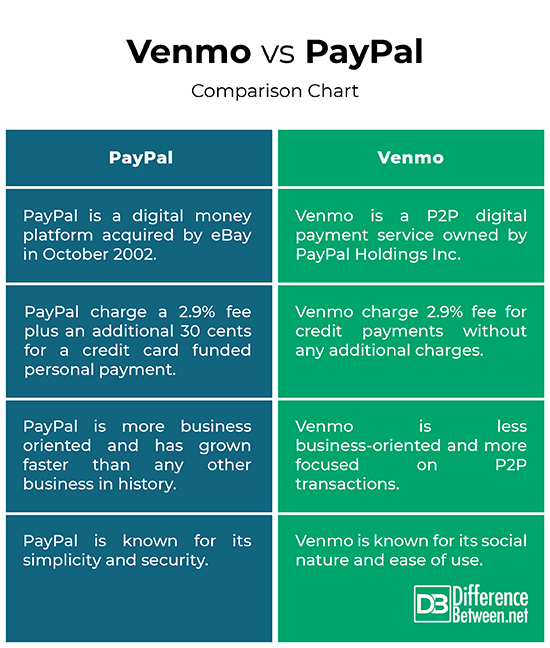

Venmo vs. PayPal: Comparison Chart

Summary of Venmo and PayPal

It’s clear that millions of buyers prefer the simplicity and security that PayPal offers. PayPal is a global leader in the digital wallet ecosystem that enables consumers around the world to pay, send money, and receive payments. PayPal has the potential to shake up the commercial industry and enable new possibilities for global payments. Venmo, on other hand, is known for its social aspect and ease of use, and although, it’s not business-oriented, it is fast, casual, convenient and trendy.

- Difference Between Caucus and Primary - June 18, 2024

- Difference Between PPO and POS - May 30, 2024

- Difference Between RFID and NFC - May 28, 2024

Search DifferenceBetween.net :

1 Comment

Leave a Response

References :

[0]Image credit: https://live.staticflickr.com/2856/33304211381_1764221078_b.jpg

[1]Image credit: https://upload.wikimedia.org/wikipedia/commons/thumb/5/53/PayPal_2014_logo.svg/500px-PayPal_2014_logo.svg.png

[2]Williams, Damon. Pro PayPal E-Commerce. New York: Apress, 2007. Print

[3]Smith, Andrew O. Financial Literacy for Millennials. Santa Barbara, California: ABC-CLIO, 2016. Print

[4]Schneider, Gary. Electronic Commerce. Boston, Massachusetts: Cengage, 2008. Print

[5]Cornelius, Sean P., et al. Complex Networks X: Proceedings of the 10th Conference on Complex Networks CompleNet 2019. Berlin, Germany: Springer, 2019. Print

Very great post. I just discovered your blog and needed to say that I have truly enyed perusing your blog entries. Any way I’ll be buying in to your feed and I trust you post again soon