Difference Between Adverse Selection and Moral Hazard

The terms adverse selection and moral hazard are both used in risk management, economics and insurance. Both terms describe situations between parties where one person gains a competitive advantage over the other, leading to the exploitation of the other. Knowing the differences between adverse selection and moral hazard ensures that all parties reach an efficient outcome and helps avoid parties being exploited.

Adverse Selection

Adverse selection takes place occurs when one entity or person, (more often the seller) has differing or more accurate information about a deal than the other person, (more often the buyer) before reaching an agreement.

Such a situation favours the party that has more info while the other person is forced to enter into an unfavourable deal. And in most cases, it is difficult for the party who does not have sufficient info to access the risk or value out of the deal. And since the more knowledgeable entity or person has all the information, they can easily evaluate the situation and access how they will benefit from it.

Adverse selection is one of the main causes of low-quality goods and services and inefficient outcomes.

- Example of adverse selection

If you have ever bought a used car, you know how much information you need to ensure you do not get short-changed. The car seller has more knowledge about the car than a buyer. For instance, if a car has ever been involved in an accident or some parts are faulty, the seller may not always disclose this to the buyer. In most instances, the buyer cannot distinguish between high quality and low-quality car. This results in the buyer purchasing the low-quality car at the price of a high-quality car. The seller benefits since they have more info about the vehicle while the buyer gets short changed.

Another example of adverse selection is the purchase of health insurance. While a person is well aware of the health issues that they face, the insurance company is not. As such, the insurer is at more risk of an unfavourable outcome.

Moral Hazard

This is a situation where one entity or person entering into a deal provides misleading information that affects the entire agreement once the agreement has been made. It can also occur when one person (more often the buyer) changes their behaviour once the parties enter into an agreement since they believe they will not face consequences for their actions. Moral hazards put the sellers in unfavourable situations since they are forced to deal with the unfavourable outcomes.

- Example of Moral Hazard

The insurance industry is often marred with moral hazards. For instance, homeowners who have not purchased flood insurance and live in flood-prone areas are very careful during the storm seasons. Most will move furniture, install drainage pumps and invest in a good drainage system.

However, once they purchase flood insurance, they are less careful with measures to mitigate the risks. This results in a greater risk for claims to the insurance company.

Similarities between Adverse selection and Moral hazard

- Both refer to situations where one entity or person has an advantage over the other

Differences between Adverse selection and Moral hazard

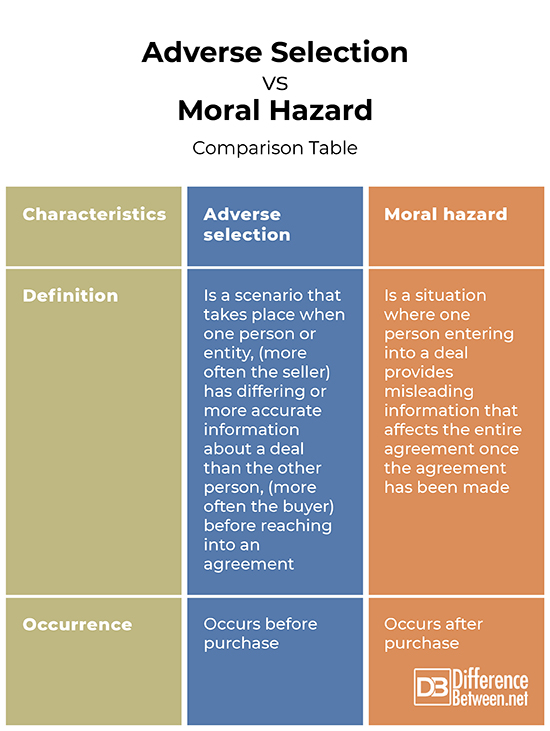

Definition

Adverse selection is a scenario that takes place when one person or entity, (more often the seller) has differing or more accurate information about a deal than the other person, (more often the buyer) before reaching into an agreement. On the other hand, moral hazard is a situation where one person entering into a deal provides misleading information that affects the entire agreement once the agreement has been made.

Occurrence

While adverse selection occurs before purchase, moral hazard occurs after purchase.

Adverse selection vs. Moral hazard: Comparison Table

Summary of Adverse selection vs. Moral hazard

Adverse selection takes place when one entity or person, (more often the seller) has differing or more accurate information about a deal than the other person, (more often the buyer) before reaching an agreement. This usually occurs before a purchase. On the other hand, moral hazard is a situation where one person entering into a deal provides misleading information that affects the entire agreement once the agreement has been made and occurs after a purchase has been made.

FAQs

What is an example of a moral hazard?

Homeowners who have not purchased flood insurance and live in flood-prone areas are very careful during the storm seasons. Most will move furniture, install drainage pumps and invest in a good drainage system. However, once they purchase flood insurance, they are less careful with measures to mitigate the risks. This results in a greater risk for claims to the insurance company.

Can adverse selection exist without moral hazard?

Yes, adverse selection can occur without moral hazard.

What is the meaning of adverse selection?

Adverse selection takes place when one person or entity, (more often the seller) has differing or more accurate information about a deal than the other person, (more often the buyer) before reaching an agreement.

- Difference Between Profit Center and Investment Center - July 2, 2022

- Difference Between Anti-Trust and Anti-Competition - June 6, 2022

- Difference Between Stocktaking and Stock Control - June 6, 2022

Search DifferenceBetween.net :

Leave a Response

References :

[0]Amy Finkelstein. Moral Hazard in Health Insurance. Columbia University Press, 2014. https://books.google.co.ke/books?id=ZzkjBQAAQBAJ&printsec=frontcover&dq=Difference+between+adverse+selection+and+moral+hazard&hl=en&sa=X&ved=2ahUKEwjSybjgnJj2AhWX7aQKHQsHB8UQ6AF6BAgLEAI#v=onepage&q=Difference%20between%20adverse%20selection%20and%20moral%20hazard&f=false

[1]Nicole Petrick. Adverse Selection and Moral Hazard in Contract Law. GRIN Verlag, 2009. https://books.google.co.ke/books?id=6BnFyUCTPsEC&printsec=frontcover&dq=Difference+between+adverse+selection+and+moral+hazard&hl=en&sa=X&redir_esc=y#v=onepage&q=Difference%20between%20adverse%20selection%20and%20moral%20hazard&f=false

[2]Eckles D & Zweifel P. Insurance Economics. Springer Nature, 2021. https://books.google.co.ke/books?id=p59GEAAAQBAJ&printsec=frontcover&dq=Difference+between+adverse+selection+and+moral+hazard&hl=en&sa=X&redir_esc=y#v=onepage&q=Difference%20between%20adverse%20selection%20and%20moral%20hazard&f=false