Difference Between Bank Draft and Money Order

Businesses and consumers nowadays are spoilt for choice when it comes to the modes of payments to use. This is due to the wide array of payment methods available ranging from cash, cheques, mobile payments, credit cards, bitcoin (yes, this has been growing for years), money orders, bartering and bank drafts. In this article, we will discuss bank drafts and money orders. Although not as common as they used to be a while back, you might come across them while making payments. They may, however, be confused for each other despite the differences between them.

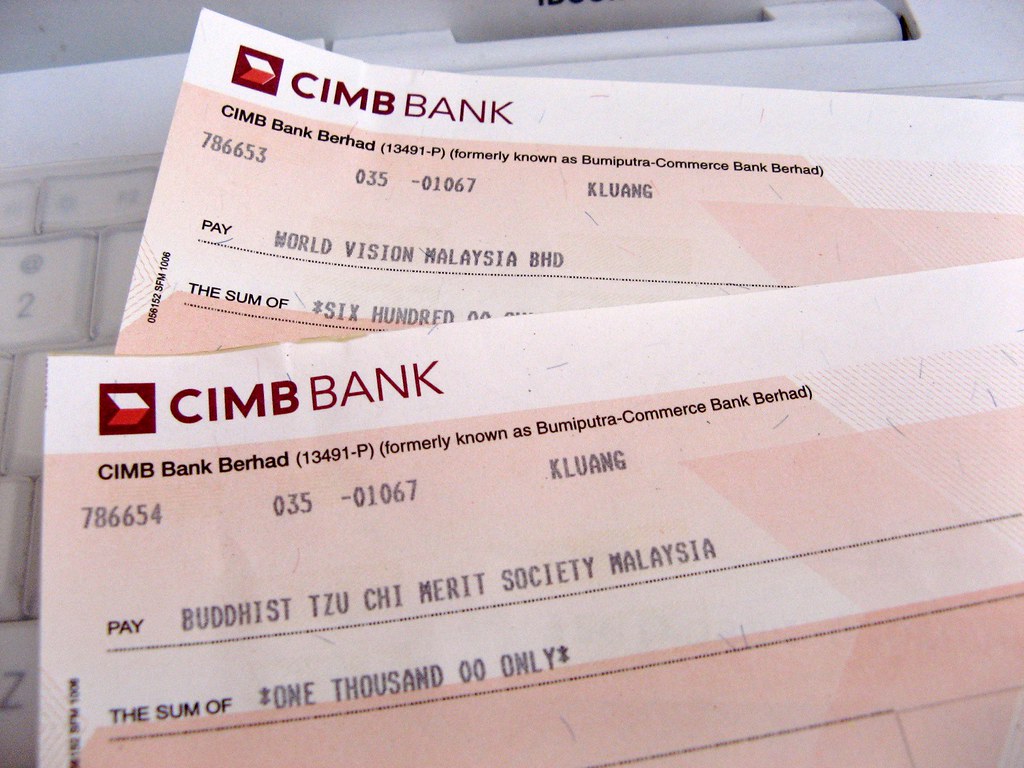

What is a Bank draft?

This is a payment made on behalf of the payer and guaranteed by the issuing bank. Before issuing the bank draft, banks review the requester’s account to determine if sufficient funds are available. The banks then set aside the funds from the drawer’s account which are given out when the bank draft is issued. By issuing a bank draft, the payee is assured of a secure form of payment.

For a payer to obtain a bank draft, equal funds to the check amount should be deposited as well as the applicable fees. Although the bank is the entity making the payment, the name of the payer is noted on the check.

The bank draft guarantees the availability of funds by drawing and issuing the draft. A bank draft can’t be cancelled as it represents a transaction that has already occurred. However, a lost, destroyed or stolen draft can be replaced or cancelled provided the purchaser has the required documentation.

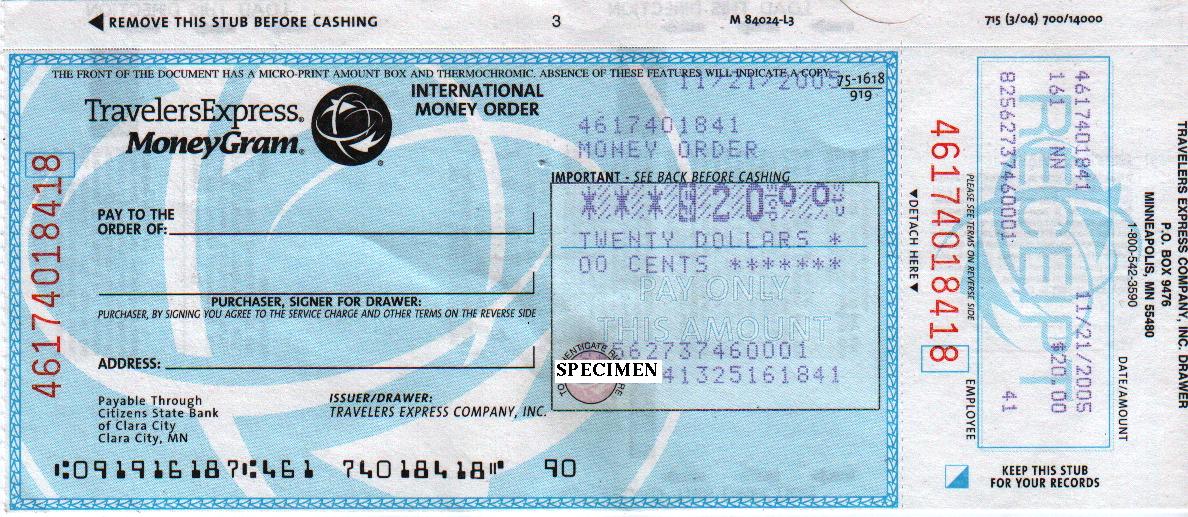

What is a Money order?

Issued by a banking institution or government, this is a certificate that guarantees the payee of payment on demand. They are often used by people without access to a standard checking account and are readily accepted and converted to cash. For anyone with cash, money orders are easy to acquire as they are sold at gas stations, post offices and grocery stores. Although they are inexpensive, they can be fraudulent. People should hence be cautious when receiving them from people they do not know.

The buyer must include the name of the recipient as well as the amount they should receive. Money orders however has a $1,000 maximum limit; hence a person would need to purchase several money orders for amounts that exceed this limit. The purchase is then issued a receipt that includes the serial order. This receipt should be kept until the purchaser is certain the money has cleared as tracing the payment without the receipt can be cumbersome.

Advantages of using money orders include;

- They are safe as they do not include personal information such as the bank account number

- They can be deposited to a bank account at no fee

- They can be cashed in a different country than the one issued in

- They can be cashed at a credit union or local bank

However, money orders have disadvantages including;

- It is difficult to find out whether a money order was cashed

- Cashing can cost a fee

- Delays may be experienced where money orders are cashed in different banks other than the issuer

- They can be fraudulent

Similarities between Bank draft and Money order

- Both are specified and printed prepaid payments

- Both are considered as safe payments as the payer does not need to carry large sums of money

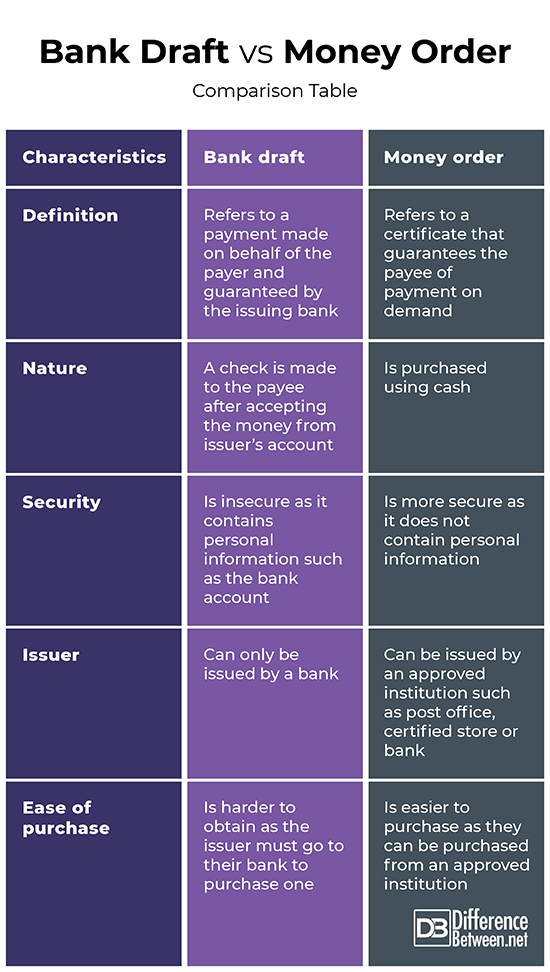

Differences between Bank draft and Money order

Definition

A bank draft refers to a payment made on behalf of the payer and guaranteed by the issuing bank. On the other hand, a money order refers to a certificate that guarantees the payee of payment on demand.

Nature

While in a bank draft a check is made to the payee after accepting the money from the issuer’s account, a money order is purchased using cash.

Security

A bank draft is insecure as it contains personal information such as the bank account. On the other hand, a money order is more secure as it does not contain personal information.

Issuer

While a bank draft can only be issued by a bank, a money order can be issued by an approved institution such as post office, certified store or bank.

Ease of purchase

Bank drafts are harder to obtain as the issuer must go to their bank to purchase one. On the other hand, money orders are easier to purchase as they can be purchased from an approved institution.

Bank draft vs. Money order: Comparison Table

Summary of Bank draft vs. Money order

A bank draft refers to a payment made on behalf of the payer and guaranteed by the issuing bank. It is made to the payee after accepting the money from the issuer’s account and can only be issued by a bank. On the other hand, a money order refers to a certificate that guarantees the payee of payment on demand. It can be issued by an approved institution such as post office, certified store or bank hence making it easier to purchase. Despite the differences, both payment methods are specified and printed prepaid payments and are considered as safe payments as the payer does not need to carry large sums of money.

- Difference Between Profit Center and Investment Center - July 2, 2022

- Difference Between Anti-Trust and Anti-Competition - June 6, 2022

- Difference Between Stocktaking and Stock Control - June 6, 2022

Search DifferenceBetween.net :

Leave a Response

References :

[0]Clarke G & Whitcomb A. Heinemann Office Procedures for CXC. Heinemann Publishers, 2000. https://books.google.co.ke/books?id=1fY-12LBTH4C&pg=PA205&dq=bank+draft+vs.+Money+order+payment+methods&hl=en&sa=X&ved=2ahUKEwiExbumzKzqAhUF1RoKHYMdA1k4ChDoATACegQIBRAC#v=onepage&q=bank%20draft%20vs.%20Money%20order%20payment%20methods&f=false

[1]Clarke G & Whitcomb A. Heinemann Office Procedures for CXC. Heinemann Publishers, 2000. https://books.google.co.ke/books?id=1fY-12LBTH4C&pg=PA205&dq=bank+draft+vs.+Money+order+payment+methods&hl=en&sa=X&ved=2ahUKEwiExbumzKzqAhUF1RoKHYMdA1k4ChDoATACegQIBRAC#v=onepage&q=bank%20draft%20vs.%20Money%20order%20payment%20methods&f=false

[2]P. C. Tulsian. Business Organisation and Management. Pearson Education India, 2002. https://books.google.co.ke/books?id=Ldjh_97MzmIC&pg=RA10-PA17&dq=bank+draft+vs.+Money+order&hl=en&sa=X&ved=2ahUKEwjzm6Koy6zqAhVB1xoKHbllAVcQ6AEwB3oECAYQAg#v=onepage&q=bank%20draft%20vs.%20Money%20order&f=false

[3]Jason Rich. Design and Launch an Online Web Design Business in a Week. Entrepreneur Press, 2009. https://books.google.co.ke/books?id=kBYdILVsvmsC&pg=PA72&dq=bank+draft+vs.+Money+order+payment+methods&hl=en&sa=X&ved=2ahUKEwiExbumzKzqAhUF1RoKHYMdA1k4ChDoATAIegQICRAC#v=onepage&q=bank%20draft%20vs.%20Money%20order%20payment%20methods&f=false

[4]Image credit: https://en.wikipedia.org/wiki/File:Money_order.jpg

[5]Image credit: https://live.staticflickr.com/209/455546397_cba00c1b79_b.jpg