Difference Between Debit Transaction and Credit Transaction

Most credit cards and debit cards have similar features. And they are easy to confuse. Similarly, understanding a debit and credit transaction does not come easy, at least for most people. How should money coming in or money going out of the bank account be referred? When do people get to use their funds vs. borrowed funds? Let’s explore the variance between debit and credit transactions.

What is Debit transaction?

Usually offered by the bank or financial institution, a debit transaction is a transaction that gives customers access to their funds by withdrawing from ATM machines or directly paying for products or services. Debit cards are mostly offered by financial institutions when customers open a checking account. While debit cards come in handy in paying bills, shopping and even during emergencies, customers ought to ensure they do not have their accounts overdrawn.

When a debit transaction is completed, the bank puts a hold on the amount of money spent. The money can then go out of the account either immediately or within 24 hours, depending on the bank. Some debit transactions take longer to be completed. Debit transactions may also entail cash withdrawal from checking accounts.

What is Credit transaction?

These are payments that are made via credit cards. Issued by financial institutions, credit cards provide an avenue for consumers to pay for products and services and reimburse the bank within the agreed time. Most banks offer credit cards with a stipulated limit that is set to control a person’s spending.

Credit transactions can either involve cash withdrawals or payments for purchases using the card. Most financial institutions require customers to clear or remit at least a minimum amount of the credit card balances at the end of each month. If payments are not cleared at the end of the month, the customer is charged interest on the outstanding amount.

Similarities between Debit transaction and Credit transaction

- In both transactions, merchants get the funds within the same timeframe

- Both provide the convenience for paying for products or services

Differences between Debit transaction and Credit transaction

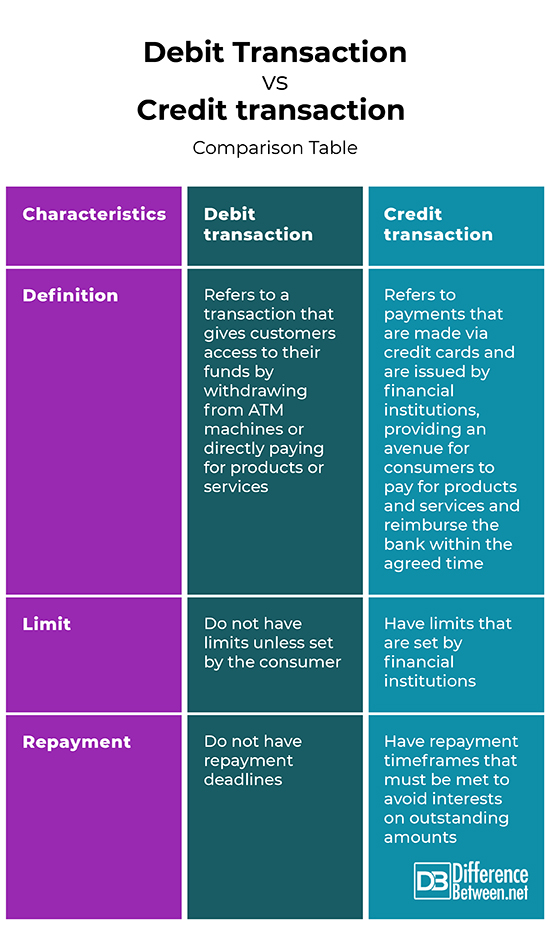

Definition

A debit transaction refers to a transaction that gives customers access to their funds by withdrawing from ATM machines or directly paying for products or services. On the other hand, a credit transaction refers to payments that are made via credit cards and are issued by financial institutions, providing an avenue for consumers to pay for products and services and reimburse the bank within the agreed time.

Limit

While most debit transactions do not have limits unless set by the consumer, credit transactions have limits that are set by financial institutions.

Repayment

Debit transactions do not have repayment deadlines. On the other hand, credit transactions have repayment timeframes that must be met to avoid interests on outstanding amounts.

Debit transaction vs. Credit transaction: Comparison Table

Summary of Debit transaction vs. Credit transaction

A debit transaction refers to a transaction that gives customers access to their funds by withdrawing from ATM machines or directly paying for products or services. On the other hand, a credit transaction refers to payments that are made via credit cards and are issued by financial institutions, providing an avenue for consumers to pay for products and services and reimburse the bank within the agreed time. Both provide the convenience of paying for products or services.

FAQs

What is a debit credit?

A debit is the flow of money into an account while a credit is the flow of money out of an account.

What is credit transaction example?

A consumer who wants a watch worth $70 but does not have the funds can use his credit card to pay for his watch. The consumer should clear this negative balance from his credit card statement within the given time to avoid interest.

- Difference Between Profit Center and Investment Center - July 2, 2022

- Difference Between Anti-Trust and Anti-Competition - June 6, 2022

- Difference Between Stocktaking and Stock Control - June 6, 2022

Search DifferenceBetween.net :

Leave a Response

References :

[0]Mr.Bruce J. Summers. The Payment System: Design, Management, and Supervision. International Monetary Fund, 1994. https://books.google.co.ke/books?id=2KQJ1vYi56QC&printsec=frontcover&dq=Difference+between+debit+and+credit+transaction&hl=en&sa=X&ved=2ahUKEwj1lqyP-Ij1AhWMhP0HHTYkAGwQ6AF6BAgJEAI#v=onepage&q=Difference%20between%20debit%20and%20credit%20transaction&f=false

[1]Michael Kane. Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small Businesses. Michael Kane, 2021. https://books.google.co.ke/books?id=JbAhEAAAQBAJ&printsec=frontcover&dq=Difference+between+debit+and+credit+transaction&hl=en&sa=X&redir_esc=y#v=onepage&q=Difference%20between%20debit%20and%20credit%20transaction&f=false

[2]Steven M. Bragg. The Ultimate Accountants' Reference: Including GAAP, IRS and SEC Regulations, Leases, and More. John Wiley & Sons, 2010. https://books.google.co.ke/books?id=-w6FZV8WjvUC&printsec=frontcover&dq=Difference+between+debit+and+credit+transaction&hl=en&sa=X&ved=2ahUKEwj1lqyP-Ij1AhWMhP0HHTYkAGwQ6AF6BAgEEAI#v=onepage&q=Difference%20between%20debit%20and%20credit%20transaction&f=false