Difference Between Futures and Options

• Categorized under Business,Investment | Difference Between Futures and Options

Derivatives are created form the underling asset like stocks, bonds and commodities. They are known to be the most complicated instruments in the entire financial market. Some of the investors find them right instruments for risk management, which increases liquidity. However, they are extremely important and have huge effects on financial markets and the economy Derivatives are mainly of two kinds, which are futures and options. There is a marked difference between futures and options.

The meaning of futures is summarized as the contract made by two different parties either to purchase or sell products at a future period where the prices are pre-determined. The meaning of options is the right without the obligation to purchase and sell underlining assets. Call option stands for the right without obligation to only buy the underlining asset and the purchaser may refuse the contract prior to its maturity. Put option means the opposite of call option.

The basic difference of futures and options is evident in the obligation present between buyers and sellers. In the future contract, both the parties are engaged in a contract with obligation to purchase or sell the asset at a particular price on the day of settlement. This is a risky proposition for both the parties. In case of the option contract, the buyer has the right without any obligation to purchase or sell the underlying asset. This is the peculiarity of the term ‘option’ and the price is paid at a premium. With this kind of trading, the purchaser’s risk becomes limited to the payment of premium but the prospective profit is unlimited.

Beside his commissions, the investor is able to engage in future contract without any advance expenditure. In the options case, it requires the payment of a premium to be made. This additional charge is paid to get relief from the obligations to purchase underlying assets in case of negative shift in prices of assets. The only loss would be in the shape of premium when the transaction is made though option and hence the risk remains limited within the payment of premium.

The other fundamental difference between futures and options relates to the size of the stock position. Usually, the position of underlying assets is very huge for the future contracts. Naturally, the obligation to purchase or selling of this huge quantity at a specified price makes the future trading absolutely risky for the fresh investor.

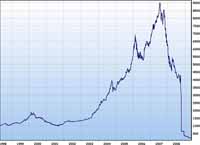

The difference between futures and options as financial instruments depict different profit pictures for parties. The gain in the option trading can be obtained in certain different manners. On the contrary, the gain in the future trading is automatically linked to the daily fluctuations in the market. This is to say that the value of profit positions for investors is dependent upon the market position at the close of the trading everyday. Therefore, every investor should have a prior knowledge of both futures and options before they enter the financial market operations.

Summary

1. A future is a contract which is governed by a pre-determined price for selling and buying at a future period. In options, there is the right to sell or purchase of underlying assets without any obligation.

2. A future trading has open risk. The risk in option is limited.

3. The size of the underlying stock is usually huge in future trading. Option trading is of normal size.

4. Futures need no advance payment. Options have the advance payment system of premiums.

- Difference Between Noodles and Spaghetti - December 2, 2009

- Difference Between Debt and Deficit - November 13, 2009

- Difference Between Mortgage Insurance and Life Insurance - November 6, 2009

Sharing is caring!

Search DifferenceBetween.net :

Cite

APA 7

, . (2011, October 12). Difference Between Futures and Options. Difference Between Similar Terms and Objects. http://www.differencebetween.net/business/difference-between-futures-and-options/.

MLA 8

, . "Difference Between Futures and Options." Difference Between Similar Terms and Objects, 12 October, 2011, http://www.differencebetween.net/business/difference-between-futures-and-options/.

2 Comments

Trackbacks

Leave a Response

Written by : lancetana. and updated on 2011, October 12

See more about : Business, futures, options, stocks

To know teh the difference between Futures and Options was very useful. Quite often we use these terminologies without actually understanding it.

thanks for an update.