Difference Between IMPS and NEFT

IMPS is the acronym of Interbank Mobile Payment System or Immediate Payment System. This is a platform that allows for individuals to transfer money from one bank account to another. It is real-time, and this means that the transactions can take place in less than a minute. In addition to this, the transactions can be done any time of the day as it is 24/7.

NEFT, on the other hand, is the short form of National Electronic Funds Transfer. It’s a payment system that enables direct funds transfer on a one to one basis. NEFT enables individuals to transfer funds using electronic devices from one bank branch to another bank in the same scheme.

What is IMPS?

IMPS stands for Interbank Mobile Payment system. This system enables transfer of funds from one account to another electronically using mobile devices. Other channels like internet banking and ATM can also be used. The services can be used 24/7 including holidays and Sundays. When a fund transfer request is made through mobile phones or internet banking, the beneficiary of the account is credited immediately.

It was launched in 2010 by the Indian government, and over the few years, many banks have become part of the system. When sending money through IMPS, ensure that you register for mobile banking. Most banks, however, register their clients for mobile banking when opening their accounts. When receiving money through IMPS, nothing is required from you. You will get a message that money has been credited to your account.

How it is used:

- Log on SBI wherever you are.

- Click on funds transfer- IMPS-mobile number and MMID

- Select debit and credit account

- Enter the desired amount to be transferred and click submit

- Click confirm

- Approve the transaction using the OTP that you will receive on your mobile phone.

Benefits of IMPS:

- Money is credited to the beneficiary’s account immediately.

- The service is available 24/7 including holidays and weekends.

- There is no minimum amount limit for transfer of funds.

- Interbank and interbank payments can be made.

What is NEFT?

NEFT is the short form of National Electronic Funds Transfer, and it is a facility that enables customers to transfer funds from one NEFT enabled account to another. It was established in 2005, and the Reserve Bank of India maintains it. It is done via electronic messages, but the fund transfers do not happen in real time. On weekdays, the transfers happen between 8:00 AM and 7:30 PM. No transfers can be made on Sundays or public holidays.

The platform has gained popularity due to the ease of usage. Below is the process of how it works.

- The client fills an application form that provides the details of the beneficiary.

- The client authorized the bank to debit their bank and remit the amount to the beneficiary.

- The bank sends the message to its pooling center (NEFT Service Centre)

- The pooling center forwards the message to their clearing center to be included in the batch that is available.

- The clearing center sorts the fund’s transfer and the remittance messages forwarded to the destination banks.

- Once the destination banks receive the messages from the clearing centers, they credit the beneficiary account.

Advantages of NEFT:

- The method is secure and efficient.

This method is secure because there are fewer chances of errors.

- Low Costs

Transferring money using this method is cheap as compared to IMPS.

- Highly Reliable

The Reserve Bank of India mainly coordinates the NEFT process. That is why this method is highly reliable.

- Eliminates Delay

This process is fast, and it has helped in eliminating delays associated with movement of funds. The vital transactions are settled in a day from the start of transactions. This ultimately leads to clients receiving their funds on time.

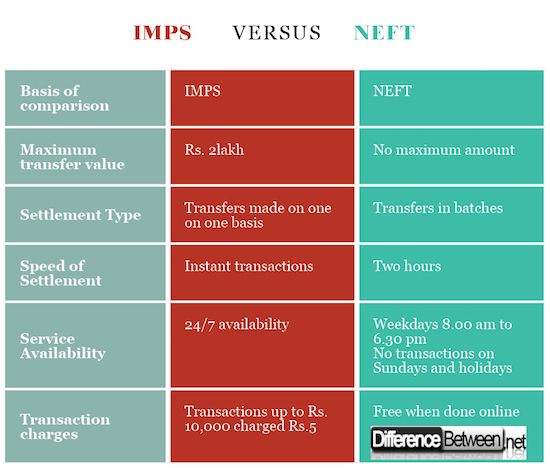

Difference Between IMPS and NEFT

1. Maximum Transfer Value for IMPS and NEFT

There is no maximum value to be transferred while using NEFT. On the other hand, when using IMPS, the maximum value of the transfer is Rs. 2 lakh.

2. Type of settlement in IMPS and NEFT

While using NEFT, the transfer of funds is made in batches. IMPS, on the other hand, transfers funds using a one-on-one arrangement.

3. The speed of Settlement for IMPS and NEFT

Because of the nature of settlement for NEFT, the transaction may take two hours. This is subject to cut-off timings and available batches. IMPS is fast, and the transaction happens instantly.

4. Service Availability of IMPS and NEFT

NEFT service is available only on weekdays from 8:00 AM to 6:30 PM and no transactions can take place on Sundays and public holidays. IMPS, on the other hand, is functional 24/7 including holidays and Sundays.

5. Transaction Charges for IMPS and NEFT

As from November 2017, the transaction charges of NEFT have been free if done online using internet banking. As for IMPS, transactions that are up to Rs 10,000 are charged Rs 5.

IMPS VS. NEFT

Summary of IMPS vs NEFT

- Thanks to the revolution of technology, individuals can now transfer funds from their accounts electronically.

- IMPS and NEFT are both methods that are used in the transfer of funds from one bank account to another using electronic devices like mobile phones and tablets. This has eliminated the need for queuing in bank halls to conduct the transactions.

- Individuals can choose whichever platform is convenient for them because the transfer of funds is instant for IMPS and it takes just two hours for NEFT.

- There should be no doubts about the safety of the facility because they are highly secure.

- Both systems have their pros and cons, and it is not easy to determine which one is easily preferred because they are all efficient.

- Difference Between S Corp and C Corp - September 9, 2018

- Difference Between Terrace and Balcony - September 9, 2018

- Difference Between Anabaptists and Evangelicals - August 31, 2018

Search DifferenceBetween.net :

Leave a Response

References :

[0]Image credit: https://cdn.pixabay.com/photo/2016/01/30/15/33/payment-systems-1169825_960_720.jpg

[1]Image credit: https://upload.wikimedia.org/wikipedia/commons/thumb/1/19/Cash_template.svg/640px-Cash_template.svg.png

[2]KT, Vindhya. A Conceptual Research on Impact of Immediate Mobile Payment System/Interbank Mobile Payment System (IMPS) on the Upliftment of Banking Transactions in India. p. 3.

[3]Upadhyaya, Anil Kumar. Banking Panorama: In India. Anil Kumar Upadhyaya, 2014.

[4]Kolekar, Yogesh. Introduction to Banking in India. Yogesh Kolekar, 2017.