Difference Between Sole Proprietorship and LLC

In any business start-ups, the choice of the business structure is one of the most critical decisions an entrepreneur should make. Depending on the type of business, an entrepreneur may be torn between a sole proprietorship and a limited liability company (LLC). Each one of these business settings has their own benefits, organization, management, features and tax structures.

Sole Proprietorship

A sole proprietorship is a business entity whereby an individual operates the business individually, without any business partners of any kind. In this kind of business entity, the business and the owner are one and the same. This is the simplest form of business.

Limited Liability Company (LLC)

An LLC is a business ownership structure whereby the owners pay business taxes on their own individual income tax returns. In this setting, the business owners enjoy legal and financial liability protection from the business. This means that personal accounts of the members are not subject to business debt or legal judgments.

Similarities Between Sole Proprietorships and LLCs

- Both business entities are governed by certain laws hence are subject to government control.

- Both carry certain risks and uncertainties-These are brought by predictable factors such as taxes, change in volume of sales and overhead costs. The risks may also be brought by unpredictable factors such as changes in trends and competition.

- Both aim at satisfying the customer.

Differences Between Sole Proprietorship and LLC

-

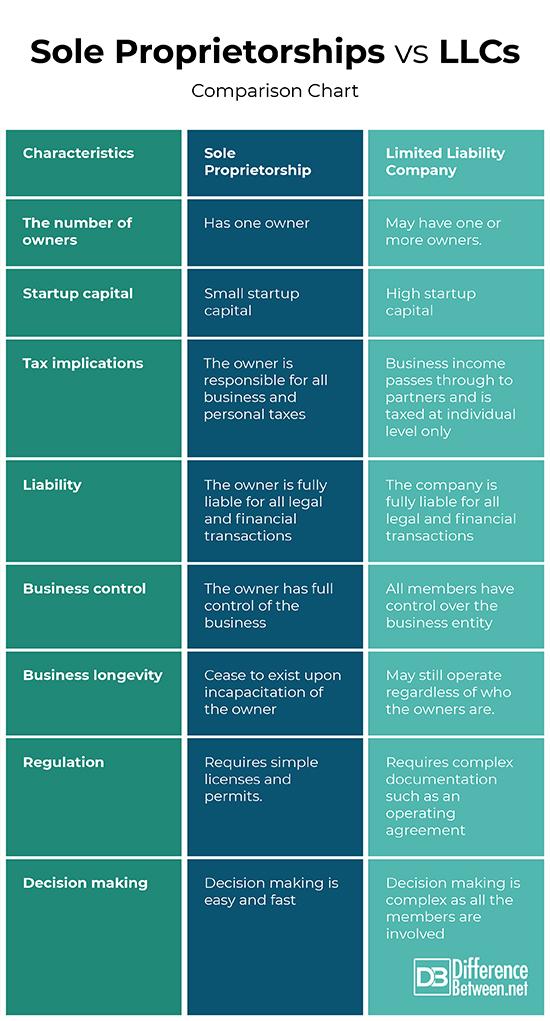

Number of Owners

Sole proprietorships have one owner while a LLC has one or more owners that may consist of corporations, foreign businesses, and even partnerships.

-

Startup Capital

For a sole proprietorship to commence, the setting up process does not entail much cost, other than the fees for obtaining any required permits and licenses. An LLC, on the other hand, requires a lot of capital to start. Registration with the state is also required which may involve payment of initial registration or filing fees.

-

Tax Implications

In a sole proprietorship, the owner is responsible for all personal and business taxes whereby the income of the business is considered the owner’s personal income for tax purposes. In an LLC, business income passes through to partners and is taxed at the individual level only.

-

Liability

For a sole proprietorship, the owner is fully and personally liable for all financial and legal transactions carried out in the business. However, for an LLC, owners are fully protected from liability that may be incurred by the business.

-

Business Control

A sole proprietor has full control of the business and is the only decision maker. In an LLC, all members have a right to take part in the decision making in the business.

-

Business Longevity

A sole proprietorship may cease to exist when the owner is incapable of running the business and also in the event of death. An LLC, on the other hand, may exist regardless of who the manager or members of the company are.

-

Regulation

Sole proprietorships mostly require simple licenses and permits. LLCs on the other hand, are governed by certain state laws, which may require an operating agreement. This often results in additional paperwork and records, which must be filed in a timely manner.

-

Decision Making

A sole proprietor is the sole decision-maker in the business, hence fast decision making. On the contrary, an LLC involves complex decision making as every member is involved in the process.

Sole Proprietorships versus LLCs: Comparison Chart

Summary of Sole Proprietorships versus LLCs

The importance of the type of a business entity cannot be emphasized enough. Being knowledgeable about the differences between sole proprietorships and LLCs comes in handy for any aspiring business owners, especially in making the critical decision on the type of entity that is ideal for a certain business.

- Difference Between Profit Center and Investment Center - July 2, 2022

- Difference Between Anti-Trust and Anti-Competition - June 6, 2022

- Difference Between Stocktaking and Stock Control - June 6, 2022

Search DifferenceBetween.net :

1 Comment

Leave a Response

References :

[0]Image credit: https://www.flickr.com/photos/taedc/14034190887

[1]Image credit: http://www.thebluediamondgallery.com/handwriting/images/sole-proprietorship.jpg

[2]Fontana, P. Choosing the Right Legal Form of Business: The Complete Guide to Becoming a Sole Proprietor, Partnership, LLC, Or Corporation. Atlantic Publishing Company, 2010. https://books.google.co.ke/books?id=pR0J7FlurkMC&printsec=frontcover&dq=difference+between+sole+proprietorship+and+llc&hl=en&sa=X&ved=0ahUKEwj9-4qCpvDdAhVEglwKHQjMDs8Q6AEIKTAB#v=onepage&q=difference%20between%20sole%20proprietorship%20and%20llc&f=false

[3]Mancuso Anthony. Incorporate Your Business: A Step-by-Step Guide to Forming a Corporation in Any State Incorporate Your Business. Nolo Publishers, 2015. https://books.google.co.ke/books?id=h7nBCQAAQBAJ&printsec=frontcover&dq=difference+between+sole+proprietorship+and+llc&hl=en&sa=X&ved=0ahUKEwj9-4qCpvDdAhVEglwKHQjMDs8Q6AEIPzAF#v=onepage&q=difference%20between%20sole%20proprietorship%20and%20llc&f=false

[4]Pakroo Peri. The Small Business Start-Up Kit: A Step-by-Step Legal Guide. Nolo Publishers, 2018. https://books.google.co.ke/books?id=1wpNDwAAQBAJ&pg=PA9&dq=difference+between+sole+proprietorship+and+llc&hl=en&sa=X&ved=0ahUKEwi4-qC6pvDdAhVJIMAKHaNMCHk4FBDoAQgwMAI#v=onepage&q=difference%20between%20sole%20proprietorship%20and%20llc&f=false

An LLC by default will be taxed as a sole proprietorship if there is only one member. It isn’t until there is more than one member (non spouses) or the scorp election is made. Your post has just added to the horrible confusion around this subject when, in most cases, an LLC is actually the best option because of the legal protection it offers.