Differnece between Causes & Cure of Trade Cycle– Keynesian & Hayekian Views

Introduction

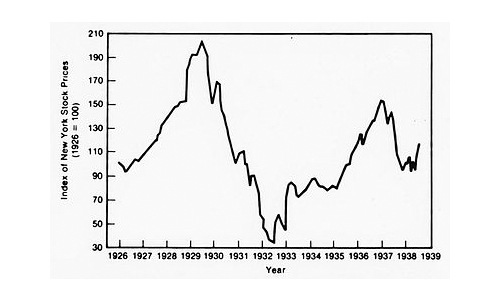

The debate between two contemporary economics scholars of 20th century namely, John Maynard Keynes of England & Friedrich Hayek of Austria, the pro-laisez-faire protagonist, as regards the causes and remedies of trade cycles remains one of the fiercely argued by their respective followers for the last eight decades, and still continues to be acknowledged as the macro-economic discussion of the century. The debate originated in the back-ground of great depression of the 1930s, which induced the two economists to find out the reasons of business-cycle, and structure their propagated measures that would presumably arrest the fluctuations in the economy, stop the down-swing, and put the economy on the up-stream.

This article is an attempt at a comparative study of the perceptions that Keynes & Hayek harboured as to causes of cyclic fluctuations, specifically why the economy slumps, and how the down-swing constructing un-employment, low levels of investment & production and income can be fixed and the economy could be put on the path of development through fiscal measures or monetary measures on the part of the government.

Keynes’ Theory

Causes

Even before his master-piece “General Theory of Income, Employment, and Money” in 1936, Lord Keynes expressed his views on causes, and remedies of business cycle in his lesser known book “Treatise on Money” in 1930. Nevertheless, Keynes’ General Theory, apart from explaining what determines at any time the prevailing level of income, output, and employment, it also provides explanation of business cycle, as business-cycles are nothing but rhythmic fluctuations in the overall levels of income, output, and employment.

However it is worthwhile to note that Keynes’ General Theory is not a theory of business-cycle. Rather it is more than and at the same time less than a theory of business-cycle. It’s more than a business-cycle theory as it gives a general explanation as to the equilibrium level of employment quite independent of fluctuating nature of changes in employment, and it’s less than a complete business-cycle theory as it neither gives a detailed account for the various phases of trade cycles, nor does it closely examine empirical data of business fluctuations, which could well be expected from a complete theory of business cycle.

According to Keynes, the primary reason of trade cycles or fluctuations in business is fluctuations in the rate of investment, which again is caused by fluctuations in marginal efficiency of capital. Rate of interest, another determinant of investment is not highly susceptible to fluctuations, and remain more-or-less stable. It does not play any significant role in cyclical fluctuations in business. But it should be noted that at times it reinforces and even supplements the primary factor i.e. marginal efficiency of capital (MEC). The term was coined by Keynes to mean the expected rate of profit from new investment. Thus Keynes says that it is the change in expectation about rate of profit from new investment that gives rise to fluctuations in economic activities.

Fluctuation in MEC or expected rate of profit takes place due two reasons namely, (i) changes in prospective yield from capital goods, and (ii) changes in the cost of supply of capital goods. Fluctuation in the cost of supply of capital goods acts as secondary and supplementary to the changes in prospective yield of new capital goods (investment). It is prospective yield of capital goods that makes the MEC unstable, and even subject to violent fluctuations. As the boom ends, and economic decline starts, prospective yield and MEC fall due to growing abundance of capital goods. This is an objective fact that gives rise to a wave of pessimistic expectations, which is a psychological fact. This pessimism further pushes down prospective yield and in return MEC. Thus downward movement of the economic activity curve is explained by the fall in MEC. As a result of fall in MEC investment also falls, which in-turn reduces level of income. The multiplier effect sets in. A given fall in investment is reflected in more than proportionate fall in level of income. As income falls rapidly, it pulls down level of employment as well.

The up-swing phase i.e. recession to recovery of the trade-cycle could well be understood by the same logic with reverse application. The up-turn of the cycle is triggered by the revival of MEC. The portion of the cycle between the upper turning point and the lower turning point is conditioned by two factors namely;

a) Time required for the excess capital stock to completely wear-out.

b) Time required for absorbing the excess stock of finished goods left-over from the time of boom.

Due to the above two reasons, there would be felt scarcity of capital goods. This would increase MEC and prospective yield. An all-round atmosphere of optimism would set in, which would induce businessmen to go for further investment. Multiplier effect would work in the positive direction, i.e. given increase in investment would give more than proportionate increase in income. This will put the economic-engine on the upward move, and boom would eventually set in.

Remedy

Keynes opines that down-swing of the trade cycle occurs as actual investment falls below saving. During the time of dwindling private investment, the government should adjust the state and public bodies’ capital outlay to match the falling private investment. Thus disequilibrium in saving and investment would be wiped out, and the economy would remain stable. During depression the deficit in investment has to be made-up by increase in state & public sector investment, and as recovery sets in, and private investment rises, government should judiciously cut down spending. On the revenue side, during depression, government must cut down rates and taxes, and the reverse to be done during recovery. To put it in another way, the government should prepare deficit budget during depression and surplus budget during recovery.

Thus, according to Keynes, fiscal policy which is also known as contra-cyclical management of public finance may be implemented through both expenditure method as well as income method. Among the two, expenditure method is more effective, as income method leaves the entire ground for private investors, who may not be capable to direct investment in the most desired channels. However combination of the two could give the best result.

Hayek’s Theory

Causes

Novel Laureate and KLSE member Friedrich A. Hayek believes boom is the result of excessive investment and regard depression as the necessary corrective for the boom-crated imbalances. Investment during boom becomes excessive and that is reflected by faster expansion of capital goods as compared to consumption goods during the up-ward swing of the trade cycle. During depression, as investment shrinks, capital goods industries suffer more than consumption goods industries. Though Hayek does not regard trade cycle as a purely monetary phenomenon, yet he attributes disparity between the growth rate of capital goods industries and that of consumption goods industries to the elasticity of the banking system. Hayek’s monetary theory of over-investment is based upon Wicksell directed distinction between natural rate of interest and market rate of interest. Natural rate of interest is that rate at which demand for lonable fund is equal to supply of voluntary saving, on the other hand market rate of interest is the rate that prevails in the market and determined by equality of demand for and supply of money. Hayek says that as long as natural rate of interest is equal to market rate of interest, the economy remains in equilibrium. When market rate of interest falls below natural rate the economy witnesses prosperity. An increase in investment opportunities is fed by lower rate of interest, and there is encouragement among producers to adopt more and more round-about methods of production, and accordingly, as full employment exists resources get increasingly shifted from consumption goods industries to capital gods industries by the means of forced saving. Forced saving emerges from reduction in consumption of consumption goods due to fall in production and resultant increase in price. This forced saving gets channelized into production of capital goods. Competition among factors of production increases their price. Thus monetary over-investment on factors of production takes place, and the economy experiences over-all prosperity and boom. But boom does not exist for lang. Rise in factor cost reduces profit of capital goods industries, and the producers get discouraged to invest more. As a result natural rate of interest falls, and banks apply break on loan disbursement. Increase in cost of factors of production reduces profit, and demand for lonable funds by the producers fall, and consequently market rate of interest rises.

This sets the down-swing of the cycle, where production and employment both fall and eventually slump comes through.

Remedy

Hayek, being a strong pro laissez-faire opines that, as depression sets in banks pump in fresh supply of money as unused money piles up with banks. Market rate of interest falls and the producers fill encouraged to invest. An atmosphere of optimism again sets in the economy and the economy starts to experience recovery and the up-swing of the cycle starts which culminates to boom.

Summary

(i) Keynes advocated fiscal measure to combat business cycle, whereas Hayek was in favour of monetary measure.

(ii) Till 1970s, Keynes’ recommendation of positive role of the government as economic actor, especially during economic crisis was dominant among the global economics fraternity. Since 1970s Hayek’s strong laissez faire ideology started to be recognized.

(iii) Though Keynes was not actively in favour of any government planning, he believed government could play a positive role to regulate the economy. Hayek believed in free-market economy and that market demand and supply dynamics of money could act as remedy for business cycle.

- Differences between Al-Qaeda And ISIS - April 14, 2017

- Difference Between Hindu And Buddhist meditation - September 20, 2015

- Difference Between Upper Middle Class and Lower Middle Class - September 3, 2015

Search DifferenceBetween.net :

Leave a Response

References :

[0]www.econedlink.org

[1]www.yourarticlelibrary.com

[2]www.britannica.com

[3]http://upload.wikimedia.org/wikipedia/commons/thumb/3/38/Stocks29.jpg/400px-Stocks29.jpg