Difference Between Nominal Values and Real Values

Macroeconomics is a big deal. It is the study of overall or aggregate performance of an economy. It is the study of economy as a whole – which is something that affects almost every aspect of our life. For your employment status to how much you earn and pay in taxes, macroeconomics actually matters. Macroeconomists study aggregate income – the income of an entire country. They look at the aggregates of employment and unemployment and at the breakdown of gross domestic product (GDP) into customer expenditures, private investment, government consumption and investment, and net exports. Economists focus on four markets – the markets for goods, for bonds, for labor, and for money.

The interactions between these separate markets are the subject matter of microeconomics. Macroeconomics is the study of aggregate of all these markets as a single unit in which all these goods can be measured. When presenting the data, analysts have a choice between expressing the benefits and costs in nominal prices or real prices. Either can be chosen without influencing the outcome of the analysis if consistently applied to all benefits, costs, and discount rates. Nominal values are measured in current values without taking inflation into account. Real values refer to the same statistic after it’s been adjusted for inflation. Let’s take a look at how the nominal and real values of an exchange rate differ.

What is a Nominal Value?

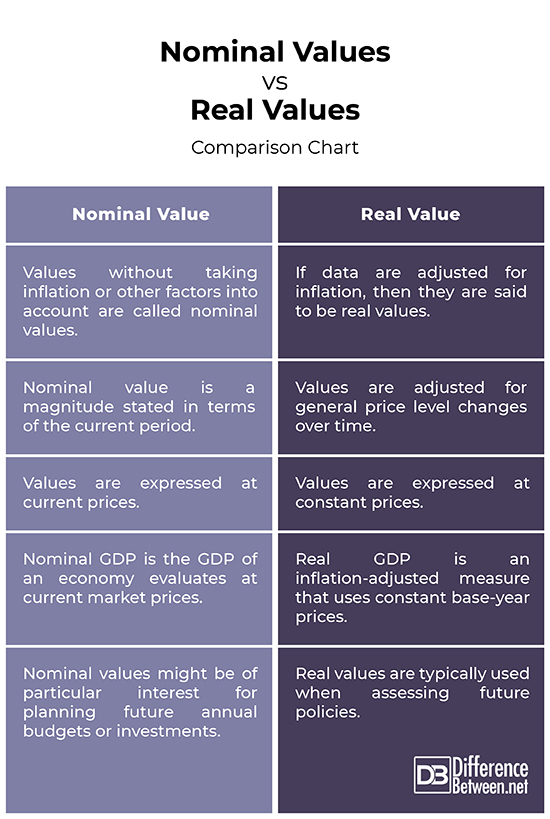

In economics, nominal value is by far the most important measure used as the value of an item measured in monetary terms. One major problem in using money as a measure is that inflation erodes the purchasing power of money. Values unadjusted for inflation meaning without taking inflation into account are called nominal values. These are values expressed at current prices, meaning at the level of prices that exist during the time period being measured. In simple terms, nominal value is a magnitude stated in terms of the current period. It simply refers to the current price without taking inflation or other factors into consideration as opposed to real values.

What is a Real Value?

If nominal value is the actual price, then real value is what should have been the price. Real value refers to the nominal value when adjusted for inflation, meaning they are adjusted for general price level changes over time. If data are adjusted for inflation, then they are said to be real values. Unlike nominal values, these values are expressed at constant prices. To do this, one period of time is taken into account as the ‘base period’ and data are then adjusted assuming that the prices of the goods were the same throughout as in the base period. Real values are more important for economic measures as opposed to nominal values, such as gross domestic product (GDP). Calculating values based on inflation help you make better financial decisions.

Difference between Nominal and Real Values

Definition of Nominal vs. Real Values

Values unadjusted for inflation meaning without taking inflation into account are called nominal values. In other terms, nominal value is a magnitude stated in terms of the current period. It simply refers to the current price without taking inflation or other factors into consideration as opposed to real values.

Real value, on the other hand, is the nominal value that is adjusted for general price level changes over time. Real values are inflation adjusted values that take into account inflation and other such factors that influence economic stability. Unlike nominal values, these values are expressed at constant prices.

GDP

GDP, short for gross domestic product, is the monetary value of all final goods and services produced within a country in a specific period of time.

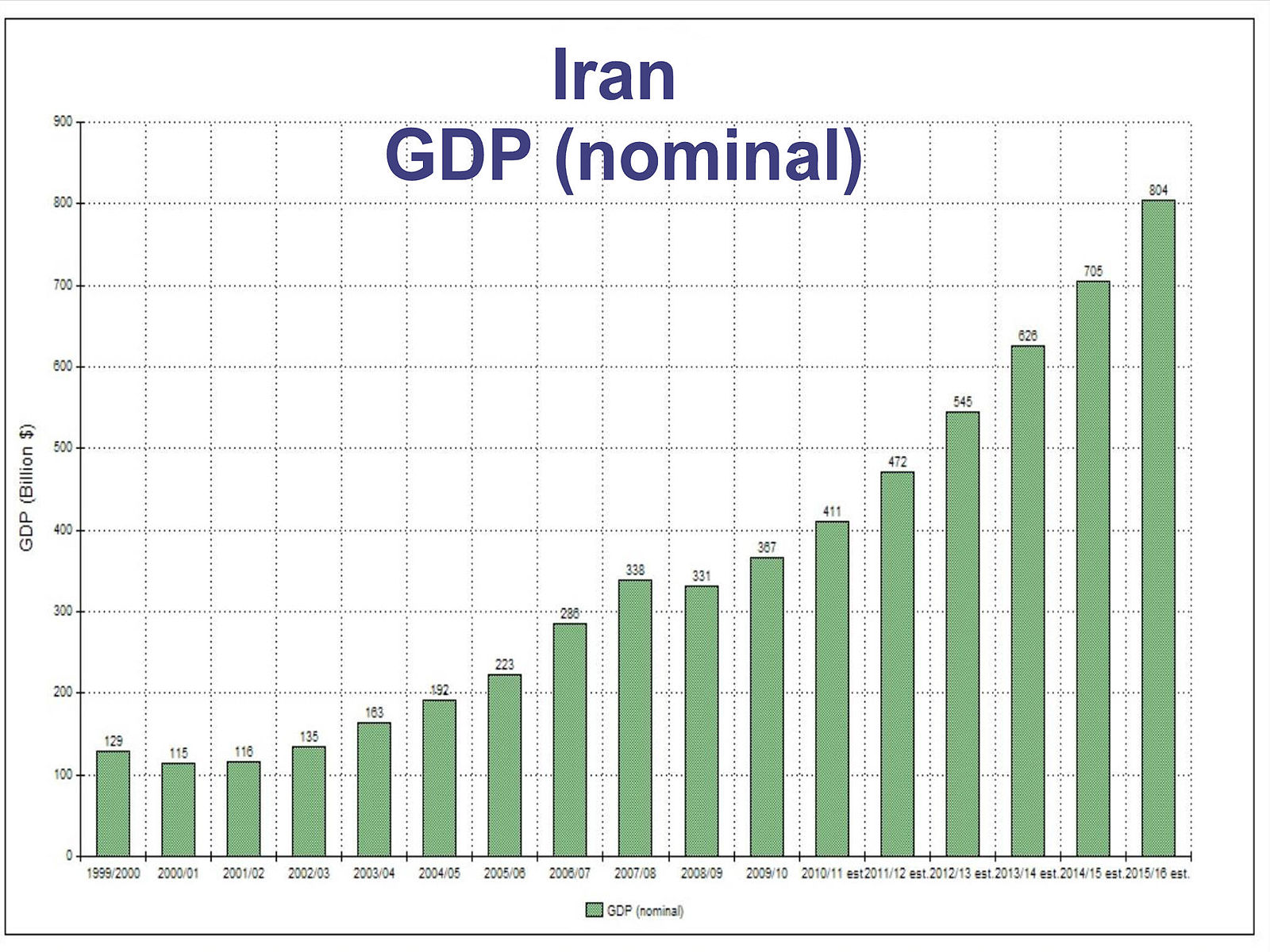

Nominal GDP is the GDP of an economy evaluates at current market prices. The gross domestic product in any one year is valued in terms of the prices of goods and services in that year. This is called Nominal GDP.

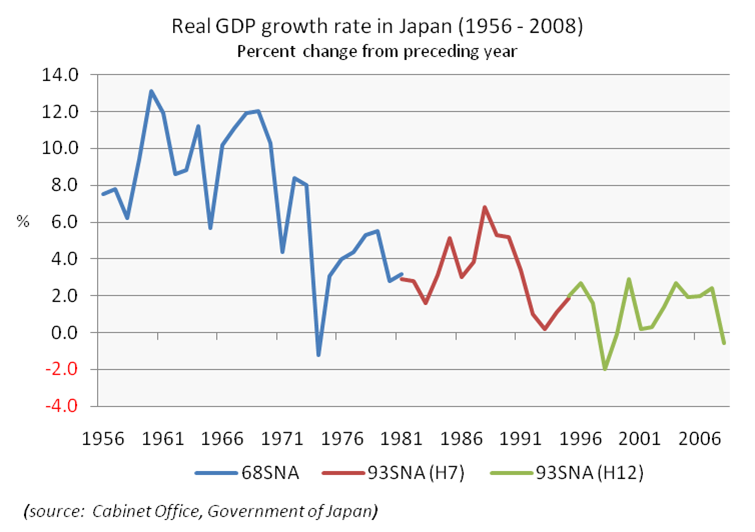

Real GDP, on the other hand, is an inflation-adjusted measure that uses constant base-year prices to place a value on the economy’s production of goods and services. Nominal GDP, on the contrary, uses current prices.

Ideal Scenario for Nominal vs. Real Values

Real values are typically used when assessing future policies because the use of real prices makes it easy for analysts to see either real price changes or if real prices remain constant, quantity changes over time.

Nominal values, on the contrary, do not account for inflation and the prices increase with inflation, these other changes are not explicitly apparent. In addition, analysts require a fewer calculations when working with relative values, particularly when real prices remain unchanged over time. Nominal values might be of particular interest for planning future annual budgets and investments.

Nominal Values vs. Real Values: Comparison Chart

Summary of Nominal vs. Real Values

In a nutshell, nominal values are measured in current values without taking inflation into account whereas real values refer to the same statistic after it’s been adjusted for inflation. Nominal value is a magnitude stated in terms of current period, so comes in handy when planning future annual budgets or investments. Real values are adjusted for inflation, hence typically used when assessing future policies. Real values are more imperative for economic measures such as GDP, as opposed to nominal values.

- Difference Between Caucus and Primary - June 18, 2024

- Difference Between PPO and POS - May 30, 2024

- Difference Between RFID and NFC - May 28, 2024

Search DifferenceBetween.net :

Leave a Response

References :

[0]Image credit: https://commons.wikimedia.org/wiki/File:IRAN_GDP.jpg

[1]Image credit: https://commons.wikimedia.org/wiki/File:Real_GDP_growth_rate_in_Japan_(1956-2008).png

[2]Mankiw, N. Brief Principles of Macroeconomics. Boston, Massachusetts: Cengage, 2006. Print

[3]Fuguitt, Diana and Shanton J. Wilcox. Cost-benefit Analysis for Public Sector Decision Makers. Westport, Connecticut: Greenwood Publishing Group, 1999. Print

[4]Barro, Robert Joseph. Macroeconomics. Cambridge, Massachusetts: MIT Press, 1997. Print