Difference Between Housing Prices and Consumer Price Index

Various price indices are used to directly or indirectly influence economic policies. Some of these include Housing Prices Indices and Consumer Price Indices. Consumer Price Index is one of the measures of inflation. That being said, shelter, the service housing units provide its occupants, is a vital part of the CPI market basket. It is however important to note that housing units do not form a part of the CPI market basket. Rather, housing units are viewed as capital and not consumption units. Let’s look at the variance between Housing Prices and Consumer Price Indices.

What is Housing Prices Index?

The House Prices Index is a measure of changes in the prices of single-family properties in Canada. What is the purpose of Housing Prices Index, you may ask? Housing Prices Index serves as an indicator of trends on housing and is used as an analytical tool in the estimation of prepayments, mortgage defaults and housing affordability. The rise and fall of Housing Prices can also be used to show potential shifts and economic shifts in the stock market.

Authorities base the Housing Prices Index on transactions that involve conforming and conventional mortgages on single-family properties. In Canada, the Housing Index increased from 118.50 points seen in September 2021 to 119.60 points in October 2021. This was an increase of 0.4%

An increase in house prices stimulates confidence among consumers prompting more confidence. This boosts GDP and overall economic growth. On the contrary, a dip in house prices promotes consumer confidence and can even trigger a recession.

What is Consumer Price Index?

Tracking everyone’s expenditure in Canada can be difficult. To get a sense of the average buying pattern for every household, Statistics Canada fills a virtual basket with a given number of services and goods that Canadians typically purchase. The CPI, which is one of the measures of inflation, captures the average shopping experience for Canadians. It takes note of various items in the basket including shelter, food, household expenses, transportation, appliances and furniture, medical & personal care, apparel, travel, sports & leisure as well as recreational items such as alcohol and tobacco.

Statistics Canada gives weight to the basket based on the amount that households spend on a given item. In Canada, for instance, households spend more on rent and groceries compared to things like haircuts. This means that shelter and food receive more weight compared to personal care services. An increase in the price of items that have greater weight has a more significant effect on the average cost of living for every household.

Why is CPI monitored in Canada? The Consumer Price Index is a familiar and simple measure of inflation. It is also used by employers to make adjustments in salaries and wages. The Canadian government also used CPI to make adjustments on social benefits and income taxes.

CPI is measured against the base year, with the basket in the base year having a value of $100. For instance, a $100 basket of services and goods in the 2002 base year would cost $140 in 2020. This shows inflation of $40.

While the CPI is the most commonly used measure of inflation, it has some issues. Some of these are experienced due to:

- The rate at which people change their buying habits. When prices increase or decrease, consumers’ buying habits change. These changes are not always reflected in the basket.

- Changes in quality changes- Technological advancements are a culprit for the quality changes. For instance, the rapid changes in electronics and computers over time lower the cost of these products.

- The introduction of new products in the market- The CPI basket is updated every two years by Statistics Canada. As such, it does not consider products that have been introduced in the Canadian market between the years.

- CPI may not capture online shopping markets where prices are often lower compared to traditional stores.

- CPI is not fully consistent with the true-cost-of-living index (COLI)

Similarities between Housing Prices and Consumer Price Index

- Both are used to make informed economic policies

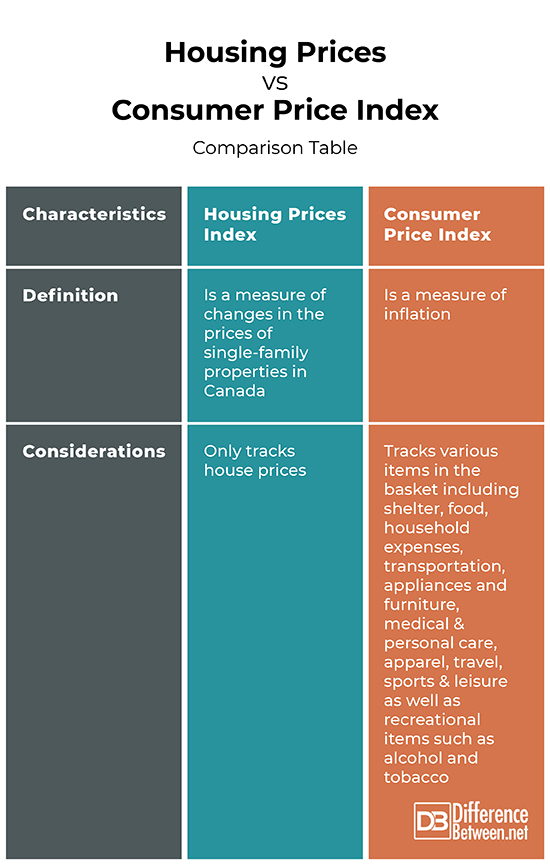

Differences between Housing Prices and Consumer Price Index

Definition

Housing Prices Indices is a measure of changes in the prices of single-family properties in Canada. On the other hand, Consumer Prices Indices is a measure of inflation.

Considerations

Housing Prices Indices only tracks house prices. On the other hand, the Consumer Prices Indices tracks various items in the basket including shelter, food, household expenses, transportation, appliances and furniture, medical & personal care, apparel, travel, sports & leisure as well as recreational items such as alcohol and tobacco.

Housing Prices vs. Consumer Price Index: Comparison Table

Summary

Housing Prices Indices only tracks house prices. On the other hand, the Consumer Prices Indices tracks various items in the basket including shelter, food, household expenses, transportation, appliances and furniture, medical & personal care, apparel, travel, sports & leisure as well as recreational items such as alcohol and tobacco. While the two are related, it is important to note that housing prices are excluded in Consumer Prices Indices.

FAQs

Are housing prices part of CPI?

No. Housing prices are excluded in the CPI market basket.

How does housing affect CPI?

Housing does not affect CPI since it’s not included in the CPI basket.

What percentage of CPI is housing?

The shelter component comprises 29.8% of the CPI basket.

Why is housing not included in CPI?

This is because housing units are viewed as capital and not consumption units.

- Difference Between Profit Center and Investment Center - July 2, 2022

- Difference Between Anti-Trust and Anti-Competition - June 6, 2022

- Difference Between Stocktaking and Stock Control - June 6, 2022

Search DifferenceBetween.net :

Leave a Response

References :

[0]Charles Goodhart, Professor of Banking and Finance Charles Goodhart, Boris Hofmann. House Prices and the Macroeconomy: Implications for Banking and Price Stability. OUP Oxford, 2007. https://books.google.co.ke/books?id=zaF9U0-Gj78C&printsec=frontcover&dq=Difference+between+housing+prices+and+consumer+price+index&hl=en&sa=X&redir_esc=y#v=onepage&q=Difference%20between%20housing%20prices%20and%20consumer%20price%20index&f=false

[1]Statistical Office of the European Communities. Handbook on Residential Property Prices (RPPIs). International Monetary Fund, 2013. https://books.google.co.ke/books?id=ILoaEAAAQBAJ&printsec=frontcover&dq=Difference+between+housing+prices+and+consumer+price+index&hl=en&sa=X&ved=2ahUKEwj11pvCter0AhVHBGMBHRJwDR4Q6AF6BAgKEAI#v=onepage&q=Difference%20between%20housing%20prices%20and%20consumer%20price%20index&f=false

[2]National Research Council, Division of Behavioral and Social Sciences and Education, Committee on National Statistics, Panel on Conceptual, Measurement, and Other Statistical Issues in Developing Cost-of-Living Indexes. At What Price?: Conceptualizing and Measuring Cost-of-Living and Price Indexes. National Academies Press, 2002. https://books.google.co.ke/books?id=UNJfosLN-QkC&printsec=frontcover&dq=Difference+between+housing+prices+and+consumer+price+index&hl=en&sa=X&ved=2ahUKEwj11pvCter0AhVHBGMBHRJwDR4Q6AF6BAgDEAI#v=onepage&q=Difference%20between%20housing%20prices%20and%20consumer%20price%20index&f=false