Difference Between Real Wage and Nominal Wage

Wages refer to the compensation paid to an individual after successful completion of a task assigned. An individual who does the labor or services for a company can be compensated in terms of money or any other benefits agreed upon.

These benefits that are termed as fringe benefits could include accommodation, travel and entertainment allowances. Some jobs however don’t have a salary package attached to it. These jobs fall in the category of temporary jobs and are compensated in two types of wages either real wage and money wage. Money wage is also referred to as nominal wage.

What is a Real Wage?

Real wages are the type of wages that take inflation rates into consideration. These wages determine the purchasing power the individual has and the amount of goods or services the individual can purchase given the current market conditions. In other words, it can also be defined as the actual amount of goods and services the employee can purchase with the payments given after inflation has been considered.

The author J.L Hanson, states that real wages are the wages in terms of goods and services that can be purchased with the. Real wages indirectly affect nominal wages as the real wage rises employees can easily demand for more money wages. Real wages can be a guide to indicate the changes in living standards.

A great example to show this is:

If the actual wages were increased by 4% and the inflation in the region was 4%, this would mean purchasing power of the wage is the same. However, if the actual wage increased by 3% and the inflation was at 4%, the purchasing power of the same amount will not be the same, your real wage is at -1%. The official formula for real wages is Real Wage = (Old Wage * New CPI) / Old CPI, CPI here represents Consumer Price Index.

What is a Nominal Wage?

Nominal or money wages are the payments done to workers in money form and do not take account of inflation rates and any other market conditions. For example, if a worker receives $15 per hour from their organization in exchange of the services or labor provided, then that is the nominal wage. Nominal wages don’t have a calculation or formula. The basic determinants of the nominal wages would be the government regulations and the organization’s compensation policy within its capacity.

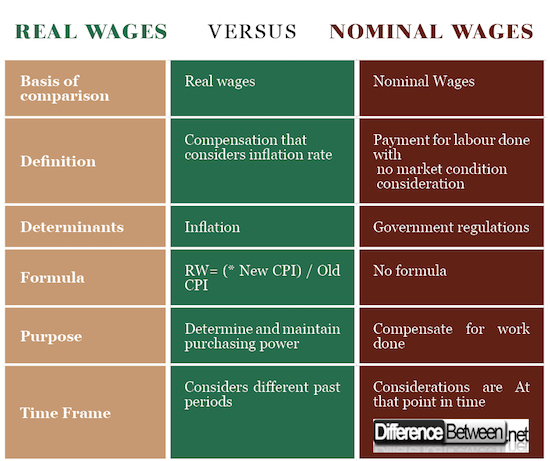

Differences Between Real Wages and Nominal wages

Definition of Real and Nominal wages

Real wage refers the compensation that takes inflation into consideration in the tabulation.

Nominal wages on the other hand is just the payment done for labor done within an organization.

Determinants of Real and Nominal wages

Real wages are determined by the inflation rates and consider the purchasing power of a given compensation amount.

Nominal wages however, don’t consider inflation and any market conditions. It is mostly determined by the government set regulations such as minimum wages.

Formula used for Real and Nominal wages

Real wage is determined by a specific formula; Real Wage = (Old Wage * New CPI) / Old CPI where (CPI is Consumer Price Index).

Nominal wages are not derived from any formula or mathematical calculation. It is simply based on what the organization is willing to pay as compensation under the government regulations.

Purpose

The purpose of real wages is to maintain the purchasing power during changes in market conditions such as inflation. Real wages help one determine the change in purchasing power by determining exactly what goods and services can be purchased with the wages paid.

Nominal wages purpose is to compensate the time and efforts put into completing a task assigned.

Time Frame

Real wages take into account different periods in time, e.g the past years market conditions.

Nominal wage only considers the current point in time.

Real Wages vs. Nominal Wages

Summary of Real Vs. Nominal wages

- Real and nominal wages are types of compensations done based on labor or services provided.

- Real wages are determined by the inflation rate and take into consideration the purchasing power of the amount paid as compensation. Nominal wages don’t consider inflation and are solely based on the current government regulations.

- Real wages are calculated with the following formula RW= (* New CPI) / Old CPI while nominal wages have no formula.

- Difference Between S Corp and C Corp - September 9, 2018

- Difference Between Terrace and Balcony - September 9, 2018

- Difference Between Anabaptists and Evangelicals - August 31, 2018

Search DifferenceBetween.net :

1 Comment

Leave a Response

References :

[0]Scholliers, P., & Zamagni, V. (1995). Labour’s Reward: Real Wages and Economic Change in 19th- and 20th-century Europe. Edward Elgar Publishing.

[1]Auerbach, A. J., & Kotlikoff, L. J. (1998). Macroeconomics: An Integrated Approach. MIT Press.

[2]PAILWAR, V. K. (2011). ECONOMIC ENVIRONMENT OF BUSINESS. PHI Learning Pvt. Ltd.

[3]Image credit: https://www.flickr.com/photos/wasdin/2393137359

[4]Image credit: https://www.maxpixel.net/Finance-Remuneration-Plan-Business-World-Hand-541430

Its really helpful