Difference Between ABA Number and Routing Number

The American Banking Association has come up with a method to facilitate the sorting, bundling, and identification of checks as well as locating the financial institutions they’re drawn from. Without this sorting facility, there would be higher risks of inaccuracies and discrepancies in terms of cash flow. Erroneous, incomplete, or mislaid routing information is the main issue costing financial organizations and individual consumers considerable amounts of money. Given such implications, bank numbers have been essential in securing the seamless progression and rotation of funds throughout practically every economic sector.

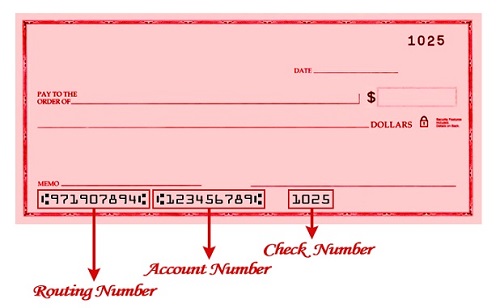

There may be several codes and confusing numbers encoded in a single check, but each one of those plays an important role in validating that specific check. It is necessary for everybody to be familiar with the basics of bank numbering systems; this can be simplified by identifying the different elements. Two of the universal codes are the ABA Transit Number, or ABA Number, and the Routing Transit Number (RTN), or Routing number. It is rather easy to distinguish one from the other based on the code construction, length, and location.

The ABA Number, or ABA Transit Number, is a numeric coding printed on a negotiable instrument in the form of a check, facilitating the check clearing process among banks, whether it’s within a branch or in an inter-bank transaction. The system is managed by the very organization the acronym ABA stands for – the American Bankers Association. It assigns a unique identifier to each U.S. financial institution. The ABA number is printed as the numerator (upper portion) of a fraction appearing at the upper right-hand corner of a check; the denominator is the bank’s Check Routing Symbol, which identifies the Federal Reserve Bank servicing that financial institution. An example of this is 12-34567/8901. The numerator – 12 in this instance – is a two-part code that indicates the geographic location of the financial institution. The next part, 34567, signifies the bank or financial firm itself. Lastly, the denominator – 8901 – points to the Federal Reserve Bank servicing the bank.

Another code is a nine-digit number called the Routing Transit Number (RTN) or, shortly, Routing Number. Like the ABA Transit Number, the RTN’s purpose it to make it easy for banks to accurately sort and identify the financial institution in which the check is drawn. It is specifically designed to facilitate the classification of checks and their and shipment back to the issuer’s account. It transmits electronic copies of checks, which is a cheaper and more convenient alternative to paper checks. For this reason, the RTN is highly utilized by Federal Reserve Banks and the Automated Clearing House system in transactions such as wire fund transfers, direct deposits, bill payments, online banking, and other forms of automated transfers. It can be seen on the bottom part of checks. Composition-wise, the RTN is a combination of the bank identifier code and the Federal Reserve Bank identifier code, as shown in the ABA Transit Number. Using the same example of 12-34567/8901 for reference, the first four digits of the RTN – 8901–point to the Federal Reserve Bank, while the last five – 34567 – pertain to the specific financial institution.

Summary

1) The ABA Transit Number and the Routing Transit Number are codes used to facilitate sorting, bundling, and identification of checks and where they are drawn.

2) The ABA Transit Number consists of three parts that refer to 1) the geographic location of the financial institution, 2) the bank itself, and 3) the Federal Reserve Bank. It is found in the upper right-hand corner of a check.

3) The Routing Transit Number has two parts indicating 1) the Federal Reserve Bank and 2) the financial institution itself. It is located at the bottom of a check.

- Differences Between Fraternity And Sorority - January 8, 2014

- Differences Between Lucite and Plastic - January 7, 2014

- Differences Between Oil and Butter - January 6, 2014

Search DifferenceBetween.net :

1 Comment

Leave a Response

References :

[0]http://ygraph.com/chart/2852

Dear Sir/Madam

Hi! Last day I have made a tt transfer from hong kong to USA~ People’s bank for schooI payment, but i only marked the Aba no. And forgot to mark the beneficiary account no. What will happen in such case.

Please advise. Thank you