Difference Between Deductible and Out of Pocket

Health insurance has a lot of components which are not always clear. The deductible and out of pocket are two of these components, and are vital to understand when it comes to paying for medical expenses. Since health insurance works on an annual basis, the deductible and out of pocket will change each year.

The deductible applies before the health insurance will cover medical costs. The out of pocket is the amount payable (a maximum applies) which a person needs to pay before the insurance will cover all further costs.

What is Deductible?

The deductible is the amount of money a person will have to pay for medical expenses before the health insurance will start to cover the costs. The deductible is a set amount, which may change annually. Not all medical expenses will be considered as part of the deductible. Only medical expenses that fall under the cover of medical insurance will count towards the deductible. Any item not covered by the medical expense will always be for an individual’s own account.

Some health insurance will have an aggregate deductible and others will also make use of an embedded deductible. If more than one person is registered on a person’s health insurance (a family) then an aggregate, in other words a total, deductible amount will apply to the family together. Once the aggregate deductible is reached then the insurance will start to cover some of the costs, regardless of which family member had the highest costs. However, an embedded deductible could also apply, where an aggregate deductible must be reached and each family member must reach an embedded deductible before the health insurance will start to cover costs.

What is Out of Pocket?

The out of pocket is the maximum threshold amount which a person will have to pay for medical expenses before the health insurance will cover the rest of the costs. This includes amounts for the deductible, co-payment, and co-insurance. The out of pocket amount is always substantially higher than the deductible amount and it will include the deductible amount.

Difference between Deductible and Out of Pocket

-

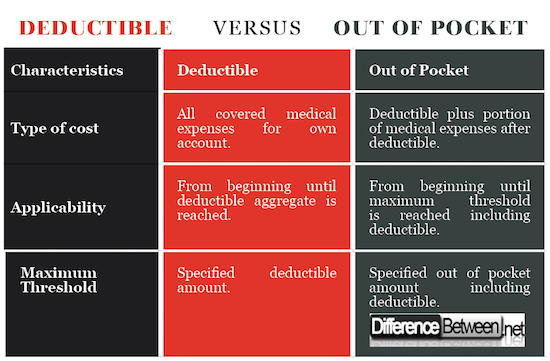

Type of cost involved in Deductible and Out of Pocket

The deductible portion is the amount a person pays for covered medical expenses from the beginning of the year up until the deductible threshold is reached at which point the insurance will start to pay some of the costs. The out of pocket amount payable by a person will be the full deductible plus a portion of the medical expenses thereafter, and until the maximum threshold is reached.

-

Applicability of Deductible and Out of Pocket

The deductible applies from the beginning of the year and only to medical expenses that would be covered by the health insurance up until the full deductible amount is reached. Then the deductible is no longer contributed towards.

The out of pocket applies from the start of the insured year up until the maximum threshold is obtained, including the deductible.

-

Maximum threshold of Deductible and Out of Pocket

The deductible has its own maximum threshold; the out of pocket maximum includes the deductible threshold plus the portion payable by an individual for medical expenses after the deductible is paid.

Deductible vs. Out of Pocket: Comparison Chart

Summary of Deductible vs Out of Pocket

- It is crucial to understand the different health insurance jargon to know what must be paid when.

- The deductible is a set amount that an individual must pay towards medical expenses before the health insurance will start to contribute towards medical accounts. This is in addition to the normal insurance premium being paid.

- Medical expenses which are not covered by the health insurance cannot count towards the deductible.

- Once the deductible is reached then the health insurance will pay a portion, or a percentage, towards the medical accounts. The insured individual will be responsible for the rest of the bill known as the out of pocket amount.

- The out of pocket amount has a maximum threshold and includes the deductible.

- Once the out of pocket maximum is reached, the health insurance will pay for all further medical costs, if covered by the health insurance.

- Difference Between TIN and TAN - June 20, 2018

- Difference Between Bitcoin and Litecoin - June 1, 2018

- Difference Between Walmart and Amazon - May 23, 2018

Search DifferenceBetween.net :

Leave a Response

References :

[0]“Deductible vs. out of pocket limit: what’s the difference?” Health Markets, Oct. 25, 2016, www.healthmarkets.com/resources/health-insurance/deductible-vs-pocket-limit-whats-difference/.

[1]Matli, Dave. “The difference between your deductible vs out of pocket maximum.” Parasail, Jan. 9 2017, www.parasail.com/2017/01/09/deductible-out-of-pocket-maximum/.

[2]Weliver, David. “Understanding your health insurance: deductible, co-pay, co-insurance and out of pocket maximum.” Money under 30, May 16, 2017, www.moneyunder30.com/understanding-your-health-insurance.

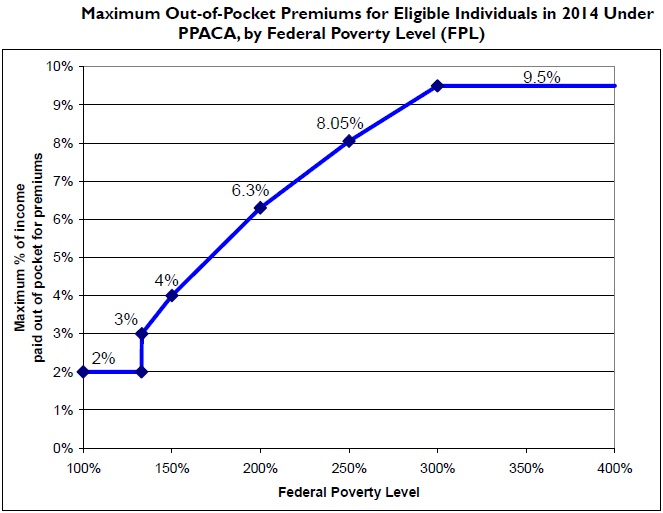

[3]Image credit: https://commons.wikimedia.org/wiki/File:PPACA_Premium_Chart.jpg#/media/File:PPACA_Premium_Chart.jpg

[4]Image credit: https://pixabay.com/en/blog-word-cloud-wordle-graphic-1337564/