Difference Between Hedge Fund and Asset Management

Hedge funds and assent management are two of the most sophisticated investment vehicles that have grown as an investment allocation in institutional portfolios. There seem to be some sort of confusion between the two investment styles because of their similar nature. However, each style has its own nuances that can make it more or less suited for your investment portfolios requirement.

Hedge Fund

Hedge Funds are one of the most sophisticated investment vehicles among institutional investors to explore the world of alternate investments. Hedge funds capitalize on pooled funds and employ different proprietary strategies to hedge risks and deliver high returns. They are pools of funds for sophisticated investors, institutions like pension funds or endowments, and rich people who can handle potential losses incurred from risky trading practices. Hedge simply means to protect yourself against times of uncertainty in the context of investing. It is some kind of an investment practice that involves collecting a sum of money from different individuals and putting them into a something called a pooled fund, and using that money to invest in financial markets to earn better returns. The idea is to make money regardless of how the market is performing. And unlike mutual funds, they are not heavily regulated.

Asset Management

Asset management, as the name suggests, is a systematic approach to managing a client’s investment portfolio in a cost-effective manner. It simply means investing large sums of money on behalf of your clients in order to get high returns on the long run. These clients can be large institutions with lots of money such as insurance companies, pension funds, sovereign wealth funds, charities, and so on. Asset management refers to individuals or firms that are responsible for managing assets, both tangible and intangible, on behalf of their clients in order to obtain a superior return on their capital. So, asset management is taking money from investors and investing it into the financial markets in different investment schemes such as real estate, stocks, bonds, private equity, etc. This helps firms keep track of their assets and investment portfolio.

Difference between Hedge Fund and Asset Management

Investment Model

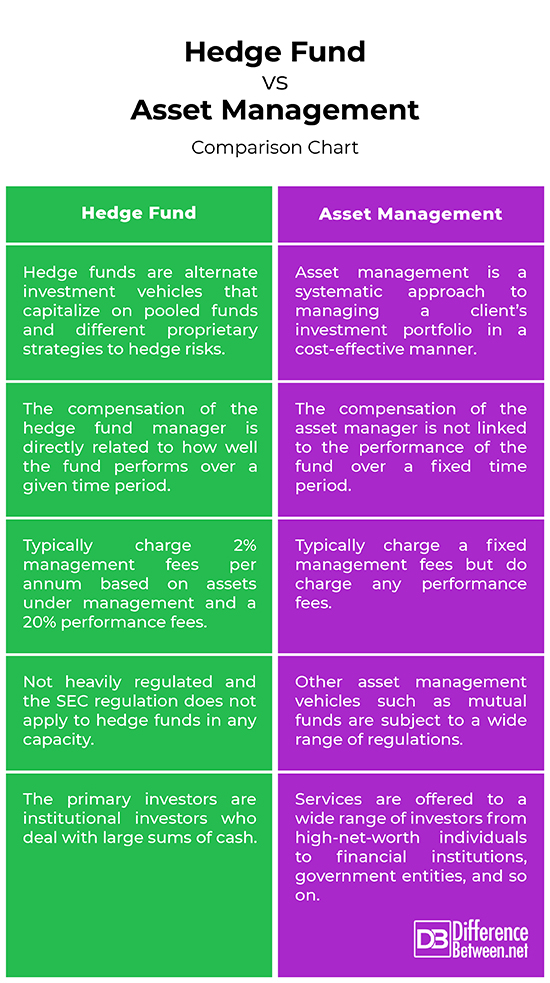

– Hedge funds are alternate investment vehicles that capitalize on pooled funds and employ different proprietary strategies to hedge risks and deliver absolute returns rather than returns relative to a benchmark index. Hedge simply means to protect yourself against times of uncertainty in the context of investing. Asset management, as the name suggests, is a systematic approach to managing a client’s investment portfolio in a cost-effective manner. It means investing large sums of money on behalf of your clients in order to get high returns on the long run.

Incentive Structure

– The compensation of the hedge fund manager is directly related to how well the fund performs over a given time period. The fee is mostly based on net realized gains or net generated income. They particularly employ a high-powered incentive structure based on a 2/20 model, which refers to a management fees of 2 percent per annum based on assets under management and a 20 percent performance fees. The performance fee is paid only if the fund manager outperforms the target return and beats the previous milestone. Other institutional investors or asset management companies charge only a fixed management fees and performance does not guarantees more fees.

Prime Brokerage

– Unlike other institutional investors, hedge funds bank on leverage to boost the expected returns on their trading strategies. Hedge funds capitalize on their relationship with investment banks and other financial institutions which function as prime brokers and provide hedge funds with leverage for their trading strategies. Thus, the prospects of hedge funds are intimately related to the performance of investment banking industry.

Legal Structure

– One of the primary benefits of using hedge funds as your alternate investment opportunity is less regulatory burden meaning they are not heavily regulated and the SEC regulation does not apply to hedge funds in any capacity. This gives hedge fund managers the freedom to capitalize on the opportunities that are usually not available for mutual funds or other regulated funds. Other asset management vehicles such as mutual funds are subject to a wide range of regulations that restrict their trading strategies significantly. The hedge fund managers are exempted from these restrictions.

Hedge Fund vs. Asset Management: Comparison Chart

Summary of Hedge Fund vs. Asset Management

Hedge fund managers face less regulatory burden which gives them freedom to capitalize on a wide range of investment opportunities that are usually not available for other regulated asset management vehicles such as mutual funds. Other regulated funds or asset managers play a relatively less active role in managing their clients’ respective portfolios. In fact, regulation is a key element in asset management industry because investors need to have some confidence in placing their capital with asset managers and for that confidence, they need to see some regulatory compliance or a credible regulatory system. Hedge fund is an unregulated investment vehicle that seeks to maintain an edge over other investment opportunities by leveraging more sophisticated investment techniques.

- Difference Between Caucus and Primary - June 18, 2024

- Difference Between PPO and POS - May 30, 2024

- Difference Between RFID and NFC - May 28, 2024

Search DifferenceBetween.net :

Leave a Response

References :

[0]Baker, Harold Kent and Greg Filbeck. Hedge Funds: Structure, Strategies, and Performance. Oxford, England: Oxford University Press, 2017. Print

[1]Gregoriou, Greg N. et al. Hedge Funds: Strategies, Risk Assessment, and Returns. Washington, D.C., United States: Beard Books, 2003. Print

[2]Ang, Andrew. Asset Management: A Systematic Approach to Factor Investing. Oxford, England: Oxford University Press, 2014. Print

[3]Holler, Julian. Hedge Funds and Financial Markets: An Asset Management and Corporate Governance Perspective. Berlin, Germany: Springer, 2012. Print

[4]Ridley, Matthew. How to Invest in Hedge Funds: An Investment Professional's Guide. London, United Kingdom: Kogan Page Publishers, 2004. Print

[5]Image credit: https://commons.wikimedia.org/wiki/File:Fund_Structure.png

[6]Image credit: https://commons.wikimedia.org/wiki/File:Data_management_for_asset_management.png