Difference Between Hedge Funds and Index Funds

Investing is a part of life, just like working, eating, shopping, and paying taxes. If your spending habits are let’s say not so good or not normal, then investing is the wise thing to do or otherwise there can be serious consequences. Because future can be very unpredictable and we live in a time when things change very quickly, it’s good to have some long-term financial goals in order to have that peace of mind that your hard-earned money is safe somewhere and it’s growing over time. This is why investing is as important as earning an income. But with so many investment vehicles out there, it is hard to choose the right investment strategy. Well, we are going to talk about two different approaches to investing – hedge funds and index funds. So, which one should you choose for your portfolio – hedge funds or index funds?

What is Hedge Fund?

Alfred Winslow Jones is widely believed to have started the world’s first hedge fund in 1949 and built the hedge fund empire we see today. According to his original hedge fund model, hedge fund is about isolating investment skills from market trends by putting a portion of a portfolio within a hedged structure, which actually justifies the term “hedge fund”. However, the definition and the nuances of the hedge fund structure have changed dramatically over the years. A hedge fund is an active investment strategy that use pooled funds and take alternative investment approaches to gain active returns for their investors. To hedge means to safeguard, so, in terms of investing, hedge fund protects your money against unforeseen market changes. This is meant for sophisticated investors who understand and are willing to take the high risks because the funds may be used aggressively to generate high returns. This is why hedge funds are mostly restricted to high net-worth individuals or more sophisticated investors.

What is Index Fund?

Index fund is a type of mutual fund or exchange-traded fund (ETF) with a portfolio of stocks or bonds designed to imitate the portfolio of a financial market index, such as the Standard &Poor’s 500 Index. Investing in index funds is investing in stocks and bonds without attempting to beat the stock market, but instead, to replicate it. Index funds are based on the theory of replicating markets, not beating them. It is a safe way to invest without worrying about losing everything. Index funds follow certain preset rules for ownership that are held constant, regardless of how the stock market is performing. An index fund relies on a computer model with little or no human input when deciding which securities are purchased. So, as a result index funds are a form of passive investment strategy with relatively little trading and few brokerage, fund, and advisory fees. When funds are attached to a specific index, it is called benchmarking.

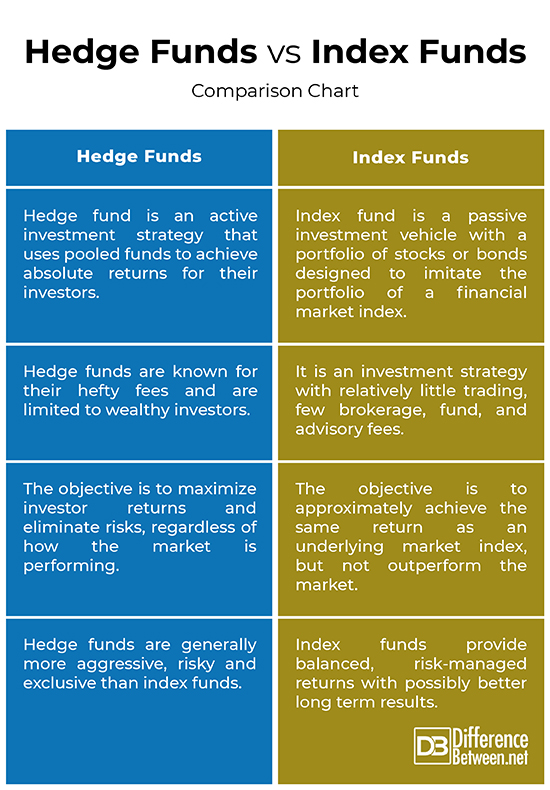

Difference between Hedge Funds and Index Funds

Approach

– Hedge fund is an active investment strategy that use pooled funds and take alternative investment approaches to minimize risks and provide active returns for their investors. Hedge funds are meant for sophisticated investors and high net-worth individuals who understand and are willing to take the high risks, and institutional investors, including pension funds. Index funds, on the other hand, are a form of passive investment strategy with relatively little trading and few brokerage, fund, and advisory fees. It is a collective investment, frequently in the form of a mutual fund, that is designed to replicate, not beating, the movements of an index for a particular financial market.

Objective

– The objective of an index fund is to approximately achieve the same return as an underlying market index, but not outperform the market. It aims to replicate the performance of a particular market index primarily by investing in the stocks and bonds of the companies that are part of a selected index. Hedge funds, on the other hand, are solely designed to maximize investor returns and eliminate risks, regardless of the performance of the market. The objective is to put the investors’ money to work at the highest rate possible with reduced market risks.

Regulation

– Hedge funds are far less transparent and lightly regulated than traditional investment vehicles such as mutual funds and exchange-traded funds. Hedge funds are only accessible to accredited investors because they face little regulation from the Securities and Exchange Commission (SEC), and they are limited to raising capital in non-public offerings, under the Securities Act of 1933. Unlike hedge funds, exchange traded funds such as index funds are highly regulated and they provide significant diversification that is easy to understand and control.

Hedge Funds vs. Index Funds: Comparison Chart

Summary

Hedge funds are meant for sophisticated investors who understand the risks and are willing to take the high risks because the funds may be used aggressively to generate absolute returns, regardless of how the market is performing. There is no accepted norm to classify the different hedge fund strategies, and each manager may choose to design its own classification or adopt a new one leveraging aggressive investment strategies. Index funds, on the other hand, are for those investors who are risk-averse and expect predictable returns on their investment. Unlike hedge funds, they provide a balanced, risk-managed return with the objective of matching the returns of a particular market index, but not beating it.

- Difference Between Caucus and Primary - June 18, 2024

- Difference Between PPO and POS - May 30, 2024

- Difference Between RFID and NFC - May 28, 2024

Search DifferenceBetween.net :

Leave a Response

References :

[0]McClatchy , Will. Index Funds: Strategies for Investment Success. New Jersey, United States: John Wiley & Sons, 2002. Print

[1]Ferri, Richard. All About Index Funds. New York, United States: McGraw-Hill Professional, 2002. Print

[2]Lhabitant, François-Serge. Handbook of Hedge Funds. New Jersey, United States: John Wiley & Sons, 2011. Print

[3]Baird, Craig W. The Complete Guide to Investing in Index Funds: How to Earn High Rates of Return Safely. Florida, United States: Atlantic Publishing Group, Inc., 2009. Print

[4]Image credit: https://www.thebluediamondgallery.com/hand-held-card/images/hedge-funds.jpg

[5]Image credit: https://pixabay.com/photos/mockup-typewriter-word-money-5288033/