Difference Between Hedge Fund and Prop Trading

Over the last decade, the growth of hedge funds has fuelled dramatically, in terms of both asset under management and number of funds. Despite so much attention and the rapid growth, the term hedge fund has still no precise legal definition. But everybody knows hedge funds are an investment vehicle reserved only for wealthy individuals and institutional investors. The investment practice is often confused with yet another investment vehicle with a similar business model called proprietary trading. In fact, both are active in the same markets and adopt many of the same trading strategies and practices. But they are not necessarily same in all respects after all.

What is Hedge Fund?

Hedge Funds are alternate investment vehicles that are often organized as private partnerships and resident offshore for tax and regulatory purposes. Hedge funds are somewhat tough to understand as a whole because they are diverse and much reserved. Hedge funds can be defined an eclectic investment pools that bank on carefully chosen pool of funds to earn active returns for their investors. They employ aggressive asset management techniques and complex trading to improve performance. The funds come from legit investors or institutions like endowments or pension funds, and extremely wealthy individuals who can incur losses from aggressive trading practices. Hedge funds typically are an investment company that raise money from outside investors and invest those funds in financial markets to generate absolute returns and charge a significant sum as fees in the process. They adopt investment strategies that provide a clear alternative to mainstream investment styles.

What is Prop Trading?

Proprietary Trading (or Prop Trading) is a type of trading activity employed by banks or other financial institutions that take advantage of non-client-related trading practices meaning they invest their own money rather than their clients’ money to profit from short-term price changes in asset markets. Prop trading is when a financial firm, such as an investment bank, a hedge fund or a commercial bank trades their own capital to invest in the stocks, bonds, or basically anything they thing they have an edge. The profitability interest of prop traders do not align with the interests of that of their clients. They take advantage of interest rate and credit products, mortgage-related securities and loan products, and other asset-backed securities. They also invest in commodities and currencies, and their derivatives. Prop trading is basically similar to hedge funds except it involves taking risky positions on their own books.

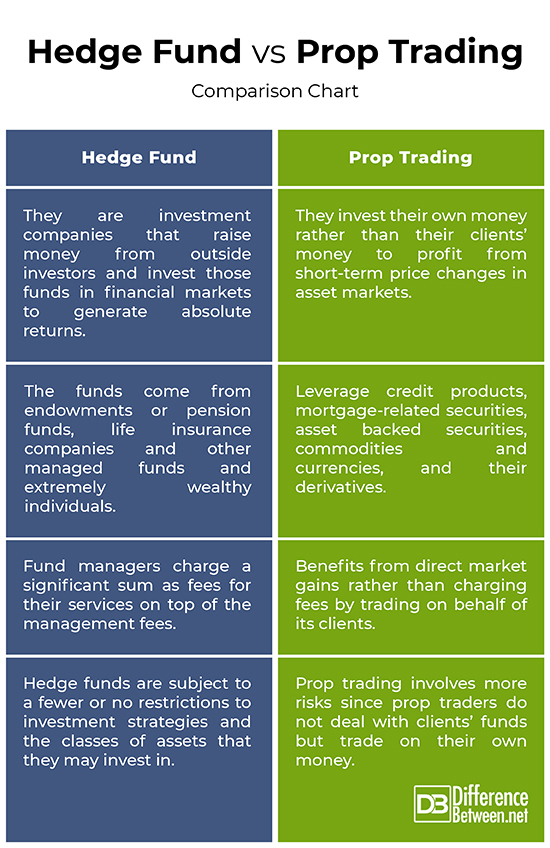

Difference between Hedge Fund and Prop Trading

Investment Model

– Hedge simply means to safeguard your investment against times of uncertainty. Hedge funds are an eclectic investment strategy that capitalizes on carefully chosen pool of funds from wealthy investors to earn absolute returns using complex trading practices and aggressive asset management techniques. Proprietary trading is a similar business model except it involves investing a firm’s own money to profit from short-term price changes in asset markets. The profitability interest of prop traders do not align with the interests of that of their clients.

Flexibility

– Hedge funds have flexible investment policies and they are subject to a fewer or no restrictions to investment strategies and the classes of assets that they may invest in. Hedge funds are also less regulated and SEC regulations do not apply to hedge fund operations in any capacity which gives hedge fund managers an edge over other asset management practices such as prop trading. Prop trading, on the other hand, involves more risks since prop traders do not deal with clients’ funds. Plus, the Volcker Rule prohibits large institutional banks from engaging in prop trading activities.

Incentive

– Hedge fund managers charge a significant sum as fees for their services on top of the management fees. In many cases, the fees depend directly on the performance of the fund over a certain period of time which subject to a “high water mark”. The fund manager must achieve the promised rate or return above a stipulated threshold after the losses incurred. Prop trading, on the other hand, benefits from direct market gain rather than charging a commission fee by trading on behalf of its clients. This may result in realizing 100 percent of the gains from an investment practice.

Leverage

– Hedge funds employ aggressive asset management techniques and complex trading to improve performance. The funds come from institutions like endowments or pension funds, life insurance companies, endowments, and other managed funds, and extremely wealthy individuals who can incur losses from aggressive trading practices. Prop trading takes positions in interest rate and credit products, mortgage-related securities, asset backed securities, commodities and currencies, and their derivatives. In many cases, their positions are leveraged by borrowing, using their positions as collateral.

Hedge Fund vs. Prop Trading: Comparison Chart

Summary

Hedge funds are lightly regulated which means less regulatory burden which in turn gives fund managers the freedom to bank on a disparate range of pooled investment vehicles, including limited liability companies, limited partnerships, and trusts. However, the returns of hedge funds are not normally distributed as the managers must achieve a minimum economic performance in order to be allowed to charge an incentive fee. Prop trading is quite similar to hedge fund investment model, except it involves trading solely for the benefit for its own firm and engages in non-client-related trading.

- Difference Between Caucus and Primary - June 18, 2024

- Difference Between PPO and POS - May 30, 2024

- Difference Between RFID and NFC - May 28, 2024

Search DifferenceBetween.net :

Leave a Response

References :

[0]Agarwal, Vikas and Narayan Y. Naik. Hedge Funds. Massachusetts, United States: now Publishers, Inc., 2005. Print

[1]Stowell, David P. An Introduction to Investment Banks, Hedge Funds, and Private Equity. Massachusetts, United States: Academic Press, 2010. Print

[2]Gregoriou, Greg N. et al. Hedge Funds: Strategies, Risk Assessment, and Returns. Washington, D.C., United States: Beard Books, 2003. Print

[3]Lhabitant, François-Serge. Handbook of Hedge Funds. New Jersey, United States: John Wiley & Sons, 2011. Print

[4]Brouwer, Gordon de. Hedge Funds in Emerging Markets. Cambridge, England: Cambridge University Press, 2001. Print

[5]Image credit: https://www.thebluediamondgallery.com/handwriting/images/hedge-fund.jpg

[6]Image credit: https://pixabay.com/photos/stock-trading-monitor-business-1863880/