Difference Between Annuity and Perpetuity

The value of money changes over time, due to factors such as inflation and market changes. In determining the value of a financial asset, the concept of time value of money is very helpful. It is the idea that money that is available at the present is worth more as compared to the same amount in the future. There are two concepts used to determine the time value of money. These are annuity and perpetuity.

What is Annuity?

This is a concept whereby a fixed amount of money either paid or received at periodic intervals, which could be weekly, monthly, tri-monthly, semi-annually or annually.

Examples of annuities include pension payments and mortgage payments.

There are different types of annuities

- What is Fixed annuities?

– These are fixed interest investments that pay guaranteed rates of interest and can draw or defer income immediately. They are popular among people looking for a no-cost, guaranteed and modest investment.

- What is Variable annuities?

-These allow a group of investors to choose from a group of subaccounts whereby the account value is determined by the performance of the subaccounts. These are popular among people willing to try out capital appreciation with guaranteed lifetime income.

- What is an Immediate annuities?

– This is an annuity whereby the investor gives the insurer a lump sum amount in return to regular payments for a specified period of time. These are popular among people who are comfortable with paying one principal amount in exchange for higher lifelong income.

- What is Deferred annuities?

– These annuities do not start making payments right away. The insurance company pays once one reaches a certain age, as specified in the annuity contract.

- What is Fixed-indexed annuities?

– Guarantee minimum income benefit and is ideal for people especially retirees who want to conservatively participate in potential market appreciation.

Annuities have the following advantages

- The interest is taxed once a person starts receiving payments

- Guaranteed lifetime payments when the payment is annuitized

- Guaranteed rates of return on an investment

Annuities, however, have the following disadvantages

- May be subjected to surrender periods which can lead to surrender charges

- May incur income taxes and penalties due to restrictions set on how to take money out of an annuity

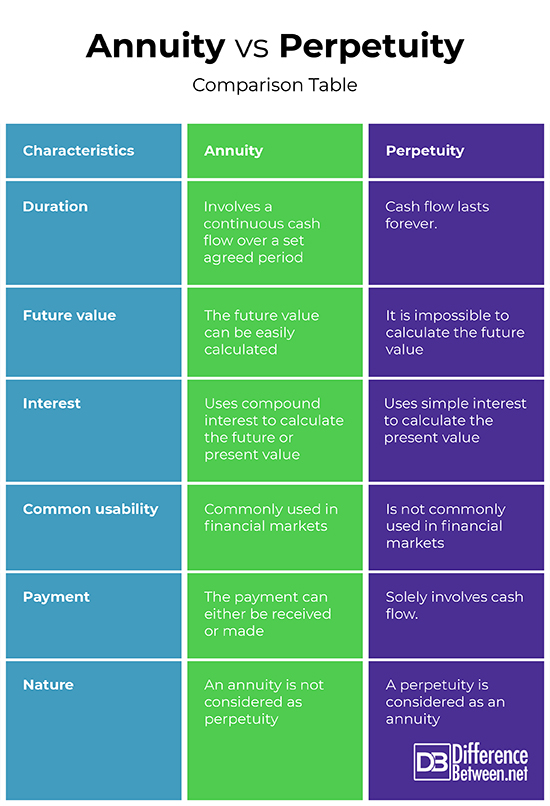

What is Perpetuity?

This is an infinite series of periodic payments of equal face value whereby the owner receives constant payments forever, on a specified time frequency.

Examples of perpetuities are corporate stock, lease rentals and dividends.

There are two types of Perpetuities

- What is a Growing perpetuity?

– This is a series of periodic payments that grow at a proportionate rate and are received for an unlimited amount of time.

- What is a Constant perpetuity?

– This is a perpetuity whereby payments are constant and do not change over time.

Similarities between Annuity and Perpetuity

- Both pay a constant stream of income

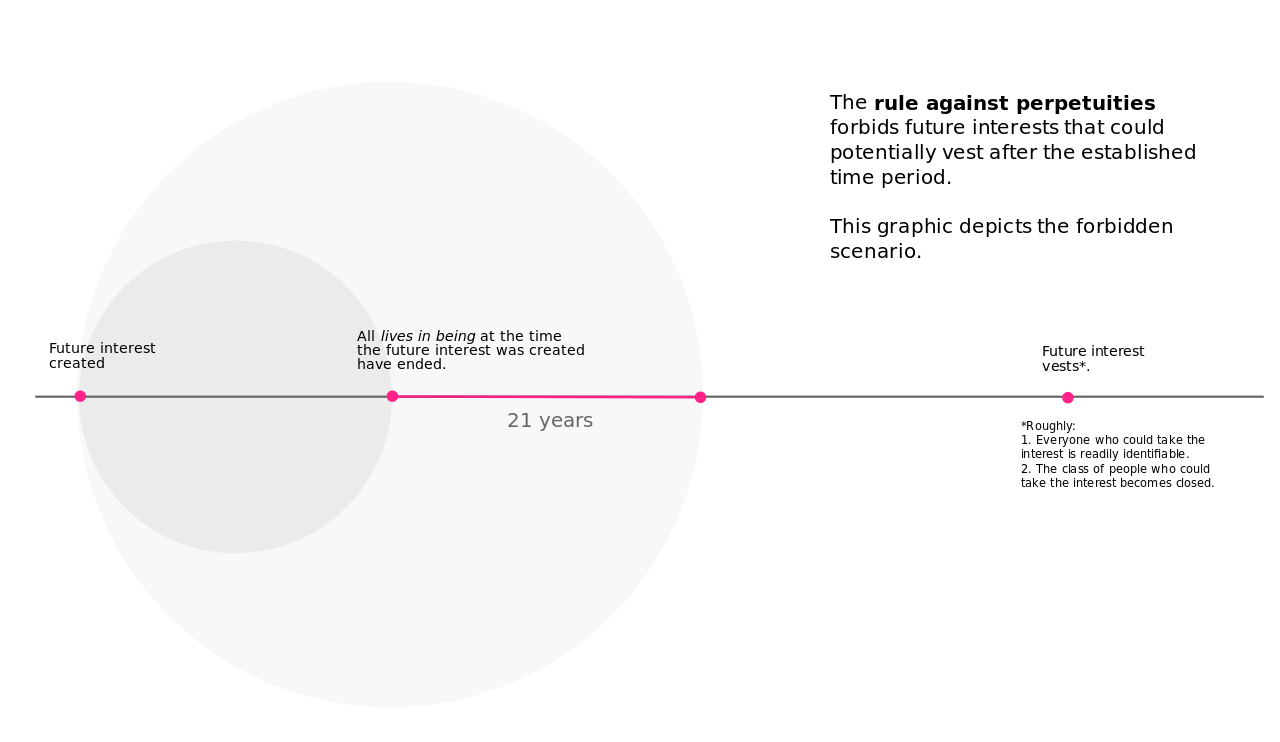

Differences between Annuity and Perpetuity

-

Duration for Annuity and Perpetuity

Annuity involves a continuous cash flow over a set agreed period while the cash flow in perpetuity lasts forever.

-

Future value of Annuity and Perpetuity

In an annuity, it is easy to calculate the future value. On the other hand, it is impossible to calculate the value of the perpetuity.

-

Interest

While annuity uses compound interest to calculate the future or present value, perpetuity uses the simple interest method to calculate the present value of the perpetuity.

-

Common usability

While an annuity is commonly used in financial markets, perpetuity is not.

-

Payment

In an annuity, the payment can either be received or made. On the other hand, in perpetuity solely involves cash flow.

-

Nature of Annuity Vs. Perpetuity

An annuity is not considered as perpetuity while perpetuity is considered as an annuity.

Annuity vs. Perpetuity: Comparison Table

Summary of Annuity vs. Perpetuity

The essence of annuity and perpetuity cannot be ignored in the financial markets. The calculating of the worth of assets such as bank deposits, bonds, stocks, and debenture has been eased by these methods. When calculating the present or future value of an annuity, factors such as cash flow tendencies, interest rate and the time at which the payments are made have to be considered. In the calculation of perpetuity, the stated interest rate and the cash flow have to be considered.

- Difference Between Profit Center and Investment Center - July 2, 2022

- Difference Between Anti-Trust and Anti-Competition - June 6, 2022

- Difference Between Stocktaking and Stock Control - June 6, 2022

Search DifferenceBetween.net :

Leave a Response

References :

[0]Williamson Gordon. Getting Started in Annuities. John Wiley & Sons Publishers, 1998. https://books.google.co.ke/books?id=9TriZiHGCAsC&printsec=frontcover&dq=annuities&hl=en&sa=X&ved=0ahUKEwi_1pyb8ereAhVJBsAKHSWUDNMQ6AEILjAB#v=onepage&q=annuities&f=false

[1]Weisman Steve. The Truth about Buying Annuities. FT Press Publishers, 2008. https://books.google.co.ke/books?id=5AWjIST4gO8C&printsec=frontcover&dq=annuities&hl=en&sa=X&ved=0ahUKEwi_1pyb8ereAhVJBsAKHSWUDNMQ6AEIUTAH#v=onepage&q=annuities&f=false

[2]Croushore Dean. Money and Banking: A Policy-Oriented Approach. Cengage Learning Publishers, 2006. https://books.google.co.ke/books?id=1nwJfISiaeYC&pg=PA80&dq=types+of+perpetuities&hl=en&sa=X&ved=0ahUKEwiP1NmZ8-reAhUoD8AKHapFBq4Q6AEILjAB#v=onepage&q=types%20of%20perpetuities&f=false

[3]Image credit: http://www.picpedia.org/clipboard/images/annuity.jpg

[4]Image credit: https://upload.wikimedia.org/wikipedia/en/thumb/0/0d/Rule_against_perpetuities_--_forbidden_scenario.svg/1280px-Rule_against_perpetuities_--_forbidden_scenario.svg.png