Difference Between EBIT and Operating Income

• Categorized under Business,Finance | Difference Between EBIT and Operating Income

Knowing how to read financial statements is a critical aspect of running a business, which also allows you to make informed decisions. There are three main financial statements, each offer unique details with information that is all interconnected. First one is the balance sheet which identifies a business’s present finances including what you own and what you owe at a point in time; second one is the income statement which is like a profit and loss statement during a period; and finally the cash flow statement which is an overview of how much cash enters and leaves your business during a period. EBIT is an income statement metric.

What is EBIT?

EBIT, short for Earnings Before Interest and Taxes, is one of the important income statement metrics which is measure of profitability and measures a business’s core profitability based on industry factors, without taking into effect the company’s financial leverage or taxes. Earnings are the same as income or profit. The word “before” suggests that you exclude certain items from your operational performance metric. It includes all operating and non-operating incomes and expenses, but excludes the interest and income tax expenses. EBIT is often used synonymously with the term operating income.

However, EBIT is usually not considered a good measure of cash flow because it does not take into account debt payments, capital expenditures, and working capital. And it also includes depreciation and amortization (non-cash items). EBIT is not part of the U.S. Generally Accepted Accounting Principles (GAAP), which means businesses are under no obligation to put EBIT on their income statements. Since it does not factor in D&A expenses stemming from capital investments and acquisitions, it overcomes the limitation of EBITDA arising in capital-intensive industries.

What is Operating Income?

Operating income is an accounting figure that measures the amount of profit realized from a company’s business operations after deducting their regular, recurring costs and expenses. The terms profit or earnings can be used interchangeably with income. You take revenues and deduct the direct operating costs and then deduct the indirect operating costs, you get a sub total which is referred to as the operating income. It is the adjusted revenue of a company that is left after deducting all the expenses of operation and depreciation.

Operating income is often referred to as the earnings before interest and taxes (EBIT). Operating income is the gross income minus the operating expenses. Gross income is the amount of money left after deducting the costs of goods sold from the revenue. Operating expenses include all the costs involved with running the core business operations, such as the rent, equipment cost, cost of employee wages, insurance and funds allocated with the R&D division, etc. In short, operating income measures the profitability of a company’s core business operations. Higher the operating income, more profitable the business.

Difference between EBIT and Operating Income

Meaning of EBIT vs Operating Income

– Both the financial terms EBIT and operating income are often used interchangeably. EBIT is earnings before interest and taxes which includes all operating and non-operating incomes and expenses but excludes the interest and income tax expenses. Operating income can be described as the amount that can be converted into profit. It is the adjusted revenue of a company that is left after deducting all the expenses of operation and depreciation.

Measure of EBIT vs Operating Income

– While both EBIT and operating income are important financial statement metrics used to measure profitability of a business’s core operations. EBIT is measure of profitability and measures a business’s core profitability based on industry factors, without taking into effect the company’s financial leverage or taxes. Operating income is basically the amount of profit gained through a company’s business operations. It is the gross income minus the operating expenses.

Calculation of EBIT vs Operating Income

– EBIT is basically the sum of net income, interest and taxes. It can also be calculated by deducting the depreciation and amortization expenses from the EBITDA. Operating income is the amount of profit realized from a company’s business operations after deducting their regular, recurring costs and expenses. It is the adjusted revenue of a company that is left after deducting all the expenses of operation and depreciation.

EBIT = Net Income + Interest + Taxes = EBITDA – Depreciation and Amortization Expenses

Operating Income = Gross Income – Operating Expenses

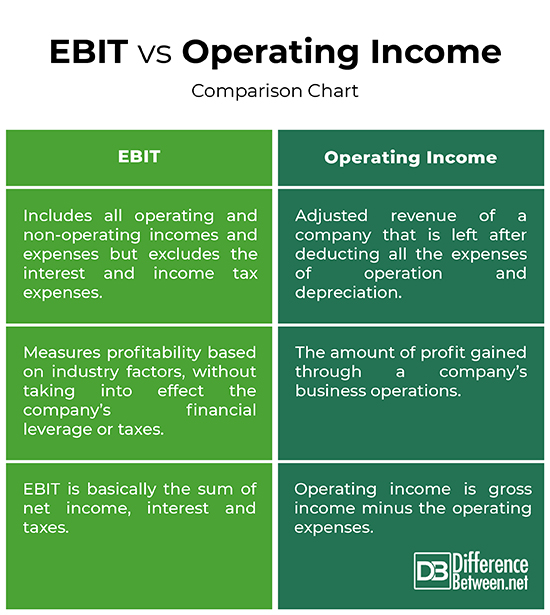

EBIT vs. Operating Income: Comparison Chart

Summary

Operating income can be described as the amount that can be converted into profit, so it basically is the profit realized from a company’s business operations after deducting their regular, recurring costs and expenses. It can be calculated by deducting overall expenses from the gross income. EBIT is often referred to as the operating income but with subtle differences. EBIT measures a business’s core profitability based on industry factors, without taking into effect the company’s financial leverage or taxes. EBIT is not officially recognized the GAAP, whereas operating income is an official GAAP measure.

Is EBIT the same as operating income?

EBIT, or Earnings before Interest and Taxes, is the profit-making ability of a company whereas operating income is about how much revenue can be converted into profit. Both are profitability metrics that measure the profitability of a business. EBIT is not recognized by the GAAP whereas operating income is.

Is operating income EBITDA or EBIT?

Operating income and EBIT are often used interchangeably, and both are important profitability metrics used to measure the profit-making ability of a company or business.

Outside his professional life, Sagar loves to connect with people from different cultures and origin. You can say he is curious by nature. He believes everyone is a learning experience and it brings a certain excitement, kind of a curiosity to keep going. It may feel silly at first, but it loosens you up after a while and makes it easier for you to start conversations with total strangers – that’s what he said."

- Difference Between Caucus and Primary - June 18, 2024

- Difference Between PPO and POS - May 30, 2024

- Difference Between RFID and NFC - May 28, 2024

Sharing is caring!

Search DifferenceBetween.net :

Cite

APA 7

Khillar, S. (2022, September 14). Difference Between EBIT and Operating Income. Difference Between Similar Terms and Objects. https://www.differencebetween.net/business/difference-between-ebit-and-operating-income/.

MLA 8

Khillar, Sagar. "Difference Between EBIT and Operating Income." Difference Between Similar Terms and Objects, 14 September, 2022, https://www.differencebetween.net/business/difference-between-ebit-and-operating-income/.

Leave a Response

Written by : Sagar Khillar. and updated on 2022, September 14

References :

[0]Feldman, Matan and Arkady Libman. Crash Course in Accounting and Financial Statement Analysis. New Jersey, United States: John Wiley & Sons, 2011. Print

[1]Schmidlin, Nicolas. The Art of Company Valuation and Financial Statement Analysis: A Value Investor's Guide with Real-life Case Studies. New Jersey, United States: John Wiley & Sons, 2014. Print

[2]Bodmer, Edward. Corporate and Project Finance Modeling: Theory and Practice. New Jersey, United States: John Wiley & Sons, 2014. Print

See more about : ebit, Operating Income