Difference Between EBIT and Gross Profit

In financial terms, a company is considered as a bundle of resources, or you could say tools, the purpose of which is to generate income. These resources are bought with funds from two sources – money from lenders and owners. This can be clearly seen in the balance sheet of the company. So, a good understanding of fundamental financial strategies is important. Balance sheet is one of the three main financial statements, along with income statement and cash flow statement. EBIT and gross profit appear on a company’s income statement and are important metrics for assessing the profitability of a business.

What is EBIT?

EBIT, short for Earnings Before Interest and Taxes, is a fundamental measure of a company’s or organization’s operating efficiency. It is a metric that calculates the profitability of a business based on its core operations, without factoring in financial leverage or taxes. The name itself is self explanatory; earnings refer to the operating profit, but the main keyword here is ‘before,’ which suggests exclusion of interest and income tax expenses. So, EBIT is the profitability of a business based on its operating and non-operating incomes and expenses, minus the interest payments and income taxes.

EBIT can be calculated in two ways; first by taking EBITDA and then deducting depreciation and amortization from EBITDA, and second by adding net income, interest and taxes. However, EBIT is not approved by the U.S. Generally Accepted Accounting Principles (GAAP), meaning companies are not legally bound to put EBIT on their income statements. Simply put, EBIT is a financial metric that measures a business’s profitability without considering different items or costs.

What is Gross Profit?

Gross profit is yet another important financial metric that measures a company’s profitability after deducting all the expenses related to manufacturing and selling its products or services. It shows the earnings of a company, but the profit is calculated differently. Gross profit shows up on a company’s income statement and refers to the operating profit before charging any indirect expenses. Both the terms EBIT and gross profit are often used interchangeably because they both measure the profitability of a business but in different ways.

The gross profit measures a company’s profitability in terms of revenue and cost of goods sold, allowing businesses to make informed decisions. It factors in variable costs, which refer to expenses that depend upon production volumes, such as direct labor, direct materials, sales commissions, shipping charges, and so on. Fixed costs, such as rent, administrative expenses, insurance, and amortization do not come under gross profit. Since it does not factor in all of the company’s expenses, it cannot be used all the times to determine the true profitability of a business.

Difference between EBIT and Gross Profit

Metric

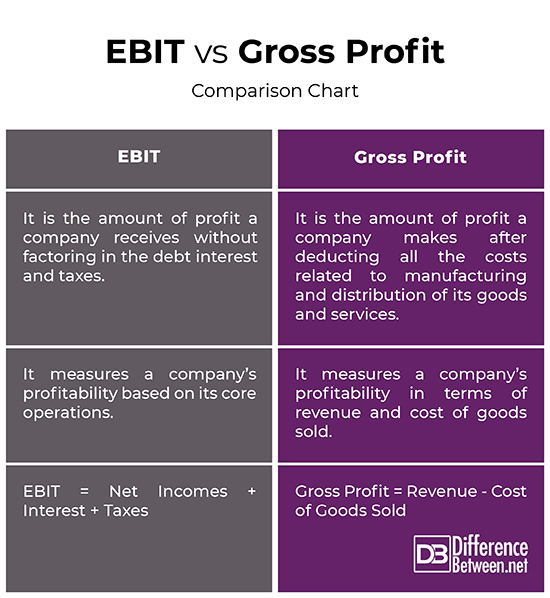

– EBIT, short for Earnings Before Interest and Taxes, is one of the last subtotals in the income statement and is an indicator of a company’s profitability. EBIT refers to the amount of profit a company receives without considering the debt interest and taxes. Gross profit is also a profitability metric of a company that measures the profit-making capability of a business. It is the amount of profit a company makes after deducting all the costs related to manufacturing and distribution of its goods and services.

Calculation

– EBIT can be calculated in two ways; first by taking EBITDA and then deducting depreciation and amortization from EBITDA, and second by adding net income, interest and taxes.

EBIT = EBITDA – Depreciation and Amortization Expenses

Or, EBIT = Net Incomes + Interest + Taxes

Gross profit appears on a company’s income statement and is calculated by deducting the cost of goods sold (COGS) from the revenue.

Gross Profit = Revenue – Cost of Goods Sold

EBIT vs. Gross Profit: Comparison Chart

Summary

The amount of profit a business makes depends on how profit is defined and measured. Business managers at all levels need to understand financial statements and the accounting methods used to prepare the statements. Profit equals what’s left over from sales revenue after you deduct all expenses. Normal profit ratio varies widely from industry to industry. Remember, profit is not always called profit; it’s often called net income. In that sense, gross profit is the revenue minus costs of goods sold. EBIT is earnings minus the interest payments and income taxes.

Is EBIT and gross profit the same?

Both are important profitability metrics that measure the profit-making capability of a business but in different ways. EBIT measures the profitability of a business based on its core operations, without factoring in financial leverage or taxes. Gross profit is the leftover profit a company makes after deducting all the direct expenses from the revenue or sales.

What is the difference between EBIT and net profit?

EBIT is an indicator of a business’s profitability or operating efficiency based on its core operations without taking into account any indirect expenses. Net profit is a true profit indicator that a company is left with after deducting all operating interests and tax expenses over a financial period.

How do you calculate gross profit from EBIT?

Gross profit is calculated by deducting the costs of goods sold from a company’s revenue or sales. You deduct the company’s operating expenses from the gross profit, you’ll get EBIT.

- Difference Between Caucus and Primary - June 18, 2024

- Difference Between PPO and POS - May 30, 2024

- Difference Between RFID and NFC - May 28, 2024

Search DifferenceBetween.net :

Leave a Response

References :

[0]Tracy, John A. and Colin Barrow. Understanding Business Accounting For Dummies. New Jersey, United States: John Wiley & Sons, 2011. Print

[1]Priester, Charles and Jincheng Wang. Financial Strategies for the Manager. Berlin, Germany: Springer Science+Business Media, 2010. Print

[2]Law, Jonathan. A Dictionary of Accounting. Oxford, United Kingdom: Oxford University Press, 2016. Print

[3]Atrill, Peter, et al. Accounting: An Introduction, 6/E. Melbourne, Australia: Pearson Australia, 2015. Print