Difference Between EBIT and Net Income

While profitability remains the main agenda for most businesses, not all business entities actualize their profitability and growth goals. Although profitability, in most cases, is associated with good cash flow, businesses out to use financial indicators to determine profitability. Among the most common indicators include Earnings before interest and taxes (EBIT) and net income. This article further explains the differences between these two indicators.

What is an EBIT?

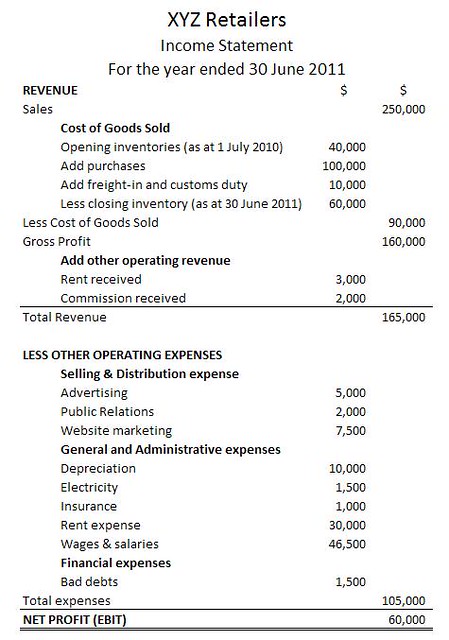

Also referred to as operating profit, operating earnings or profit before interest and taxes, earnings before interest and taxes (EBIT) refers to an indicator of profitability in a company derived by deducting expenses from the revenue excluding tax and interest.

EBIT is derived by deducting the cost of goods sold and operating expenses from revenue whereby the cost of manufacturing in a company includes total operating expenses including wages and total operating expenses. It can also be derived by summing net income, interest and taxes. It can also be derived by adding net income, interest and taxes.

By ignoring interest and tax expenses, this method focuses on a company’s ability to generate revenue while ignoring capital structure and tax burden.

Importance of EBIT includes:

- A business can determine its ability to generate revenue, pay debts and maintain its operations.

- Helps investors know the profitability of businesses without considering the taxes

- Helps investors analyze capital intensive businesses without considering debt and interest expense

However, EBIT has several limitations including:

- The inclusion of the depreciation expense could hurt the company with a fixed asset as the expense leads to a reduction in profit or net income

- The process could inflate a company’s earnings potential especially if a company has a lot of debt as this translates to a high amount of interest expense

What is a Net Income?

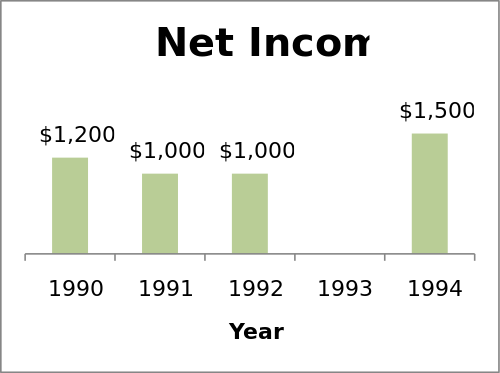

Also referred to as net earnings, this is a financial indicator derived by subtracting all expenses cost of goods sold, operating, administrative, depreciation, taxes, interest and any other expenses from the sales. It is hence used as a measure of a company’s profitability.

It is also used to measure an individual’s income after deductions and taxes. In businesses, net income is used to calculate earnings per share.

The formulas used to calculate net income include deducting the cost of operations from the revenue or deducting the total expenses from the total revenue.

Similarities between EBIT and Net Income

- Both indicate the financial capabilities of companies

Differences between EBIT and Net Income

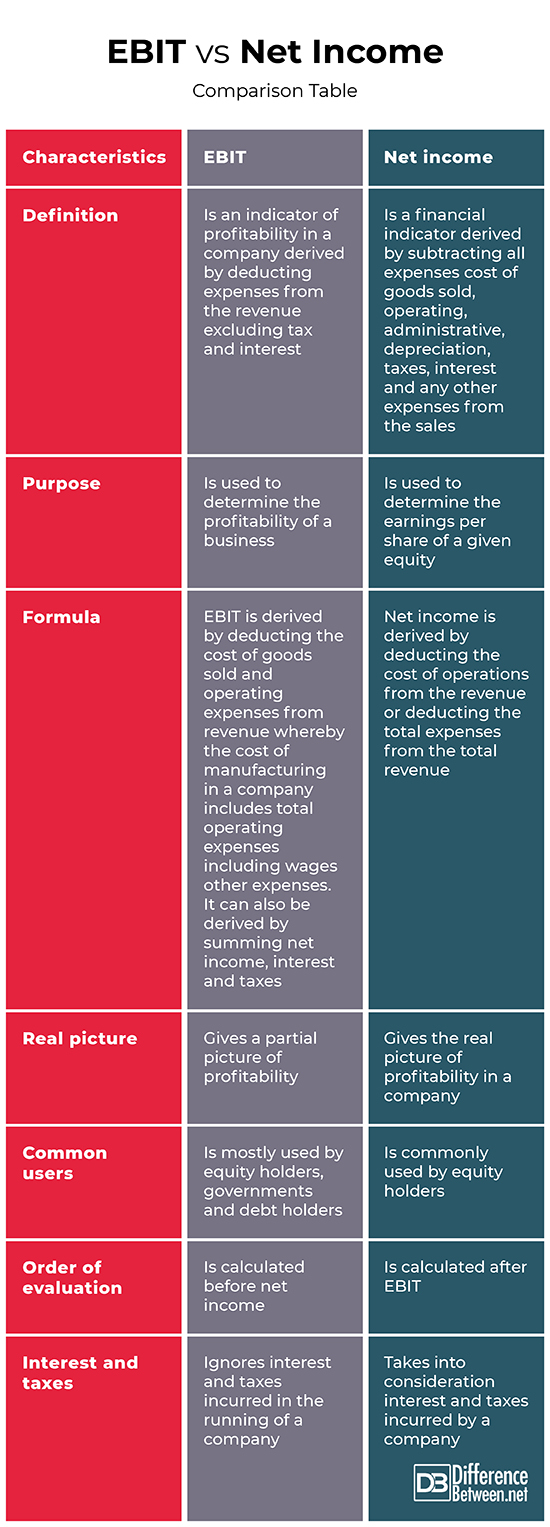

Definition

EBIT is an indicator of profitability in a company derived by deducting expenses from the revenue excluding tax and interest. On the other hand, net income is a financial indicator derived by subtracting all expenses cost of goods sold, operating, administrative, depreciation, taxes, interest and any other expenses from the sales.

Purpose

While EBIT is used to determine the profitability of a business, net income is used to determine the earnings per share of a given equity.

Formula

EBIT is derived by deducting the cost of goods sold and operating expenses from revenue whereby the cost of manufacturing in a company includes total operating expenses including wages and total operating expenses. It can also be derived by summing net income, interest and taxes. On the other hand, the formulas used to calculate net income include deducting the cost of operations from the revenue or deducting the total expenses from the total revenue.

Real picture

While EBIT gives a partial picture of profitability, net income gives the real picture of profitability in a company.

Common users

While EBIT is mostly used by equity holders, governments and debt holders, net income is commonly used by equity holders.

Order of evaluation

While EBIT is calculated before net income, net income is calculated after EBIT.

Interest and taxes

While EBIT ignores interest and taxes incurred in the running of a company, net income takes into consideration the interest and taxes incurred by a company.

EBIT vs. Net Income: Comparison Table

Summary of EBIT and Net Income

EBIT is an indicator of profitability in a company derived by deducting expenses from the revenue excluding tax and interest. Although it is used to determine the profitability of a business, it gives a partial picture of profitability. On the other hand, net income is a financial indicator derived by subtracting all expenses cost of goods sold, operating, administrative, depreciation, taxes, interest and any other expenses from the sales. It is used to determine the earnings per share of given equity and gives the real picture of profitability in a company.

- Difference Between Profit Center and Investment Center - July 2, 2022

- Difference Between Anti-Trust and Anti-Competition - June 6, 2022

- Difference Between Stocktaking and Stock Control - June 6, 2022

Search DifferenceBetween.net :

Leave a Response

References :

[0]Houston J & Brigham E. Fundamentals of Financial Management. Cengage Learning Publishers, 2012. https://books.google.co.ke/books?id=cZAJAAAAQBAJ&pg=PA66&dq=Difference+between+ebit+and+net+income&hl=en&sa=X&ved=2ahUKEwjD2uWEhNXqAhVMUxoKHesMD7IQ6AEwCHoECAcQAg#v=onepage&q=Difference%20between%20ebit%20and%20net%20income&f=false

[1]Houston J & Brigham E. Fundamentals of Financial Management. Cengage Learning Publishers, 2012. https://books.google.co.ke/books?id=cZAJAAAAQBAJ&pg=PA66&dq=Difference+between+ebit+and+net+income&hl=en&sa=X&ved=2ahUKEwjD2uWEhNXqAhVMUxoKHesMD7IQ6AEwCHoECAcQAg#v=onepage&q=Difference%20between%20ebit%20and%20net%20income&f=false

[2]Pasquale De Luca. Analytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company Valuation. Springer Publishers, 2018. https://books.google.co.ke/books?id=V9p1DwAAQBAJ&pg=PA63&dq=Difference+between+ebit+and+net+income&hl=en&sa=X&ved=2ahUKEwjD2uWEhNXqAhVMUxoKHesMD7IQ6AEwAXoECAMQAg#v=onepage&q=Difference%20between%20ebit%20and%20net%20income&f=false

[3]CHANDRA SEKHAR. FINANCIAL STATEMENTS ANALYSIS: Financial statements, Comparative analysis, Common size analysis, Trend analysis, Inter-firm analysis, FAQs. Chandra Sekhar. https://books.google.co.ke/books?id=Z8nsDwAAQBAJ&pg=PA5&dq=Difference+between+ebit+and+net+income&hl=en&sa=X&ved=2ahUKEwjD2uWEhNXqAhVMUxoKHesMD7IQ6AEwAnoECAEQAg#v=onepage&q=Difference%20between%20ebit%20and%20net%20income&f=false

[4]Image credit: https://upload.wikimedia.org/wikipedia/commons/thumb/7/7e/Net_income_graph_missing_loss.svg/500px-Net_income_graph_missing_loss.svg.png

[5]Image credit: https://live.staticflickr.com/8282/7690678408_db6467fb7a_z.jpg