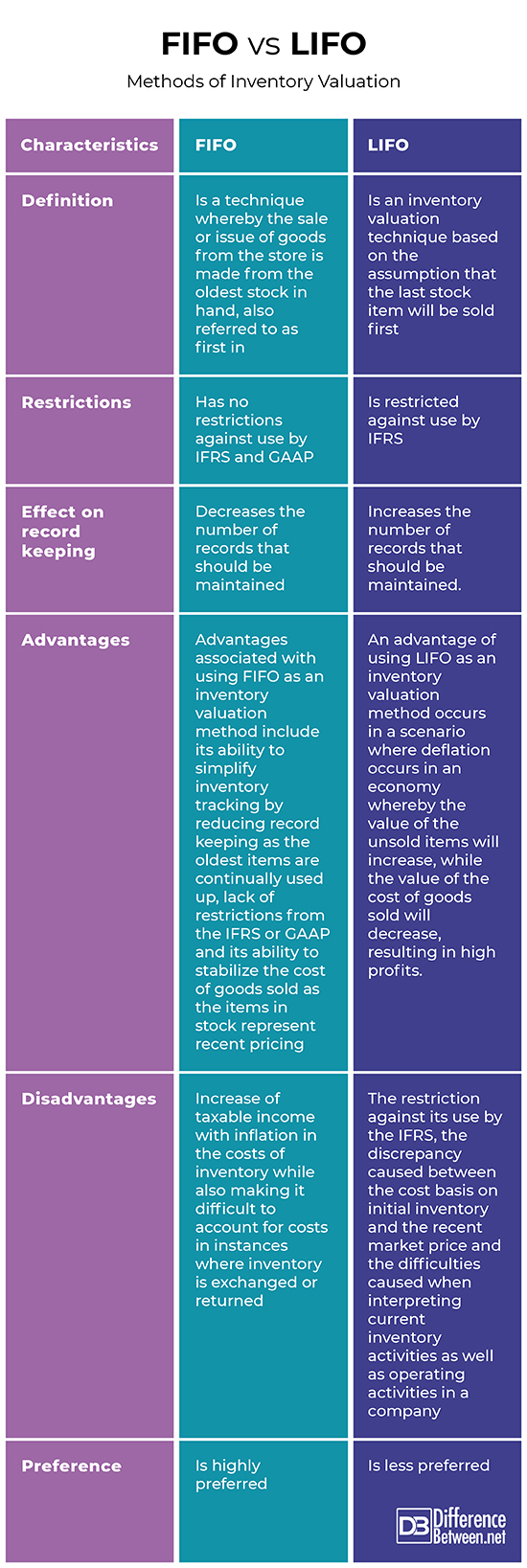

Difference Between FIFO and LIFO Methods of Inventory Valuation

Being one of the largest assets in retail and manufacturing businesses, inventory, including raw materials, goods in production and finished goods, is one of the most important aspects of a business. Failure to effectively and efficiently manage can lead to business downfall. This is because inventory is used to identify business profitability by evaluating the cost of goods sold. While various inventory valuation methods such as Last-In-First-Out (LIFO), First-In-First-Out (FIFO) and Weighted-Average-Cost (WAC) are available, it is advisable to use the right method based on business activities as using the wrong valuation method can greatly affect a business.

What is FIFO?

The first in-first out (FIFO) method is a technique whereby the sale or issue of goods from the store is made from the oldest stock in hand, also referred to as first in. In a scenario whereby perishable goods are involved, this is the most suitable method as the earliest stock is handled first, hence reducing the risk of perishability.

Advantages of using the FIFO technique include;

- It makes it simpler to track inventory by reducing record keeping as the oldest items are continually used up

- There are no IFRS or GAAP restrictions to using this technique in financial reporting

- The items in stock represent recent pricing hence stabilizing the cost of goods sold

It, however, has a few disadvantages:

- Taxable income increases with inflation in the costs of inventory

- It makes it difficult to account for costs in instances where inventory is exchanged or returned

What is LIFO?

The last in-first out (LIFO) is an inventory valuation technique based on the assumption that the last stock item will be sold first. This technique is however proven to be contradictory to the movement of inventory and illogical. In a scenario where there is inflation in an economy, the value of the items unsold will decrease, while the value of the cost of goods sold will increase, resulting in low profits and income tax. However, in a scenario where deflation occurs in an economy, the value of the unsold items will increase, while the value of the cost of goods sold will decrease, resulting in high profits.

Other disadvantages of using the LIFO inventory valuation method include:

- It is restricted by the IFRS

- It causes a bigger discrepancy between the cost basis on initial inventory and the recent market price

- It makes it difficult to interpret current inventory activities as well as operating activities in a company

Similarities between FIFO and LIFO Methods of Inventory Valuation

- Both are inventory valuation techniques

Differences between FIFO and LIFO Methods of Inventory Valuation

Definition

The first in-first out (FIFO) method is a technique whereby the sale or issue of goods from the store is made from the oldest stock in hand, also referred to as first in. On the other hand, the last in-first out (LIFO) is an invento/ry valuation technique based on the assumption that the last stock item will be sold first.

Restrictions

While FIFO has no restrictions against use by IFRS and GAAP, LIFO is restricted against use by IFRS.

Effect on record keeping

While FIFO decreases the number of records that should be maintained, LIFO increases the number of records that should be maintained.

Advantages

Advantages associated with using FIFO as an inventory valuation method include its ability to simplify inventory tracking by reducing record keeping as the oldest items are continually used up, lack of restrictions from the IFRS or GAAP and its ability to stabilize the cost of goods sold as the items in stock represent recent pricing. An advantage of using LIFO as an inventory valuation method occurs in a scenario where deflation occurs in an economy whereby the value of the unsold items will increase, while the value of the cost of goods sold will decrease, resulting in high profits.

Disadvantages

Disadvantages associated with FIFO as an inventory valuation technique include the increase of taxable income with inflation in the costs of inventory while also making it difficult to account for costs in instances where inventory is exchanged or returned. On the other hand, disadvantages associated with LIFO include the restriction against its use by the IFRS, the discrepancy caused between the cost basis on initial inventory and the recent market price and the difficulties caused when interpreting current inventory activities as well as operating activities in a company.

Preference

While FIFO is highly preferred, LIFO is less preferred.

FIFO vs. LIFO methods of inventory valuation

Summary of FIFO vs. LIFO Methods of Inventory Valuation

The decision on a suitable valuation method for a business can be challenging. However, a business person should base the choice of the valuation method based on the business location, how much a business inventory varies as well as whether a business operating costs are increasing or decreasing. While the FIFO valuation method is suitable for most businesses as it gives a clear picture of costs incurred as well as profitability, it is not suitable for all businesses. It is hence important to consult before making a decision on which inventory valuation method to apply in any business.

- Difference Between Profit Center and Investment Center - July 2, 2022

- Difference Between Anti-Trust and Anti-Competition - June 6, 2022

- Difference Between Stocktaking and Stock Control - June 6, 2022

Search DifferenceBetween.net :

Leave a Response

References :

[0]Lessambo Felix. Financial Statements: Analysis and Reporting. Springer Publishers, 2018. https://books.google.co.ke/books?id=kQ92DwAAQBAJ&pg=PA47&dq=Difference+between+Fifo+and+Lifo+methods+of+inventory+valuation&hl=en&sa=X&ved=0ahUKEwjg5LrFzK_jAhWKasAKHVWfC9kQ6AEIJjAA#v=onepage&q=Difference%20between%20Fifo%20and%20Lifo%20methods%20of%20inventory%20valuation&f=false

[1]Carl Warren. Survey of Accounting. Cengage Learning Publishers, 2008. https://books.google.co.ke/books?id=VsRd-6IgJL4C&pg=PA221&dq=Difference+between+Fifo+and+Lifo+methods+of+inventory+valuation&hl=en&sa=X&ved=0ahUKEwjg5LrFzK_jAhWKasAKHVWfC9kQ6AEIMDAC#v=onepage&q=Difference%20between%20Fifo%20and%20Lifo%20methods%20of%20inventory%20valuation&f=false

[2]Grover Brent. Exploring the Financial Fundamentals of Distribution -, Volume 1. Natl Assn Wholesale-Distr, 2007. https://books.google.co.ke/books?id=2dr2ZJbmD4gC&pg=PA67&dq=Difference+between+Fifo+and+Lifo+methods+of+inventory+valuation&hl=en&sa=X&ved=0ahUKEwjg5LrFzK_jAhWKasAKHVWfC9kQ6AEITzAH#v=onepage&q=Difference%20between%20Fifo%20and%20Lifo%20methods%20of%20inventory%20valuation&f=false

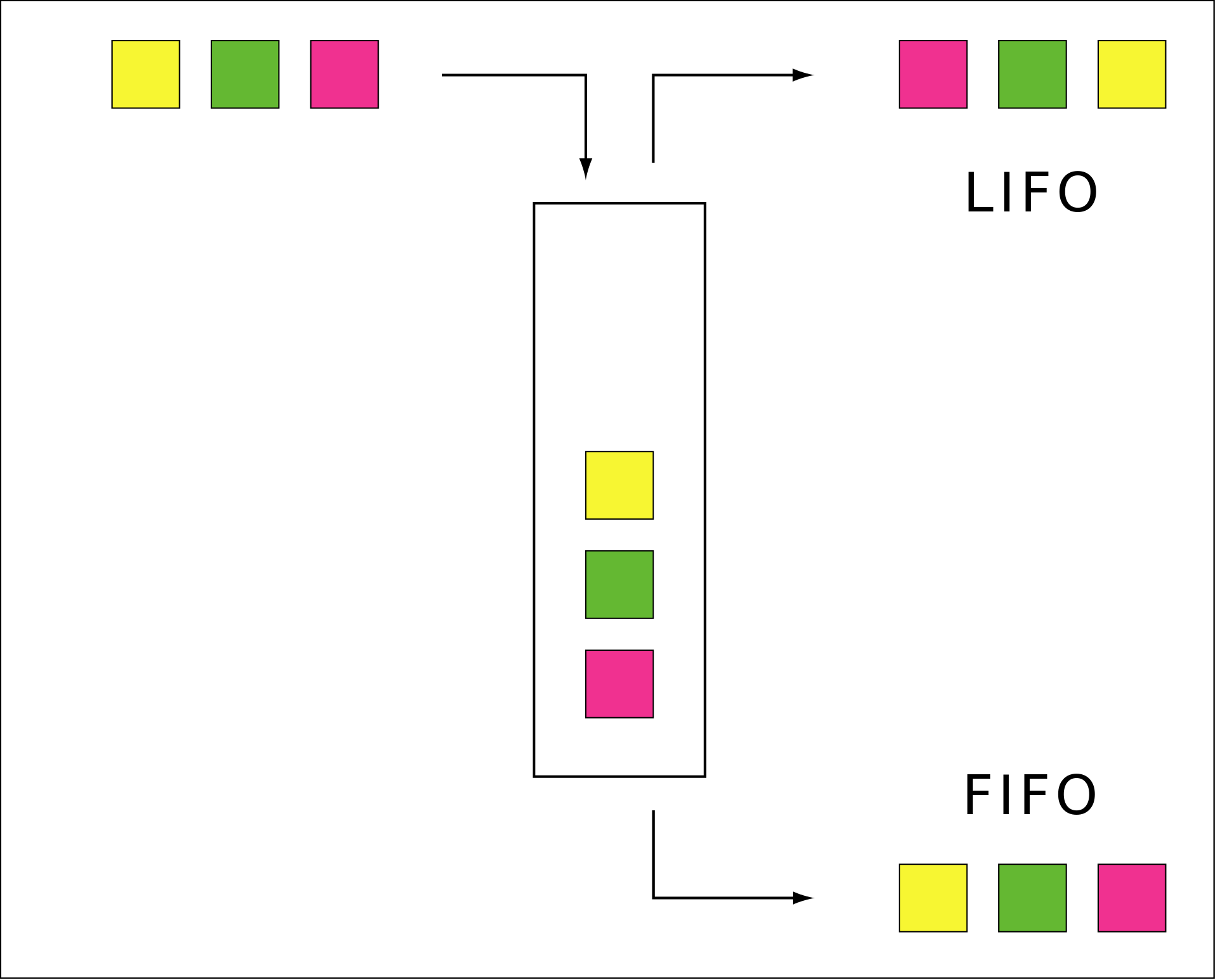

[3]Image credit: https://it.wikipedia.org/wiki/LIFO#/media/File:FIFO-LIFO.svg

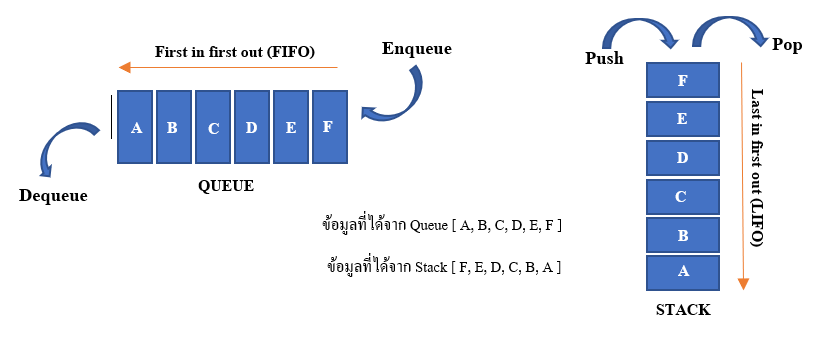

[4]Image credit: https://commons.wikimedia.org/wiki/File:QUEUE_VS_STACK.png