Difference Between Variable and Fixed Rate Student Loans

Student loans are not an occasional practice anymore but it has become the new paradigm of college funding for most of those attending college, especially in the United States. And repaying college debt has become the new normal of the early to middle adult life. Student loans are definitely a burden but for those who do not have the money to pay for college education, student loans are like a lifeline. Plus the dramatic increase of the college fees in the recent years have forced many to seek student loans. After all, why your children should be deprived of their life and career they want only because you cannot afford their education right now? However, when you apply for a student loan, you might have the option to choose between variable and fixed rates. While lower interest rates are always the best, whether or not your interest rate can change down the road also matters.

What is Variable Rates?

In the past, all private student loans had variable interest rates. Well, your interest rate terms are likely set on the basis of your credit and the range the bank or lender offers. So, variable interest rates, as the name suggest, are interest rates that vary based on an index rate, like the prime rate or the LIBOR. This index acts as a fundamental component that helps the bank to determine how much it will cost them to borrow the money they need to lend to you. Banks are the middlemen; they borrow the money they lend out, which fluctuates in terms of cost for the banks every night. So, depending on your loan, the interest rate changes based on the index. So, what all this means for you? In simple terms, your monthly payments could be sometimes low or sometimes higher based on the index rate. Variable rates often are much lower initially but they might go up in the coming months or years. If the interest rates are down, you pay less and if interest rates go up, you end up paying more. As 1-month LIBOR changes, you student loan rates change accordingly.

What is Fixed Rates?

Fixed rate student loans, are interest rates that stay the same throughout the tenure of your loan repayment term. This means your monthly payment against the student loan never changes over time and you know exactly what your repayment costs will be if you make your monthly payments on time. Fixed rate is exactly what the name implies: fixed or the same. The interest rate at the time of your loan commencement will be the same throughout the entire repayment period. For example, if you were given the fixed interest rate of let’s say 7.5% at the time you took the loan, you pay the same 7.5% interest rate every month with no regards to the changing margin and index rate. So, even if the index rate decreases, you pay the same 7.5% meaning you do not benefit from the lower interest rate. But at the same time, you do not have to pay extra if the index rate increases.

Difference between Variable and Fixed Rate Student Loans

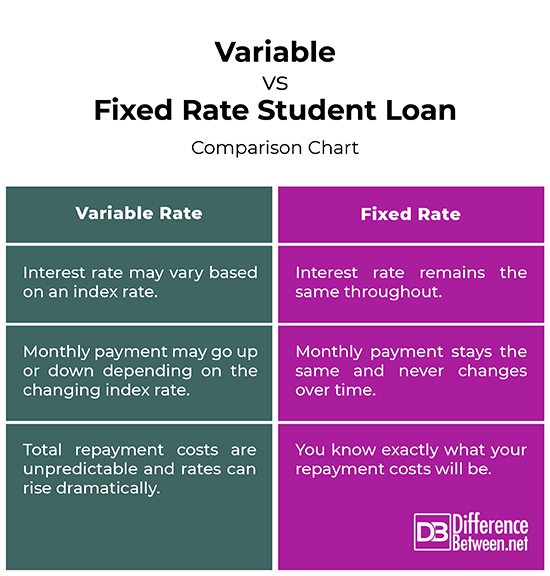

Interest Rate

– Variable interest rates, as the name suggest, are interest rates that vary based on an index rate, like the prime rate or the LIBOR. A variable rate is basically a sum of two components, a fixed margin and a variable index rate. An interest rate is something that usually comes with a fixed rate loan or a loan that remains the same for a period of time of a year or more. So, a fixed rate means interest rates stay the same throughout the entire period of your loan repayment term.

Monthly Payment

– Banks borrow the money they lend out, which fluctuates in terms of cost for the banks every night. For variable rate loans, the interest rate changes based on the index depending on your loan. So, monthly payments could be sometimes low or sometimes higher based on the index rate. With fixed rates, interest rate at the time of your loan commencement will be the same throughout the entire repayment period. So, monthly payment against the loan never changes over time and you know exactly what your repayment costs will be if you make your monthly payments on time.

Example

– For example, you took the student loan at a fixed interest rate of 6.5% and a variable interest rate option of 4.5% (3.5% margin + 1% index rate). So, in case of fixed rate loans, the interest rate won’t be affected in any scenario and it remains the same 6.5% throughout the tenure. However, in case of variable rate loans, the rate will go up and down based on the changing index rate. So, the index rate might vary; sometimes, it can be as low as 0.50% and sometimes, you can end up paying as high as 3.5% on top of the 3.5% margin, meaning you have to pay a total of 7% interest rate.

Variable vs. Fixed Rate Student Loan: Comparison Chart

Summary

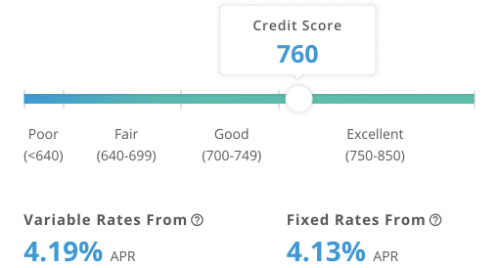

At the time of commencement of loan, the interest rate on a fixed rate student loan can be typically higher compared to variable rate student loans with the same repayment term. On a fixed rate loan, the interest rates are mostly set based on your creditworthiness and the range the bank offers. So, a fixed rate means you pay the same interest rate throughout the entire repayment period whereas in case of variable rates, the interest rate may go up or down based on fluctuating index (LIBOR). So, at the end of the day, the decision of whether to choose a fixed or variable rate student loan is entirely up to you. You should carefully figure out your options and choose the one which will best fulfill your requirements.

- Difference Between Caucus and Primary - June 18, 2024

- Difference Between PPO and POS - May 30, 2024

- Difference Between RFID and NFC - May 28, 2024

Search DifferenceBetween.net :

Leave a Response

References :

[0]Gobel, Reyna. CliffsNotes Parents' Guide to Paying for College and Repaying Student Loans. Massachusetts, United States: Houghton Mifflin Harcourt, 2015. Print

[1]Heller, Donald E. and Claire Callender. Student Financing of Higher Education: A Comparative Perspective. Abingdon, United Kingdom: Routledge, 2013. Print

[2]Image credit: https://www.thebluediamondgallery.com/hand-held-card/images/student-loans.jpg

[3]Image credit: https://www.credible.com/blog/wp-content/uploads/2018/07/Rate-estimator.png