Difference between Federal Debt and Federal Deficit

The terms “federal debt” and “federal deficit” are often used by policymakers and practitioners when discussing the wealth of the nation and the efficiency of existing or proposed policies.

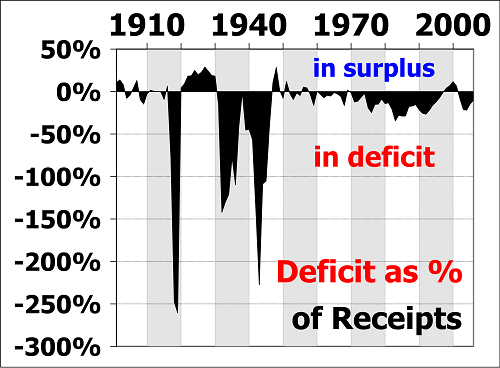

The two concepts are quite similar but not interchangeable. In fact, as per definition, federal deficit is “the annual difference between government spending and government revenue,” whereas federal debt is “the accumulation of past deficits, minus surpluses” – in other words, the debt indicates the amount of money that the federal government owes.

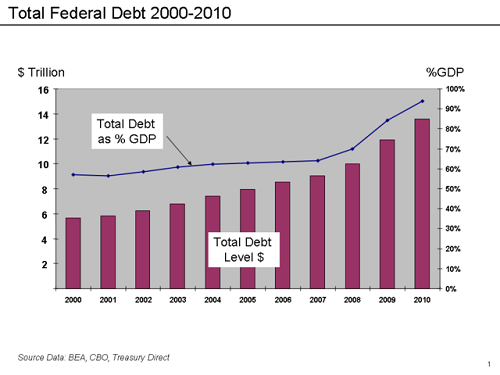

While national deficit may shrink or increase depending on the amount of revenue collected by the government in a fiscal year, the debt is a cumulative sum that tends to grow with time – as the government continues to borrow money to face its deficits. As such, federal deficit may decrease (i.e. the government might have a budgetary surplus if it collects more than it spends) but, at the same time, federal debt may grow.

Federal deficit

Federal deficit is calculated every fiscal year – for instance, fiscal year (FY) 2018 goes from October 1, 2017 to September 30, 2018.

According to recent statistics, the American federal budget deficit for FY 2018 amounts to $440 billion. This data is obtained by subtracting the annual revenue of $3.654 trillion from the annual spending of $4.094 trillion (data from the “Mid-Session Review Fiscal Year 2017, Table S-5,” Office of Management and Budget).

Although the government reduced the deficit for FY 2017, and in spite of the optimistic Obama Administration’s forecasts, the elimination of the federal deficit would necessarily entail large tax increases and huge spending cuts.

In spite of reductions in the last fiscal year, the U.S. national deficit has grown in the past decade. Such increase depends on various factors:

- Increase in mandatory spending: the federal government has paid larger sums for Medicare, Social Security and similar federal programs. Mandatory spending consumes most of the budget collected from revenues each year, and – on average – it exceeds $2 trillion a year.

- Increase in military budget: hikes in military budget followed the fear of terrorist attacks. Military spending grew from $437.4 billion in 2003 to $855.2 billion in 2011.

- The recession: the 2008 financial crisis had serious repercussions on the U.S. budget as a whole. In fact, as the economy collapsed, tax revenues drastically decreased (from $2.57 trillion in 2007 to $2.1 trillion in 2009). Furthermore, the government was forced to issue the so-called “economic stimulus package,” which increased unemployment benefits and boosted public works (aimed at creating jobs).

Indeed, while the recession played a big role in increasing the federal deficits, there are other important factors that must be taken into account. Furthermore, since 2008, the American economy has largely recovered (even if backlashes remain evident) – yet, the federal deficit has not disappeared.

On the contrary, deficit spending is intentionally created by the government in each fiscal year. Although it may seem contradictory, government spending is one of the main drivers of economic growth – as such, the President and the Congress need to invest in security, military, healthcare, infrastructures and public projects. Not only does the spending create workforce, but it also boosts economic development. The cycle is simple:

- The government spends money investing in the country’s economy;

- Economic growth boosts the job market;

- Unemployment is reduced and people have more money; and

- People spend more money and – consequently – the economy grows.

Intentional deficit spending is part of the so-called “expansionary fiscal policy,” which may also entail tax cuts and increased benefits.

On the contrary, if the government needs or wants to achieve a balanced budget or a budgetary surplus, it will implement a “contractionary fiscal policy,” which entails a reduction in public investments, tax increases and reduction of benefits.

Federal debt

Federal debt is the cumulative amount of money that the U.S. government owes. To date, the U.S. federal debt has reached a worrying $19.8 trillion. The humongous amount is divided into two categories:

- Intragovernmental holdings; and

- Debt held by the public.

Intragovernmental holdings account for around 30% of the total debt and are owed to various federal agencies (over 230).

In this case, the process is quite complicated as federal agencies are part of the government itself. Intragovernmental holdings are generated when agencies collect more tax revenues than they need and use the extra money to buy U.S. Treasuries (government debt instruments issued by the Department of the Treasury to finance the national debt).

According to the Monthly Treasury Statement of the U.S. Department of the Treasury, as of December 2016, intragovernmental holdings were divided as followed:

- Social Security: over $2.000 trillion;

- Office of Personnel Management Retirement: $888 billion;

- Military Retirement Fund: over $650 billion;

- Medicare: over $200 billion; and

- Other retirement funds: over $300 billion.

The largest share of the debt (over $14.400 trillion) is held by the public (i.e. investors, governmental entities, foreign governments, mutual funds, businesses, banks, insurance companies, etc.).

According to the Treasury Bulleting of the U.S. Department of Treasury, as of December 2016, public held debt was divided as follows:

- Foreign governments/investors/stakeholders: $6.000 trillion;

- Federal Reserve: over $2.000 trillion;

- Mutual funds: over $1.500 trillion;

- Local and national governmental entities: over $900 billion;

- Banks: over $650 billion;

- Private pension funds: over $550 billion;

- Insurance companies: over $300 billion; and

- Enterprises, companies, corporate and non-corporate businesses and other investors: over $1.500 trillion.

The biggest shares of the U.S. foreign debt are held by China (over $1.100 trillion) and Japan (over $1.100 trillion). Other big holders are Ireland, Brazil, Cayman Islands, Luxemburg, Belgium, Switzerland, UK, Hong Kong, Saudi Arabia and India – which hold between $130 and $245 billion.

The U.S. debt – which is almost at $20 trillion – is one of the largest in the world – even though we need to consider the population and the size of the country and of its economy. The growing size of the federal debt can be explained by several factors:

- The debt is caused by an accumulation of federal deficits (minus surpluses) – and it is likely to grow even further following the large tax cut promised by President Trump;

- Foreign countries (i.e. China and Japan) invest in U.S. Treasuries to maintain their currency low;

- Stakeholders continue to buy Treasuries as they are confident that the U.S. has the economic power to pay them back;

- Federal agencies with a revenue surplus invest in Treasuries (in particular Social Security); and

- The debt ceiling continues to be raised by the Congress.

The growing size of the federal debt represents a serious problem for the American economy. In fact, while in the short run government spending is positive, the constant growth of national debt might eventually reach a tipping point.

Every President needs to invest in economic growth and to promote public projects; furthermore, Presidential candidates often promise large tax cuts and increased benefits to obtain the support of the population. However, in the long term, the U.S. economy might suffer grave consequences.

For instance, debt holders might demand higher interest rates, the demand for U.S. Treasuries might decrease, foreign countries might stop lending money, and the Social Security Trust Fund left might not be sufficient to cover the retirement benefits of baby boomers. If the federal debt reached a tipping point, the government would be forced to raise taxes and cut benefits, while pension funds would drastically decrease.

Summary

Federal debt and federal deficit are two key concepts linked to the U.S. federal budget. In spite of some similarities, debt and deficit are quite different and cannot be mistaken.

Federal deficit is the difference between government spending and government revenue calculated every fiscal year (the fiscal year goes from October 1 to September 30 of the following year) whereas federal debt is the amount of money owed by the government to various stakeholders.

Debt and deficit are strictly linked to one another; in fact, the accumulation of yearly deficits is one of the reasons behind the growth of the federal debt.

Federal deficit grows when the government spends more than it takes in. Yet, at the same time, government spending boosts the economy and creates jobs – therefore, all presidents intentionally create federal deficit in every fiscal year.

In addition, even if the fiscal year ended with a balanced budget or a budgetary surplus, the federal debt would still be likely to increase. To date, the U.S. has one of the largest federal debts in the world (almost $20 trillion) and the main debt holders are foreign governments, corporate and non-corporate businesses, federal agencies, banks, insurance companies and private pension funds.

In the long term, the growth of federal deficit – coupled with growing interest rates – might cause a disproportionate increase in federal debt and the American economy might suffer grave consequences.

- Difference Between Michelle Obama and Melania - January 29, 2019

- Difference Between Trump and Modi - December 4, 2018

- Difference Between Carbon Tax And Cap And Trade - December 4, 2018

Search DifferenceBetween.net :

Leave a Response

References :

[0]Current US Federal Budget Deficit, The Balance, available at https://www.thebalance.com/current-u-s-federal-budget-deficit-3305783

[1]Debt VS Deficit: what’s the difference? Peterson Foundation, available at http://www.pgpf.org/blog/2016/10/debt-vs-deficits-whats-the-difference

[2]Debt VS Deficit: what’s the difference? PolitiFact, available at http://www.politifact.com/truth-o-meter/article/2014/feb/27/debt-vs-deficit-whats-difference/

[3]Deficit Spending: Causes, Why It's Out of Control, The Balance, available at https://www.thebalance.com/deficit-spending-causes-why-it-s-out-of-control-3306289

[4]FY 2017 Mid-Session Review, Office of Management and Budget, available at https://obamawhitehouse.archives.gov/omb/budget/MSR

[5]The U.S. Debt and How It Got So Big, The Balance, available at https://www.thebalance.com/the-u-s-debt-and-how-it-got-so-big-3305778

[6]U.S. Debt by President: By Dollar and Percent, The Balance, available at https://www.thebalance.com/us-debt-by-president-by-dollar-and-percent-3306296

[7]Who Owns the U.S. National Debt? The Balance, available at https://www.thebalance.com/who-owns-the-u-s-national-debt-3306124

[8]https://commons.wikimedia.org/wiki/File:Federal_debt_to_GDP_-_2000_to_2010.png

[9]https://commons.wikimedia.org/wiki/File:US_annual_federal_deficits_1901_to_2006.svg